Commodity indices surge to new 7-year highs

Surging energy prices were driving the principle commodity indices to new seven-year highs. The energy-heavy Goldman Sachs index has risen for eight consecutive weeks—up 18% from the mid-August Key Turn Date—up ~170% from the 17-year lows in April 2020.

European Natgas prices quadrupled from the mid-August lows on fears of shortages this coming winter. Indications from Putin that Russia would increase exports cause prices to drop ~50%.

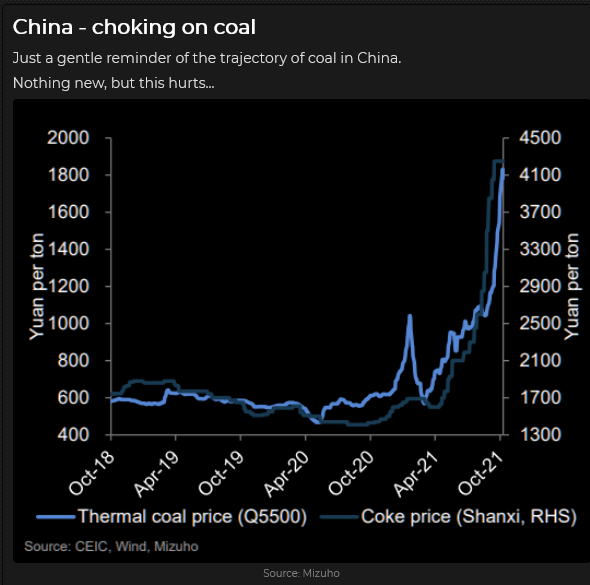

Coal prices soared as India and China run short. Both countries use coal for the majority of their power generation.

WTI crude oil rallied for eight consecutive weeks—up 33% from the August lows to a 7-year high.

The NYMEX gasoline futures contract was also at a 7-year high—up 6X from the 20-year lows in April 2020.

Uranium has more than tripled since last year’s lows, but is still a VERY long way below the highs hit in 2011.

Energy markets may be capturing the headlines in the commodity space, but prices in a host of other markets are also surging higher. Copper rallied ~50 cents last week (12%) and has more than doubled from last year’s lows.

The London Metal Exchange Index of six primary metals hit All-Time highs this past week—up more than 100% from last year’s lows.

Cotton futures hit a 10-year high this week.

Live cattle futures were up ~60% from last year’s lows.

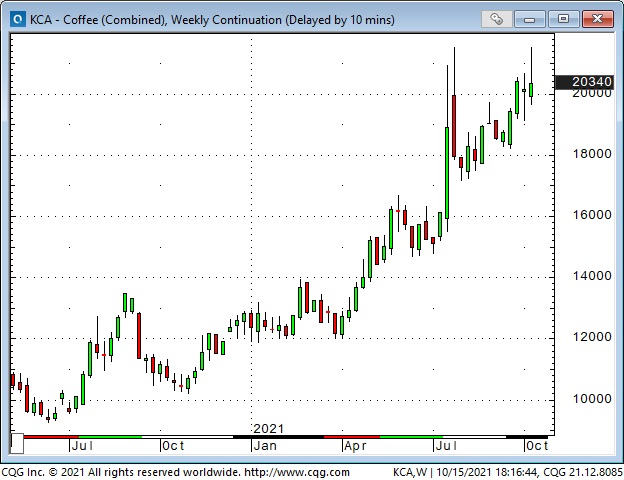

New York futures made 7-year highs—about a double from last year’s lows.

Should commodity bulls be worried by the front-page coverage?

Veteran traders will be familiar with the “magazine cover curse” that has top-picked so many markets over the years. The thinking (according to Don Coxe, a true veteran) is that you want to be getting into a market when it’s a page 16 story—not a page 1 story.

