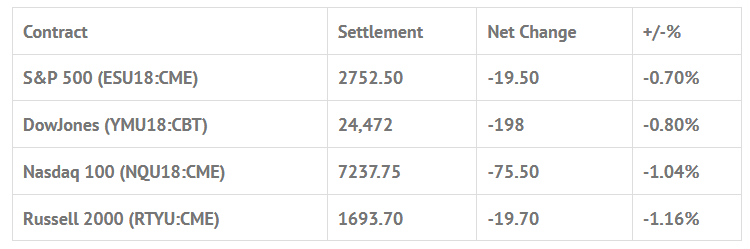

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.49%, Hang Seng +0.15%, Nikkei -0.78%

- In Europe 11 out of 13 markets are trading higher: CAC +0.85%, DAX +0.40%, FTSE +0.98%

- Fair Value: S&P +2.59, NASDAQ +23.14, Dow -4.54

- Total Volume: 1.48mil ESU & 328 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes OPEC meetings Friday and Saturday, Markit’s U.S. index for June manufacturing at 9:45 a.m. ET, and the Baker-Hughes rig count at 1 p.m.

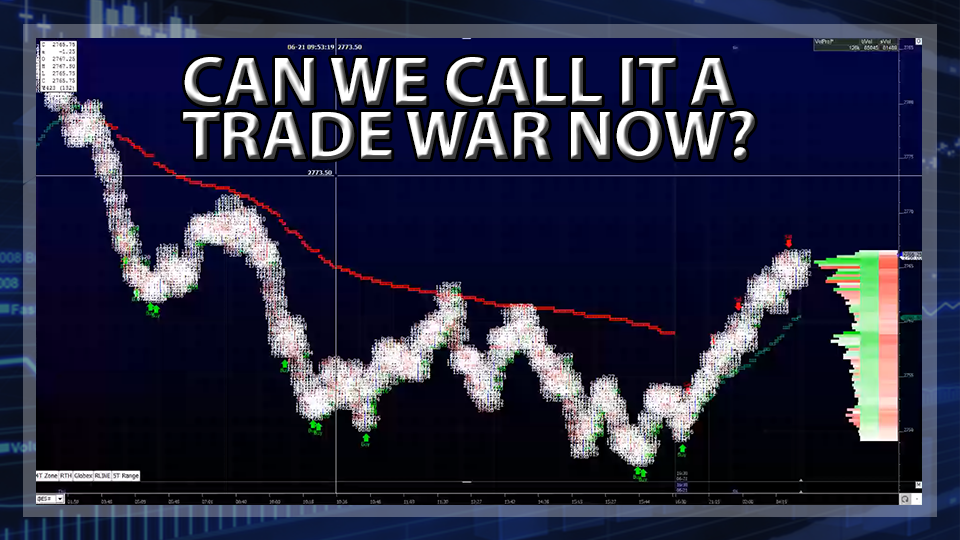

S&P 500 Futures: #ES Retreats as Trade Tensions Linger

Following a volatile overnight trade with 23.25 handles of range and 239k contracts traded, the S&P 500 futures opened yesterday’s regular session at 2770.00, down -1.75 handles. An early high was made on the open at 2770.50 before a wave of sell programs pushed the futures down to 2751.25, just then following a 5.50 handle rally, the ES made the low of day at 2750.25 just after 9:45 am.

From there, into the late morning, the equity futures attempted a rally, pushing up to the late morning high of 2763.50 just after 10:50 am, and then sold off down to 2752.00 just after the noon hour, making a higher midday low, before rallying up to a lower 2761.00 high just after 1:00 pm, and then drifting lower into the final hour.

The last hour of the trading day saw weakness early on as the ESU made new lows down to 2747.75 just after 2:20, and then rallied up to 2755.00 quickly before taking a trip back down to new lows down to 2747.00 as the 2:45 CT MiM reveal came out at 600 million to sell. After that, the futures pushed higher in the final minutes of the session to 2754.25. The ES went on to print 2752.50 on the 3:00 cash close before settling the day at 2752.00, down -20.00 handles, or -0.72%.

In the end, the ES did rally on Globex overnight, but stumbled in the early morning and during yesterday’s day session as the US / China trade war rhetoric picked up. Like I said in yesterday’s Opening Print, the dark clouds that are hanging over the global stock markets right now are really centered on one thing, the US / China trade wars, and from the look of it there doesn’t seem to be an end in sight. In terms of the ES’s overall tone, it was one of failed rallies, and in terms of the days overall trade, 1.4 million total futures contracts traded.

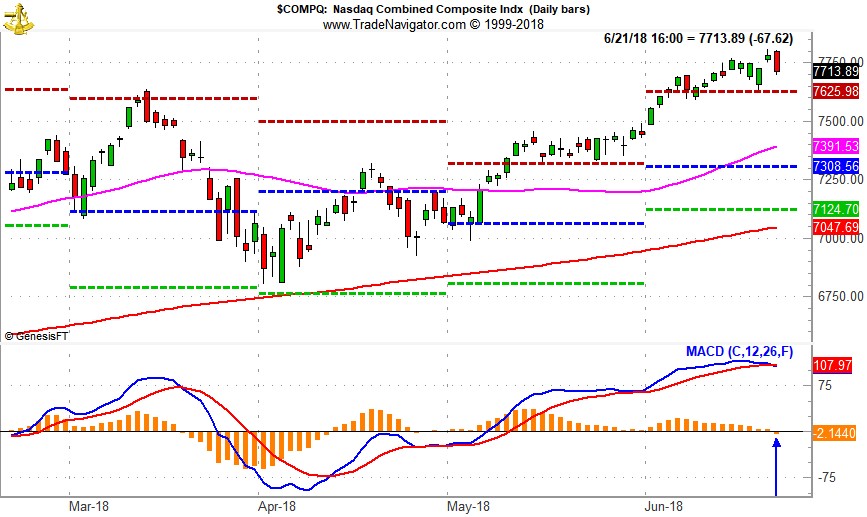

NASDAQ Seasonal MACD Sell Signal Triggers – Trades to Make

From Stock Traders Almanac:

As of yesterday’s close, the slower moving MACD “Sell” indicator applied to NASDAQ has turned negative. At this time we are issuing our official MACD Seasonal Sell signal for NASDAQ.

NASDAQ’s “Best Eight Months” have come to an early end. As a result, Sell SPDR Technology (XLK), iShares US Tech (IYW), iShares Russell 2000 (IWM) and PowerShares QQQ (QQQ). For tracking purposes, these positions will be closed out of the ETF Portfolio using tomorrow’s average price.

Also, at this time we will officially add to existing positions in iShares 20+ Year Treasury Bond (NASDAQ:TLT) and iShares Core US

Aggregate Bond

(AGG) using applicable buy limits. SPDR Utilities (XLU) and SPDR Consumer Staples (XLP) can also be considered on Dips. New buy limits appear below in the updated ETF Portfolio.

This NASDAQ Seasonal Sell Signal is a reminder to tighten stop losses and/or take profits on technology related positions as NASDAQ’s seasonally favorable period has come to an end. Russell 2000 exhibits a similar pattern to NASDAQ and small-cap positions could also be trimmed.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.