On Tuesday the S&P 500 experienced the first real giveback since the May rebound kicked off. Economic headliners were mixed, but that’s all it took to knock us from the highest levels in a couple of months.

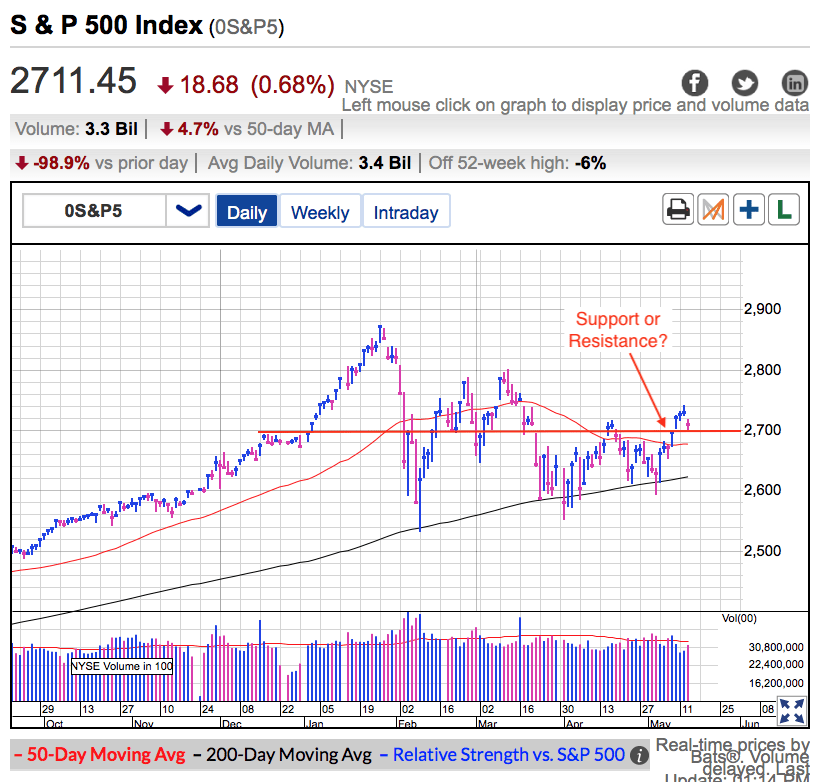

Last Thursday I warned readers to be more careful now that we were approaching the upper end of the trading range. Risk is a function of height and this was the highest we’ve been since early March. Recent gains made this a better place to be taking profits than adding new positions. And Tuesday’s pullback to 2,700 support validated those warnings.

The question is what happens next? It was nice to see buyers show up once prices slipped to 2,700. Market crashes are brutally quick and while we are not in the clear yet, one day of support is constructive. If this market was grossly overbought, we would have tumbled far more dramatically from the highs. Tuesday was a more measured pullback and that tells us this market is not overly vulnerable.

Hold 2,700 for another day and everything is looking pretty good and the path of least resistance remains higher. But if we slip under 2,700 Wednesday, be prepared for a wave of technical selling to weight on the market. The way it responds to this violation of support tell us what comes next. If the selling intensifies, expect the weakness to carry us back into the heart of the trading range. That puts 2,650 and the 200dma in play. But if we dip under support, supply dries up quickly, and we reclaim 2,700 before the close, then things are looking strong and the May rebound continues.

At this point the odds are 50/50 if support holds or fails. For a good trade, we want better odds than that. The this opportunity doesn’t get real attractive unless we dip back to the 200dma and bounce. That’s where the discounts create a safer and more profitable trade. If prices don’t dip and we hold current levels for a few more days, that tells us the market wants to go higher. In that case 2,800 is in play and we need to be patient.

I don’t know what the market will do next, but I have several trading plans ready to go. It won’t be long before the market tells us what it wants to do next and those of us that are ready will be positioned to profit from it.

After holding $9k support for several weeks, Bitcoin finds itself under this widely watched support level. As I warned readers two weeks ago, there comes a point where support turns into stalling. That is what happened here. The inability to move beyond support made a violation inevitable. The latest rebound from the $6k lows helped rebuild sentiment, but expect most of those positive feelings to disappear if we stumble back into the $7k range. It often takes bubbles six to twelve months to find a bottom. If that happens here, that means lower-lows are still ahead of us. I’m skeptical of BTC at these levels and it needs to recover $9k as soon as possible to prove me wrong. Otherwise expect nervous selling to return and push us back under the $6k lows.