This week, Kevin Muir (The Macrotourist) wrote a blog asking if it was time to bail out of the very crowded long energy trade. Ultimately he decided to stay long (for the long haul), but I sent him a note pointing out that it was his “trader’s intuition” that had him asking that question. In the old days on the commodity trading floors in Chicago, everybody knew the expression, “When they’re yelling, you should be selling.” That expression meant that when the public was screaming to get into a market, you should be getting out.

In July of 2008, as WTI futures were hitting All-Time highs at $147, a famous chief strategist at one of the major Canadian banks was forecasting $200 to $300 within the very near future. Five months later, WTI was $32.

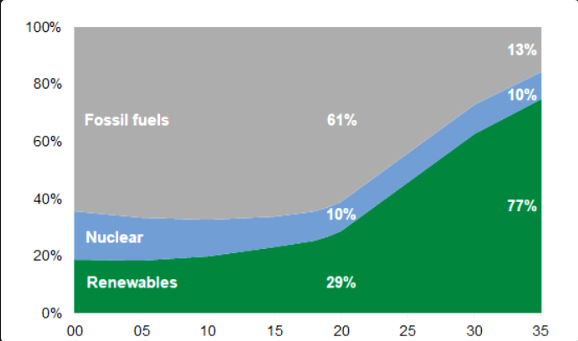

The bull case for energy is compelling. Demand will keep increasing, and there has not been enough capital investment to create the supply necessary to meet demand. The “transition” plans to switch from fossil fuels to alternative energy sources are unrealistic in cost, timelines and compliance.

Central banks worldwide have been creating ~$300 Billion of new money every month for the past 18 months. Why would we be surprised to see stocks, commodities, real estate etc., rising in price? Another aspect of the bull case is that you can’t print energy (or food or gold.)

The bear case, in part, is that the re-opening supply-chain-induced shortages have created higher prices, and the best cure for high prices is high prices. High prices (usually) curb demand and spur supply. Another aspect of the bear case is that when the people are cold and hungry, the governments will burn coal and to hell with climate change concerns.

China seems to be slowing (on purpose?) Xi Jinping is determined to “re-shape” China, which might very well mean that they become a less significant force in global commodity demand. Commodity bulls will argue that Indian commodity demand is about to surge, which will more than make up for any decline in Chinese demand.

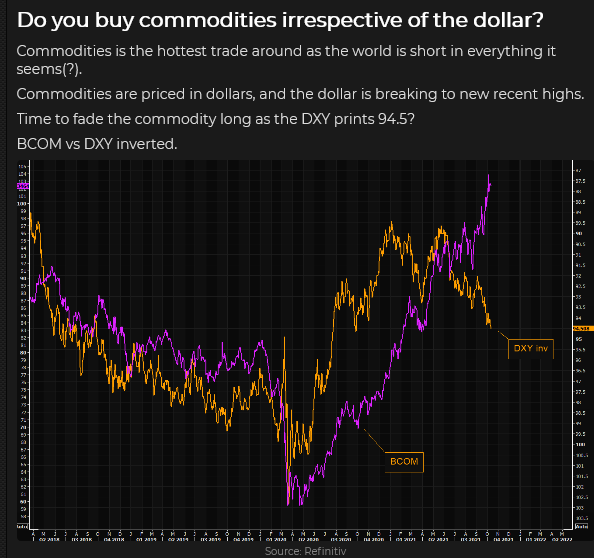

Maybe, I don’t know. Different folks have different time horizons. From the perspective of my short-term trading, I’m not a buyer of commodities here. I’m also not going to sell them short. The bullish psychology seems over-done to me (page 1), but the momentum is powerful. The best time to short any market is after it has started to go down.

Stock indices were higher last week

The major indices have chopped sideways for the past three months, but there has been a lot of “rotation” inside the markets. For instance, the Toronto index has hit new All-Time highs, Transports have rallied sharply after trending lower for four months, but big tech, which had outpaced the broad market, is now slow to rebound.

