The designer and maker of engineered and applied products, TriMas Corporation (NASDAQ:TRS) recently announced the relocation of its corporate headquarters to a renovated center in Bloomfield Hills, MI. The new office is close to its previous location.

Through the new head office TriMas will be able to significantly reduce its square footage and annual expense with an updated and refreshed environment. This step will boost the company’s growth in future.

Now, TriMas’ new address is 38505 Woodward Avenue, Suite 200, Bloomfield Hills, MI 48304. Stucky Vitale Architects supported TriMas for design and project management in the identification and building of the new center, while D-A Contracting, LLC assisted for general contracting. In addition, CBRE helped the company for real estate services.

TriMas offers customers with innovative product solutions under well recognized brands, with approximately 4,000 employees in 12 countries. The company will continue to assess product and facility performance under a new business model.

TriMas continues to invest in new products and sales initiatives to drive sustainable and long-term growth. Consistent rise in demand levels will translate into brighter prospects for increased manufacturing efficiencies and additional operating leverage.

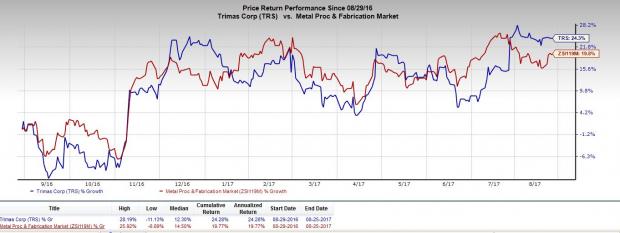

TriMas has outperformed the industry with respect to price performance in a year’s time. The stock gained around 24.3%, while the industry rose 19.8%.

Zacks Rank & Key Picks

TriMas currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the sector include Kaiser Aluminum Corporation (NASDAQ:KALU) , Worthington Industries, Inc. (NYSE:WOR) and Terex Corporation (NYSE:TEX) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kaiser Aluminum generated an average positive earnings surprise of 17.24% for the trailing four quarters. Worthington Industries generated an average positive earnings surprise of 4.05% over the last four quarters, while Terex has an impressive average positive earnings surprise of 122.78% for the same time frame.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Terex Corporation (TEX): Free Stock Analysis Report

Worthington Industries, Inc. (WOR): Free Stock Analysis Report

TriMas Corporation (TRS): Free Stock Analysis Report

Kaiser Aluminum Corporation (KALU): Free Stock Analysis Report

Original post

Zacks Investment Research