TransDigm Group Incorporated (NYSE:TDG) is a leading global designer, producer and supplier of highly engineered aircraft components that are used in in-service commercial and military aircraft. The company has an extensive portfolio of proprietary products, which boosts its competitive position.

TransDigm is seeing some negative trends at present, like weaker defense aftermarket orders and soft business jet, helicopter and freighter revenues, which is hurting its prospects. Softness in global macroeconomic conditions is impacting air travel, adding to the company’s woes. The company has some concerns about the commercial transport industry in the coming times as well. These factors have been hurting its financials in recent times.

However, on the positive side, about 90% of TDG’s sales are generated by proprietary products, that is, products for which the company owns the intellectual property. This translates into consistent and sustained revenue generation capacity through all phases of the aerospace cycle.

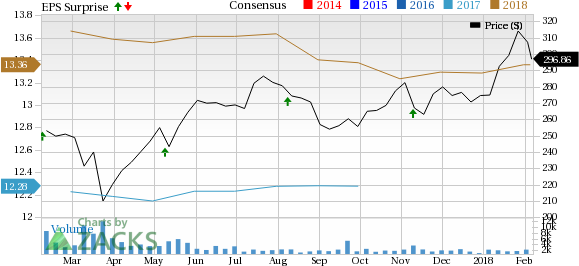

The company has had a decent earnings history. It has trumped the Zacks Consensus Estimate each time in the trailing four quarters, with an average positive surprise of 3%.

Transdigm Group Incorporated Price, Consensus and EPS Surprise

Currently, TDG has a Zacks Rank #3 (Hold) but that could definitely change following its first-quarter fiscal 2018 earnings report, which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key details from the just-released announcement below:

Earnings: TDG’s adjusted earnings came in at $5.58 per share, up a whopping 121.4% year over year, driven largely by the favourable impact of the recent tax reforms.

Revenue: Revenues came in at $848 million, missing the Zacks Consensus Estimate of $862 million.

Key Stats: Concurrent with the fiscal first quarter results, the company reiterated its revenue outlook and revised its earnings guidance for fiscal 2018, to incorporate the new tax regulations. Adjusted earnings per share are now forecasted to be in the band of $16.95 to $17.59 per share, in comparison to the earlier guided range of $12.78 to $13.42 per share.

Stock Price: TDG shares were inactive following the release. It would be interesting to see how the market reacts to the results during the trading session today.

Check back later for our full write up on this TDG earnings report later!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Transdigm Group Incorporated (TDG): Free Stock Analysis Report

Original post