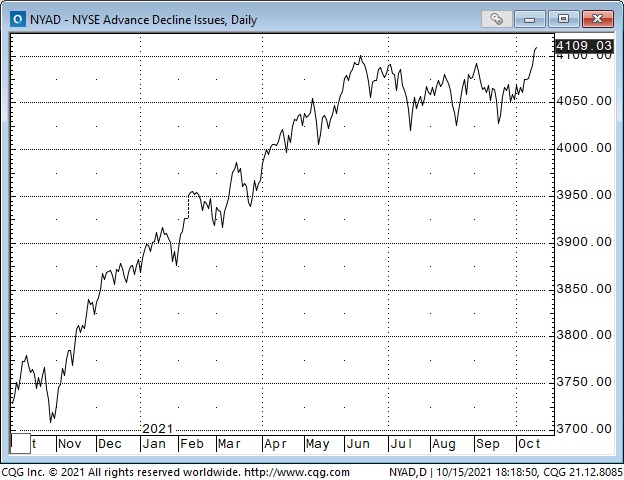

Since June, the New York A/D line has been going sideways but broke out to new All-Time highs this week.

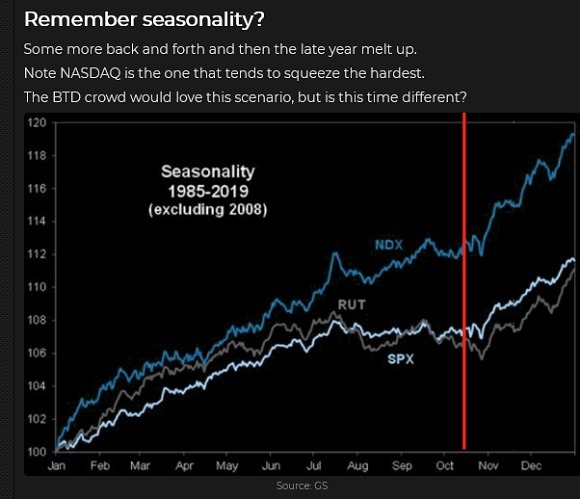

Seasonally, the stock market rallies during the October to December period.

Currencies

The US dollar index hit 12-month highs last week but fell back by the end of the week. Large speculators have built long positions in the USD to a 2-year high. The euro has been weak, but the yen has been even softer.

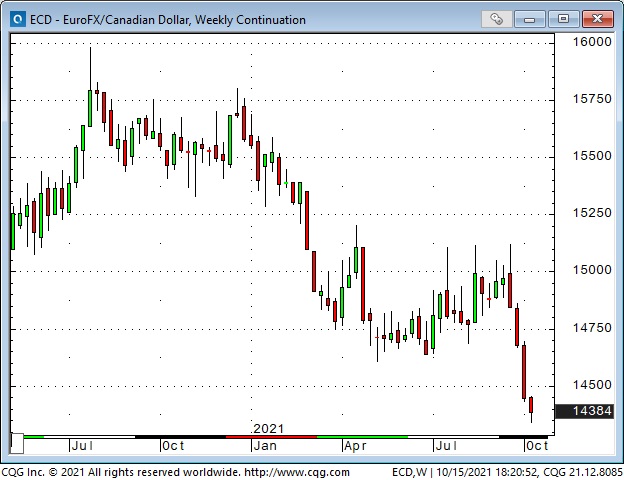

The Canadian dollar rallied last week to its best levels against the USD since early July. Surging commodity markets (especially energy markets) helped boost the CAD, as did the stock market rally. Canadian 2-year interest rates were ~40bp premium to US 2-year rates. The CAD has surged to nearly a 4-year high against the EUR and was at a 6-year high vs. the yen.

My short term trading

The S&P rallied ~150 points from 3-month lows the week before last, but seemed to run out of gas near the end of the last week. The market opened strong on Monday but rolled over after (barely) taking out Friday’s high and started to fall. I shorted the market as it fell and covered the position on Tuesday for a gain of ~60 points.

