From Mike Burnick: My colleague Bill Hall has been telling investors all year to watch just ONE indicator to gauge the path financial markets will take.

That is, the yield on the U.S. 10-Year. Treasury note. And he’s absolutely correct.

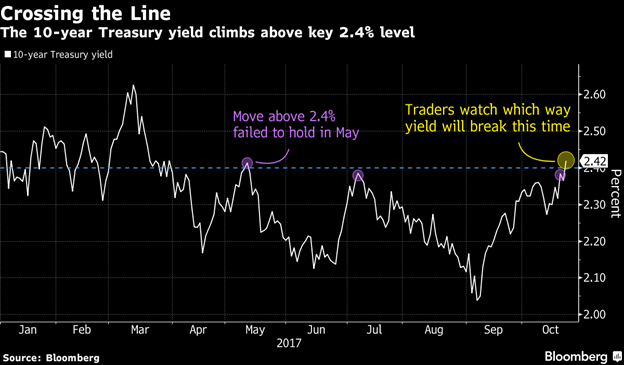

The 10-year has spent this year stuck in a trading range between roughly 2% on the low end, and 2.5% at the highs. Bond market investors have essentially been playing tug-of-war with Treasuries, pushing the bond market back and forth within this range.

On the one hand, they’re concerned about signs of accelerating economic growth. And with it, the threat of inflation. After all, global central banks have engineered a near-zero (and at times sub-zero) interest-rate environment for several years.

And the staggering amount of cheap money sloshing around the global financial system today is potential rocket fuel for inflation.

All that’s needed to ignite it is a lit match.

On the other hand, central bankers have pursued this ultra-easy monetary policy because deflation, not inflation, has been public enemy No. 1 ever since the financial crisis nearly 10 years ago.

A lot of investors today believe interest rates can stay lower for a lot longer. If they’re right, then asset values — especially stocks — can continue skyward. So, we would have nothing to fear from higher Treasury bond yields.

But what if they’re dead-wrong?

The fact is, the world economy is a different place now than during the deflationary financial crisis nearly a decade ago.

Growth has picked up around the world — still at a subpar pace, to be sure. But the rate of change is moving higher. So are inflation measures like consumer and producer prices in the world’s two largest economies: the U.S. and China.

The Chinese have been pumping both monetary and fiscal stimulus into their economy almost nonstop in recent years. And inflation is accelerating. Producer prices in China jumped at a 6.9% annual rate last quarter.

In the U.S. it’s been all about monetary stimulus, with multiple rounds of QE since 2008.

But now the hint of fiscal stimulus is also in the air.

If Washington can get its act together, a massive tax-overhaul plan could soon pass. One that includes trillions in cash held overseas by U.S. corporations coming home at a reduced tax rate.

Defense and infrastructure spending are also high priorities.

Another, more fundamental factor, has changed for the Treasury bond market, too: simple supply and demand.

Until recently, the Fed was the buyer of last resort for Treasury bonds. But the Fed ended its bond-buying scheme nearly three years ago. And now, it’s starting to cash in some of its bonds.

This means less demand for Treasury bonds from their biggest buyer in recent years.

Meanwhile, the issuance of new Treasury debt is set to accelerate in November, December and beyond, to fund Washington’s fiscal spending spree.

Less demand, plus more supply is likely to put additional selling pressure on Treasury bonds. This points to higher yields.

And next year, the Fed plans to drain even more cash from the bond market. It aims to reduce its bloated balance sheet of Treasury and mortgage-backed securities by $50 billion a month by this time next year. That’s up from $10 billion a month in redemptions now.

Bottom line: Expect the 2.5% line in the sand for Treasury yields to be shattered sooner rather than later, with the 10-year yield likely to shoot up to 3% and beyond.

When that happens, the stock market will surely take notice of this new and more-hostile interest-rate environment. And investors won’t like what they see!

The iShares Barclays 20+ Yr Treas.Bond ETF was trading at $124.58 per share on Wednesday morning, up $0.12 (+0.10%). Year-to-date, TLT has gained 6.12%, versus a 16.59% rise in the benchmark S&P 500 index during the same period.

TLT currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 28 ETFs in the Government Bonds ETFs category.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Treasury Yields Are Hitting A Major Inflection Point

Published 11/02/2017, 01:29 AM

Treasury Yields Are Hitting A Major Inflection Point

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.