Over the past few weeks, the focus has shifted from a resilient US economy to one that may fall into recession. From the business owner who’s worried about rising prices for inputs to the consumer worrying about the rising cost of living and the safety of their job. The uncertainty is leading everyone to believe the worst, and now it’s starting to show up in the data. It started with the decline in sentiment, which led to the first monthly decline in consumer spending in years. And the multiple retailers reporting higher prices ahead only confirmed their worst beliefs.

Since it all comes down to trade policy and government spending cuts, we’ll break down the details of the latest trade report.

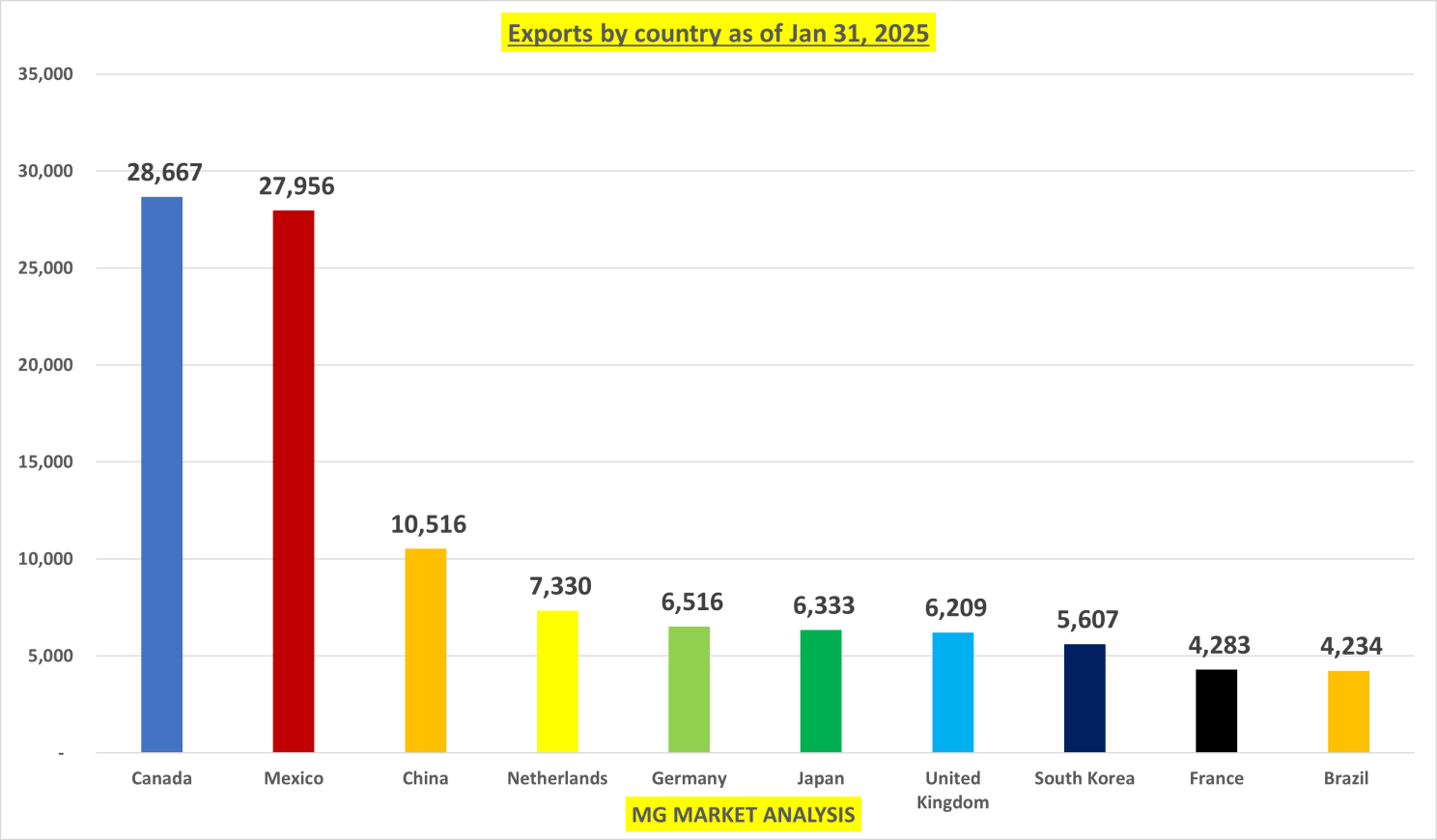

Total exports (what we sell to other countries) of goods came to $172.8 billion. Total exports by country shows Canada and Mexico are by far our biggest customers. Accounting for 1/3rd of total exports for goods.

