A quick recap of the reactions to the Bank of Japan’s Friday announcement:

Kuroda and co.’s 5-4 decision has certainly created a huge amount of excitement on the back of adopting QQE, which is now moving some benchmark rates into the negative. Abenomics has been based on the ‘three arrows’ monetary policy, following a similar call with three ‘areas’ of policy - ‘quantity’, ‘quality’ and ‘rates’.

Concentrating on the final ‘area’ benchmark, rates turning negative has had a triple channel effect:

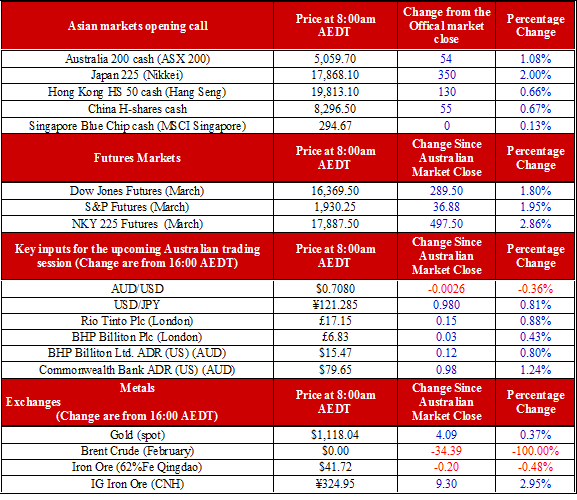

1. Stimulus for CAPEX and spending mean borrowing costs hit effectively 0% on the Japanese domestic front. There is an international benefit here in that it will ramp up the carry trade; the ASX has a net yield 5.27%, its highest since 2011. AUD/JPY is one to watch, as is index buying of the ASX.

2. A lower JGB yield curve – this forces Japanese firms to rebalance portfolios from safe-haven assets into risk assets.

3. Currency can again compete with other central bank movements and will promote devaluation of the JPY.

The market reactions to the BoJ’s decision in the US season on Friday night was pretty clear – a net positive for risk, net positive for international trade and increases in fund flows in Asia. All are seen as a macro positive.

Four themes of earnings season

February sees the beginning of half-year FY16 earnings for the ASX – in my view H1FY16 will be the final shake-out of the negative pricing that has been building in the ASX over the past six months.

1. Top-down issues: I have been pretty strong on pointing out the impact of top-down issues. The global industrial cycle has taken a big hit in 2015, commodities prices have hit multi-decade lows and the domestic housing market has slowed. This has impacted the 47% financial service weighting of the ASX.

However, barring the international headaches on the macro front, domestic macro factors show; activity is at a five-year high, business conditions and business confidence have picked up in the back half of 2015, and employment has been stronger than expected. (Side note: This is likely to give the RBA more breathing room tomorrow and into Q1 2016)

2. Costs: There are possible surprises here. The AUD is a positive on the export side and may help cost surprises on the upside for exporters. However, as FX hedging rolls over for importers, margins will be squeezed. The employment increases will increase fixed costs and credit costs were independently raised in the second half of the calendar year by the private banks – cost ‘surprises’ are likely and a possible negative on earnings.

3. Fundamentals showing flawlessness: Although the ASX has seen a huge re-basement in its overall fundamentals with its current P/E ratio trading at approximately a 5% to 6% discount to the historical level.

Cyclical stocks on a forward 12-month blended basis are trading at the highest levels in decades (ie. BHP's (N:BHP) forward P/E has been as high as 24 times in the past eight weeks: its highest level since 2004). What’s more, the reaction from the market to ‘missing earnings expectations’, coupled with these multi-decade high P/Es has left growth stocks with no margin for error. No graces are given in the post-GFC world – firms that miss expectations with high forward P/Es will see high double-digit percentage ‘re-basements’.

4. Low estimate hurdles: A possible positive is that Australia is starting to see US-styled earnings estimates. Current estimates are at the lowest level of the past eight years. EPS growth on the ASX is just 3.57%. Estimates are pricing in EPS downgrades for FY17 and FY18. Now, while the downgrades are justified, the level is very low even in the current environment. Like the US earning season, we may see firms beating expectations on a higher-than-normal basis.

My focus is on the following sectors for earnings season: capital goods, industrials (ex-banking and mining) and domestically-focused service firms.