Record debt levels, record margin levels, record central bank stimulus, and record government intervention. It certainly feels like we’re in uncharted territory. I’d be inclined to say we are experiencing record stupidity at a government level, but then I’ve read enough history to realise that this is not true.

Unfortunately we’re merely experiencing extremes at this juncture in history, and while mean reversion can be a bitch it can also turn pennies into pounds. Insular, incestuous, inbred politicians, and parasitic central bankers have always existed, probably always will. Our task is to profit from what is happening.

When extremes present themselves I take notice because extremes in anything rarely last. Extremes set up for truly asymmetric payoff situations.

But lest I be accused of opinions, let us look at the data. Like it or not, I can’t argue with data points. This is what Brad and I have been discussing recently. Below is Brad’s run down on the charts he’s been looking over and sharing with me.

We are witnessing implied volatility in all asset classes simply collapse to the lowest levels witnessed in 20 years, or at least the lowest levels achieved prior to the GFC in early 2007. This is true in equity markets, bond markets, currency markets and commodity markets. A truly unique setup and one which I believe the market is simply not paying attention to. It is certainly unique in my experience as a professional trader, and historical data backs me up on this.

In essence this implies that the crowd is expecting the markets to remain stable. Stable to a degree that defies both fundamentals and certainly a geopolitical environment which screams otherwise. The market currently believes that volatility will remain low, perhaps the lowest in a generation.

This supposition appears foolish for a number of reasons and I think within, or over the next two years, at least one of these asset markets, if not more, is going to move significantly. Given how inexpensive options are currently priced, due to the aforementioned low volatility on each asset class, we only have to be right on a couple of positions out of the asset classes mentioned to make sizeable returns.

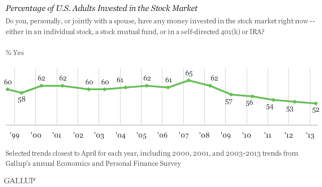

So where should we position ourselves? I like to figure out where the weak hands are positioned and take the opposite side. It seems to me that equity markets are under owned and held by strong hands. Yes, even after the massive rally in the S&P 500.

Note the recent Gallup poll.

We can see that the broad market is not positioned in stocks. As to bond markets, rates are already near zero percent or at historic lows, which suggests to me that bond markets are still dominated by weak hands (i.e. there is a huge pool of marginal sellers).

Below we have the Euro Stoxx 50. Record lows on volatility…plunging to be accurate!

Implied volatility of options 24 months to expiry on the Euro Stoxx 50 (white line) and S&P 500 (orange line)

Here we have the MOVE Index (index of implied volatility on 1 month to expiry options on the US 2, 5, 10 and 30 year Treasury Futures). It is at record lows once again.

Below I present the JP Morgan G7 Currency Implied Volatility Index (Index of implied volatility on 3 month to expiry options on G7 Currencies). More record lows. The market is extremely complacent and the price of volatility is stupidly cheap.

I’m often asked about currencies. I think everyone likes to think that easy money can be made trading currencies. I think the answer to the direction of the USD depends on the pace of the slowdown in China. I think the crowd is paying lip service to the magnitude of the “slow-down” in China. If China slows down more than the crowd expects (and that is putting it politely) then emerging market currencies are likely to depreciate against the USD and in a dramatic way. We’ve seen this happen many times previously.

Moving right along here I present you with Emerging market equities volatility. Can we go lower? It’s possible, though the price we get to buy volatility for right now, many, many years out, is truly a gift.

We wouldn’t be covering the major markets if we didn’t take a look at commodities. Volatility here is, you guessed it, at record lows.

Now, one can easily simply buy straddles in all of the markets I’ve mentioned. I expect you’ll only need one or two of them to surprise volatility sellers for you to get that new Porsche 911 you’ve been looking at. By buying straddles you don’t have to care which way the market moves. As long as it moves and complacency disappears, or even subsides, sending volatility higher.

Right now Chris and I have been discussing a 4.5 year long dated option, which I’ve recently recommended. The particular stock needs to move by 9%! 9 freaking percentage points! Just yesterday it moved 1% in a day! We have 4.5 years to break-even. Opportunities like this don’t roll around every day, but right now we have a plethora of them and I’m feasting.

If I am to present my bias, and everyone has a bias, then this is it. My positioning for the next couple of years is favoured towards:

- Developed market equities (US and Europe) – upside.

- Emerging market equities – downside

- Bond markets – downside (yields to the upside)

- USD – upside

Whatever happens, I suggest watching volatility.