FDAX:

The DAX remains unstable, switching from short to long very quickly. Currently, we are in a downtrend – medium trend size – where we are in the correction. This correction is near the upper edge of its correction zone, and if we get a close above the point three, we will have a trend break once more.

As long as the price stays inside the red zone, the trend will still have the possibility to continue. If we will see several reversal signals, we can enter a short trade with the stop above the red zone.

This US index is showing us a nicer situation, because here we can see a young uptrend. After the recent high at 17864 (future), the price went back into its green correction zone. Once in this zone, the Dow turned around again, and it now seems as though the trend will continue. This gives us a small long chance.

GBP/CAD:

This pair is generally in a stable uptrend. The most recent high is located at 2.0974 CAD, and attempted to outdo this price a second time, but was unsuccessful. As a consequence, the price dropped down sharply into its green correction zone, and even touched the last point three at 1.8149 CAD with this move.

However, more buyers led the price back up, therefore keeping the trend intact. With a very narrow stop below the green zone, investors (since we are dealing with the weekly chart) are able to speculate on a trend continuation.

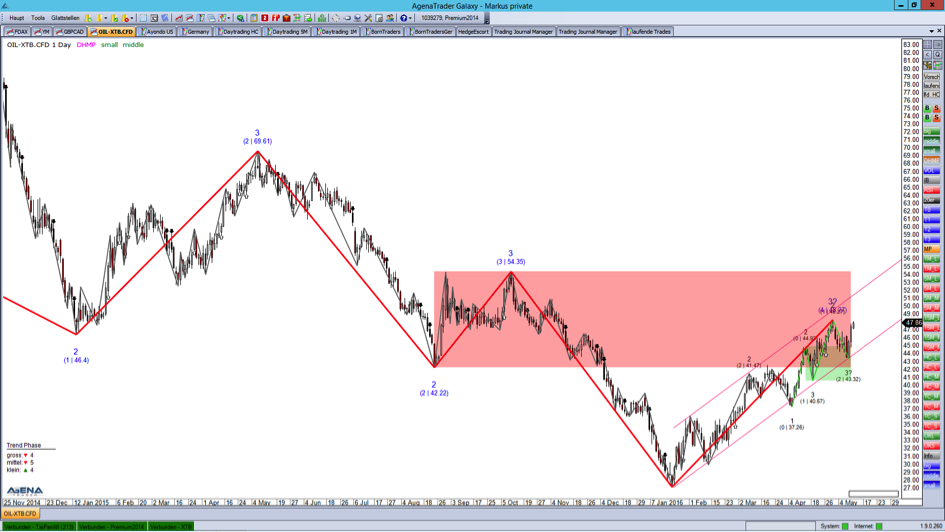

Brent Oil:

The black gold is in a very interesting situation. Two trends are visible in the chart. The big red trend is facing downwards and has come back into its red correction zone. The path from the last low up to the current price was carved by a corrective uptrend that is characterized by the trend channel in the chart.

Oil will probably increase even further, and the next target could possibly be located at the upper channel edge or the upper range of the red zone. Here we have a short long chance.

I hope you will remain favorably disposed towards me and always remember: the journey is the reward!

For demonstration purposes, the software AgenaTrader has been used.

Disclaimer: Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer's investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk. Please refer to the current version of the Terms and Conditions.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI