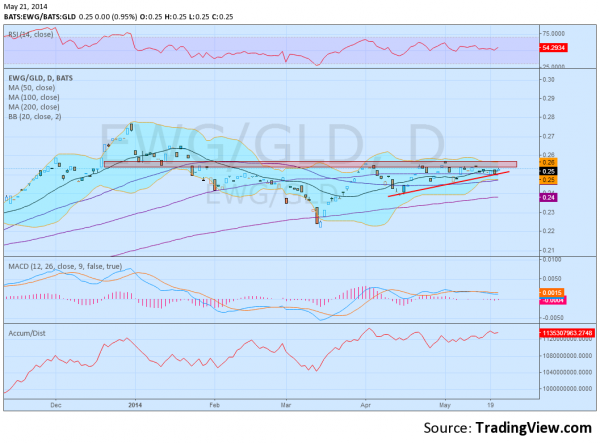

Flipping through some charts last night this came across as a good set up. Trading the German market (iShare MSCI Germany (ARCA:EWG)) against a short position in Gold. The components set up well. Just a about a week ago I noted that the German market is setting up well in Two Germans at Play. And my longer term bias in Gold has been lower for some time. This seems like a natural trade then. But the chart below settles any unanswered concerns about the trade.

The level of the ratio between 0.2525 and 0.2575 has been sticky and resistance all year. But the ratio has been making a series of higher lows against that range. Tightening against the range is a positive for a potential break out higher and the pattern would conservatively target a move to 0.275. It may not seem like much but that is a nearly 7% move. And with the leverage from a long short pairs trade it becomes quite attractive. The other indicators are supportive of the move higher too. The RSI is holding the mid line and remains bullish, the MACD is consolidating and positive and the accumulation/distribution statistic is strong. All that is left now is a break of the range higher to enter with a long position in EWG against a short position 1/4 size in Gold.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.