Total exports declined for 6 of our top 10 trading partners in the month of January, with the UK dropping the most (down $1.7 billion).

Total exports of services grew to $97 billion.

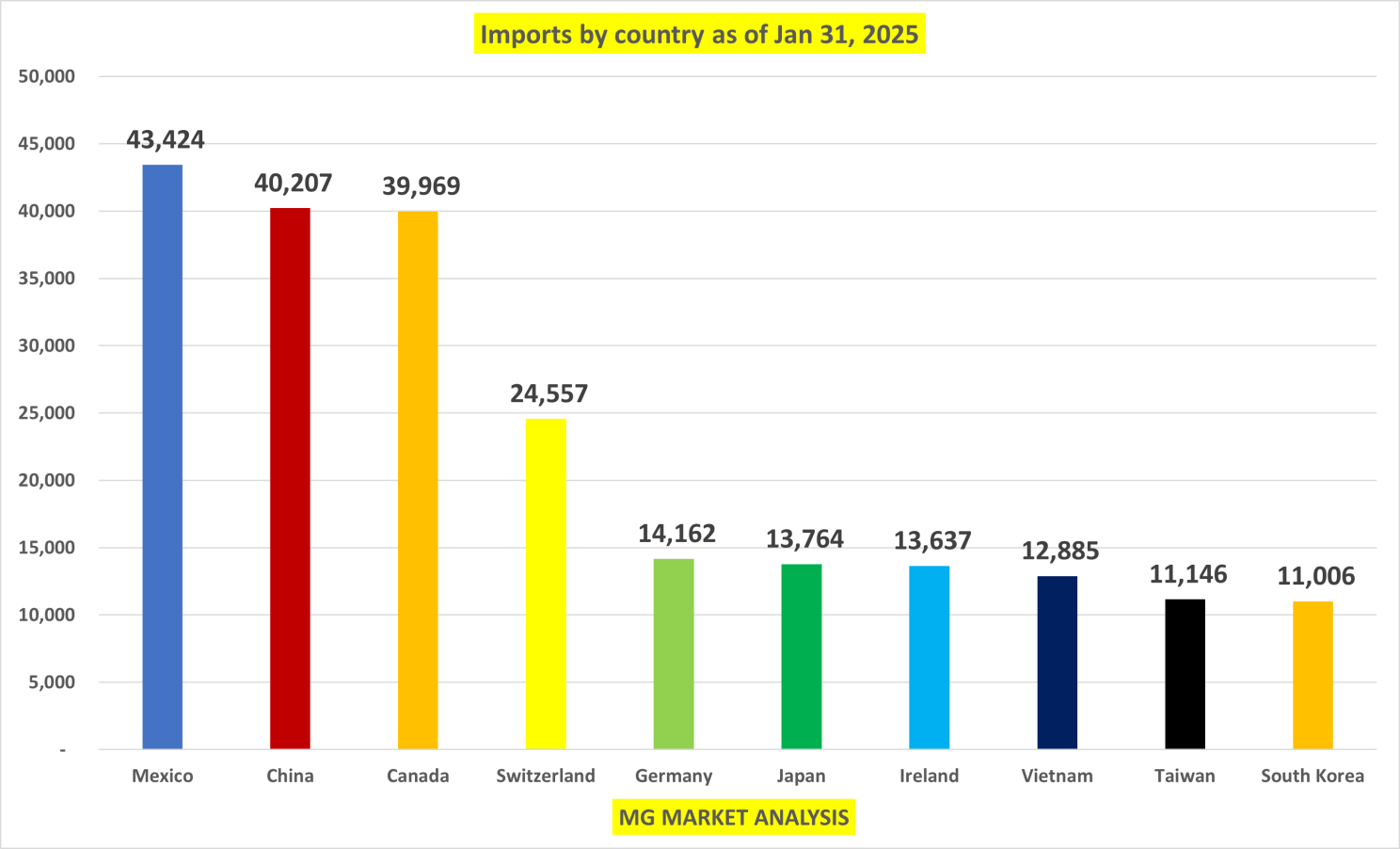

Total imports (what we buy from other countries) of goods came to $329.5 billion. Mexico, China, and Canada accounted for about 40% of total goods imported. While imports from Switzerland experienced the biggest monthly increase ($10.3 billion).

