At what point does economic resilience give way to political reality? No one’s really sure, but the Trump administration continues to press its trade-war policy and the macro blowback continues to mount. Let’s be clear: the United States economy continues to expand at a moderate pace and the risk of recession remains low for the immediate future. But investors are waking up to the fact that the White House’s policy on trade, if it continues, will probably be a critical catalyst that triggers the country’s first recession in a decade.

Despite the economic risk, the latest headlines offer no reason to think that Trump and company are changing their policy plans. Indeed, the Trump administration on Wednesday rolled out new tariffs on European Union (EU) goods that go into effect on Oct. 18. The announcement followed a decision by the World Trade Organization that gave the US approval to impose new tariffs.

Not surprisingly, the EU vows to retaliate and so the economic threat from trade-war risk continues to rise.

Let’s not forget that the US is also fighting a trade war with China—a battle that shows no signs of ending any time soon. It all adds up to a trade policy that one analyst calls “tragic.” Vishnu Varathan, who oversees economics and strategy at Mizuho Bank, advises in a note to clients that the latest US decision to impose tariffs on Europe could push global trading activity “even more off-course.” He adds: “But the blow is not just to trade as corporate margins erode, household discretionary income is diminished, shipping suffers air pockets and financial repression is prolonged.”

Still, the Trump administration pushes on. To what end? Ostensibly to enhance the US economy and create jobs. But so far the policy seems to be delivering the exact opposite.

Perhaps next week’s plans to relaunch US-China trade negotiations will provide encouraging results. But the clock is ticking and investors are running out of patience, as the sharp slide in US stocks so far in October suggest.

“This is the markets unequivocally insisting that there be verifiable, material progress in next week’s trade talks,” says Julian Emanuel, chief equity and derivatives strategist at BTIG, a brokerage.

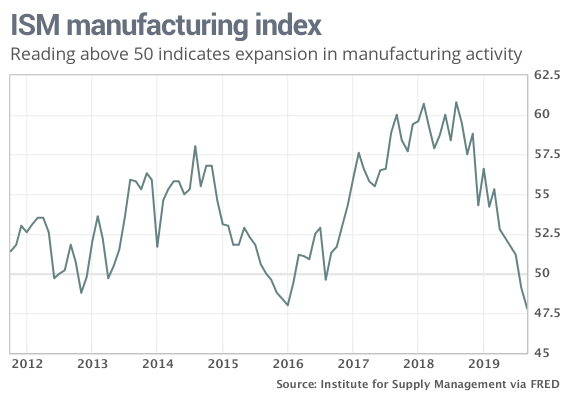

Meantime, the slow deterioration in economic data of late is a reminder that the window of opportunity for solving the trade conflict is narrowing. Yesterday’s ISM Manufacturing Index for September reveals that American manufacturers are now in recession for the first time in a decade.

The outlook for this month’s third-quarter GDP report still points to modest growth, but the Atlanta Fed’s GDPNow model for Q3 was trimmed yesterday to a sluggish 1.8% rise, slightly below Q2’s 2.0% increase.

“The disappointing data is only fanning long-standing fears of slowing global growth,” observes Alec Young, managing director of global markets research at FTSE Russell. “And with U.S.-China trade expected to produce little in the way of near-term breakthroughs, investors continue to favor countercyclical, defensive stocks with high dividend yields as weak data pushes interest rates ever lower.”

President Trump is quick to blame the Federal Reserve for the recent US economic slowdown, tweeting that the central bank has “allowed the Dollar to get so strong, especially relative to ALL other currencies, that our manufacturers are being negatively affected. Fed Rate too high.”

The Fed has cut interest rates twice in recent months and a third cut is expected at the FOMC meeting scheduled for Oct. 30. Fed funds futures are currently pricing in a 75% probability of cut from the current 1.75%-2.0% target rate.

Expecting easier monetary policy to keep the US economy humming is probably expecting too much at this late date. The headwind is less about easy money vs. misguided trade policy.

“We have now tariffed our way into a manufacturing recession in the US and globally,” says Peter Boockvar, chief investment officer at Bleakley Advisory Group.

When will the threat end? When Donald Trump says so. On what basis would such a decision be made? Good question.

Meantime, “There is no end in sight to this slowdown [and] the recession risk is real,” writes Torsten Slok, chief economist at Deutsche Bank (DE:DBKGn), in a research note this week.

That leaves the service economy for the US as the last line of defense for keeping the economy out of recession, at least for the near term. On that front, today’s September data for the ISM Non-Manufacturing Index offers a crucial update. Economists are expecting a modest weakening but to a level that still reflects a moderate pace of expansion, based on Econoday.com’s consensus point forecast.