Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

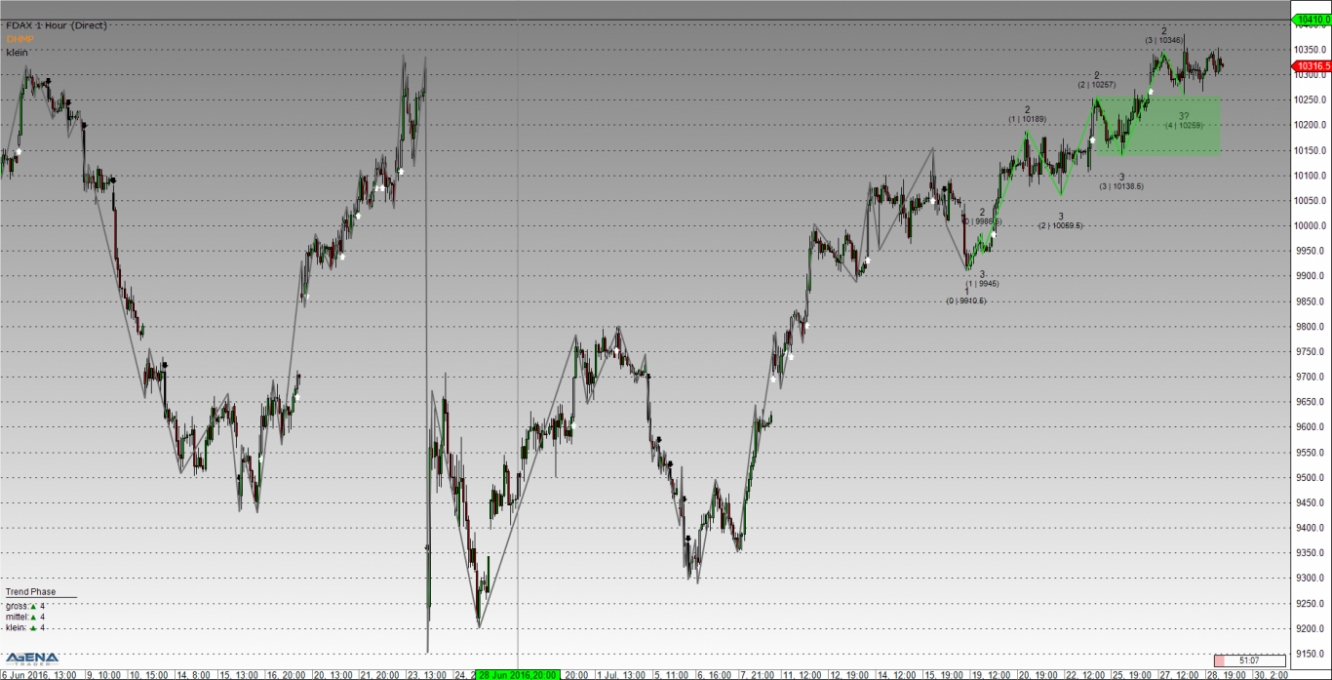

Yesterday it finally happened: the “Brexit gap” was closed. As a consequence, a new uptrend was able to be installed, with a correction zone between 10267 and 10137 points. Yesterday the market came right back to the point two, to then rise directly back up, without, however, forming a further high. If we view the RSI as an indicator, we can see that we are slowly moving into divergences.

One should start to become careful with long trades. Fundamentally, however, my statement remains the same: as long as the price does not underbid the green zone by means of the closing price, the trend can always continue onwards.

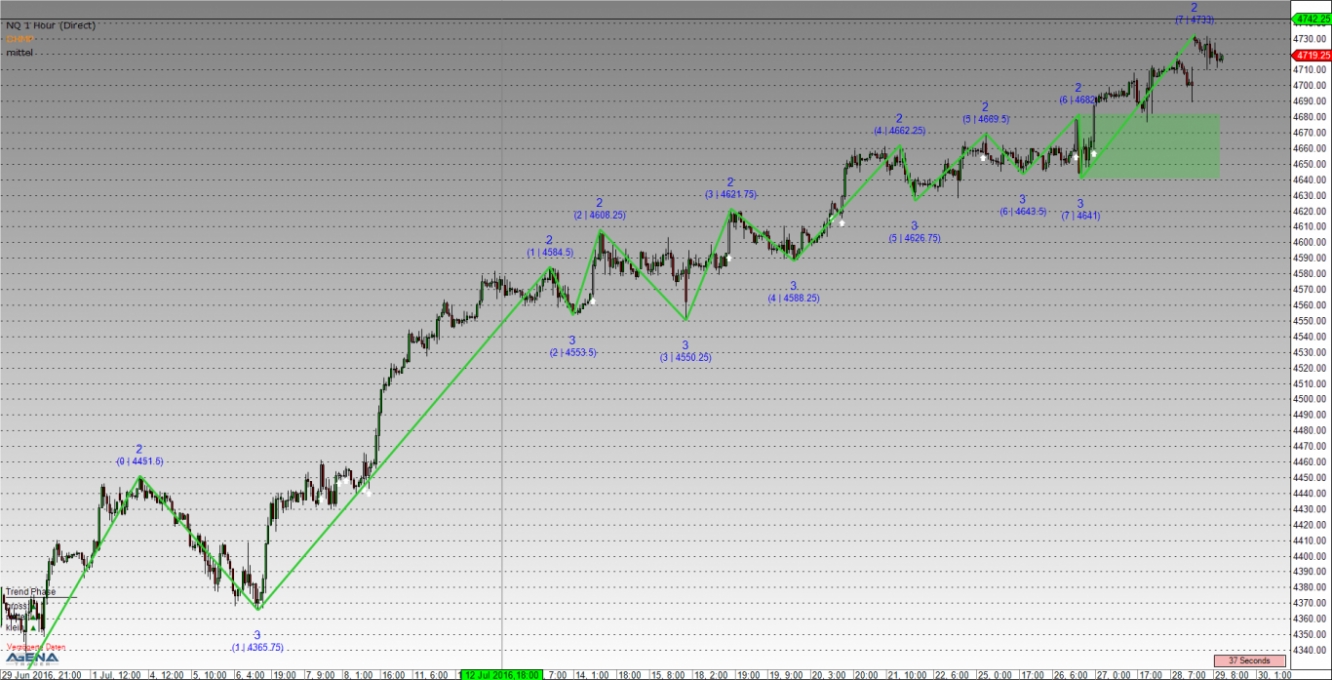

In the medium trend size, we can see a very strong trend that has, however, become very mature by now and was already in its seventh movement, now currently starting the eighth correction. The price has not quite yet reached the all-time high at 4739 points, but instead was able to form a temporary high at 4721 points.

For now, we remain with the maxim: as long as the green correction zone is not underbid by the closing price, the trend can continue on, and it is still possible to earn money with long trades.

Brent Oil

On the 9th June 2016, oil of the Brent variety reached a high at approx. $53. Since then, the price has only known one direction, namely downwards. By now, the price is in an extremely oversold state, meaning that we can reckon with a larger correction upwards soon.

The current correction zone of this downward trend runs between $43.51 and $44.13. As soon as this can be overcome by the closing price, the path is free for a correction.

Disclaimer:

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.