I bought the S&P early on Wednesday but was stopped for a 20 point loss. I rebought it and sold it Thursday for ~60 point gain. I did nothing Friday as the rally continued (without me!) My P+L was up a little better than 1% on the week, and I’m flat going into the weekend.

On my radar

As noted above, I’m watching the whole energy/commodity space with the idea that bullish enthusiasm is overdone. I won’t short a raging bull market, but I will be watching for signs that it may be rolling over.

President Joseph Biden will likely reappoint or replace Fed Chair Powell within the next couple of weeks. This could have a significant market impact. If Powell is reappointed, he may be moderately more hawkish than he has been. (The transitory inflation story is getting old.) If he is replaced, then the new Fed Chair will probably be more dovish than Powell has been (MMT here we come.)

Labor got “left behind” during the globalization/technology shift. Now labor is gaining leverage, and wages are rising. (In the USA, the “quit rate” is at an All-Time high. In August, 4.3 million people quit their jobs—that’s 3% of the workforce. We see strikes in the USA. [10,000 workers at John Deere (NYSE:DE) plants.] I’ve thought that rising wages (and rents) would be the “true test” of whether inflation was transitory or not. It’s looking like inflation well above 2% is here to stay.

Markets seek equilibrium—they try to find a level where buyers and sellers can agree on a price. We’ve had a lot of disruptions in the markets. COVID induced massive disruption in monetary and fiscal policy as well as in supply chains and social behavior. The centrally planned transition to a greener world is another colossal disruption. Changes in China may produce another level of global turmoil. I sense an extraordinary “churn” in macro markets as people try to process all of these disruptions—equilibrium may be hard to find—and our old metrics for understanding the new “rate of change” may be useless.

Thoughts on trading

I quoted Gordon Gekko in the “Quotes from the notebook” section last week: “money itself isn’t lost or made; it’s simply transferred from one perception to another.”

That concept of “perception” has been on my mind a lot this week. There were big moves in many markets, yet I only made two trades in the S&P. My perception was that I should have been doing more—and then, of course, the question becomes, “How much more?”

I reminded myself that my job is to find and execute trades and manage the risk on those trades as the market changes. I will increase my size slowly and only after I’m comfortable with my process. I’m not in competition with anybody.

In one scene in Wall Street, Gekko points out a building to Bud Fox and says, “I bought that building and sold it two years later, made an $800,000 profit. It was better than sex. At the time, I thought that was all the money in the world. Now it’s a day’s pay.“

I think that puts “perception” in perspective!

Quotes from the notebook

The first two quotes in my notebook are my own:

1) Way more money has been borrowed than will ever be repaid and,

2) Way more promises have been made than will ever be kept.

My comment: that may be a dark view of the world, but my experience is that both of those quotes are true.

“Nobody ever “owns” anything. They just have it for a while, and then somebody else gets it.” Tim Landon 2005 Hopes House Scotland

My comment: Tim and I were sitting outside the house on his Scottish grouse-shooting estate, late on a mid-summer’s evening, looking at the beautiful rolling countryside. He was one of the wealthiest people in the UK then and owned thousands of acres of land. His perspective on “owning” things has stayed with me ever since.

“I’ve spent my life trying not to be careless. Women and children can be careless, but not men.” Marlon Brando as the Godfather, Don Corleone, talking to his son Michael 1972.

My comment: he’d be dismissed as misogynistic today, but that aside, if you want to do anything well, you can’t afford to be careless.

“The best traders have evolved to the point where they believe, without a shred of doubt, or internal conflict, that anything can happen.” Mike Douglas Trading In The Zone 1995.

My comment: When I was a commodity broker, I had a strip of yellow paper scotch-taped to the top of one of my screens (for years) that said, “Anything can happen.” It was to remind me that I knew nothing. That I needed to understand that the world as I knew it could change dramatically in a heartbeat. The message was taped to my screen years before I read Mike’s book. It didn’t mean that I was a great trader, but I truly understood what he meant.