The stock market is close to a record high, supported by the outlook for moderate US economic growth. Yet the bond market once again seems to be pricing in the prospects for a weaker economy.

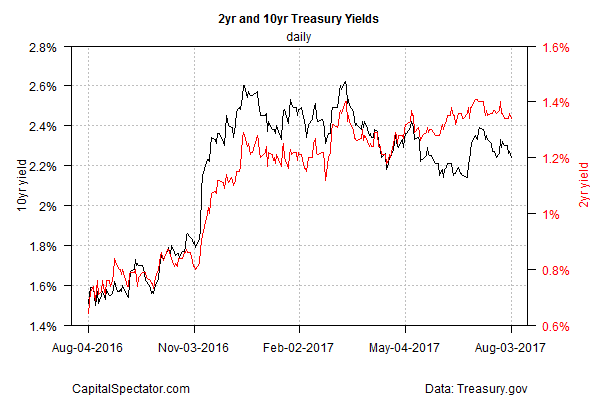

The divergence between the upward-biased S&P 500 Index and downward sloping Treasury rates has become conspicuous over the last several weeks. The benchmark 10-year Treasury yield fell to 2.24% yesterday (Aug. 3), the lowest in nearly three weeks, based on daily data via Treasury.gov.

The downside bias in the 10-year rate is even more obvious on a year-to-date basis. The benchmark yield ended 2016 at 2.45%, briefly ticking above 2.60% before stumbling lower by nearly 40 basis points as of yesterday’s close.

The 10-year rate’s weakness for much of 2017 is all the more striking at a time when the stock market has remained firm. The S&P 500 is up nearly 12% year to date, supported by signs that economic growth, although still moderate, remains poised to roll on.

True, consumer spending growth has been slowing lately. Personal consumption expenditures decelerated to a 3.8% year-over-year increase in June, the softest pace in nearly a year. But moderate growth for payrolls suggests that the recent slowdown in spending will be temporary, or at least stabilize.

Friday's positive outcome for payrolls aligns with Thursday’s report on job cuts at US employers in July. According to Challenger, Gray’s monthly update, the number of announced layoffs fell to roughly 28,000 last month, the lowest since last November, the consultancy reported.

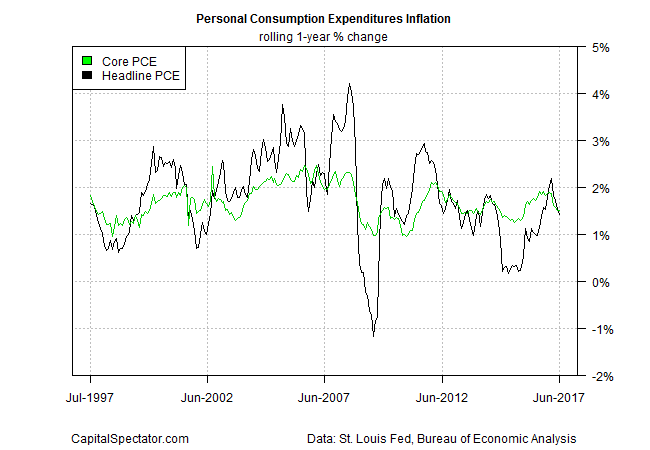

What, then, is propping up the appetite for the safe haven of Treasuries and putting downward pressure on yields in the process? Perhaps it’s the softer-than-expected inflation data. Personal consumption expenditures-based inflation, which the Federal Reserve monitors closely, decelerated for a fourth month in June, slumping to a 1.4% annual increase – the lowest since last September.

It’s unclear if the recent slide in inflation is temporary or the start of a new downturn in pricing pressures, but for the moment the crowd thinks that the Fed will delay additional interest-rate hikes. Fed funds futures are currently pricing in a high probability of no change in monetary policy for the central bank’s September and November meetings, with a roughly even chance of a rate expected in December.

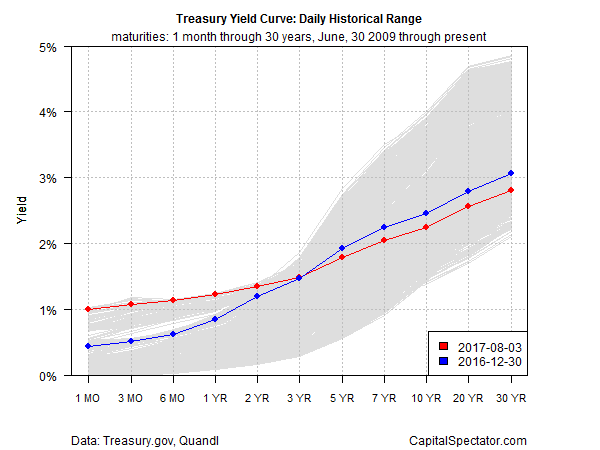

Meantime, the Treasury yield curve this year has flattened. Short rates through the 2-year maturity are above levels at last year’s close while rates for 5-year through 30-year securities still reflect modest declines on a year-to-date basis through yesterday (Aug. 2).

The disconnect between the equity and Treasury market isn’t new, but its revival is a reminder that skepticism about the economy’s prospects still run deep since the last recession ended eight years ago. Nonetheless, recession risk remains low and the best guesses for the near-term outlook still point to moderate economic growth.

The IHS Markit US Composite PMI Output Index, a GDP proxy, increased to 54.6 in July, the highest since January. “At current levels, the [PMI] surveys are indicative of GDP rising at an annualized rate of approximately 2%, but if growth accelerates further in line with the upturn in new business, the third quarter could be even stronger,” said Chris Williamson, chief business economist at IHS Markit, in yesterday’s release.

In other words, the case is still compelling for expecting that the rebound in GDP growth in the second quarter to a 2.6% annualized rate will hold in Q3. In fact, some preliminary estimates are calling for a substantially faster expansion. The Atlanta Fed’s initial GDP nowcast for Q3 popped to 4.0% in Thursday’s update. There’s still a long way to go for Q3 data, of course, but at the moment the near-term outlook remains encouraging.

The bond market, however, remains skeptical while the stock market is effectively betting on moderate growth or better. It’s anyone’s guess when the divergence between fixed income and equities will end — after eight years, it’s reasonable to assume the conflicting expectations will continue. Meantime, the appetite for hedging remains brisk, an implicit bet via Treasuries that economic growth and inflation will remain subdued.