About 60% of this import splurge ($20.5 billion) came from the “finished metal shapes” category. Which consists of auto components and physical gold.

Total imports of services came to $71.7 billion.

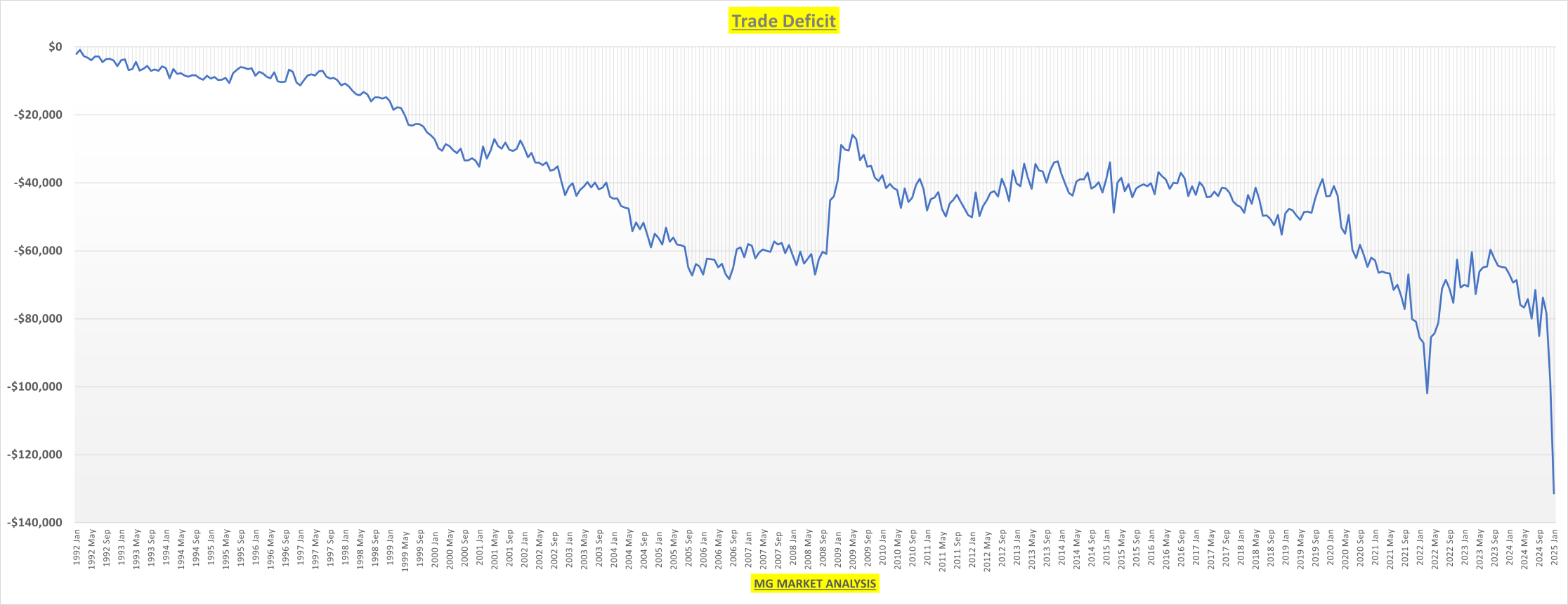

We ran a trade deficit of $156.8 billion for goods and a net trade surplus of $25.4 billion for services. Add it all up, and you get a trade deficit of $131.4 billion. The worst monthly trade deficit on record.

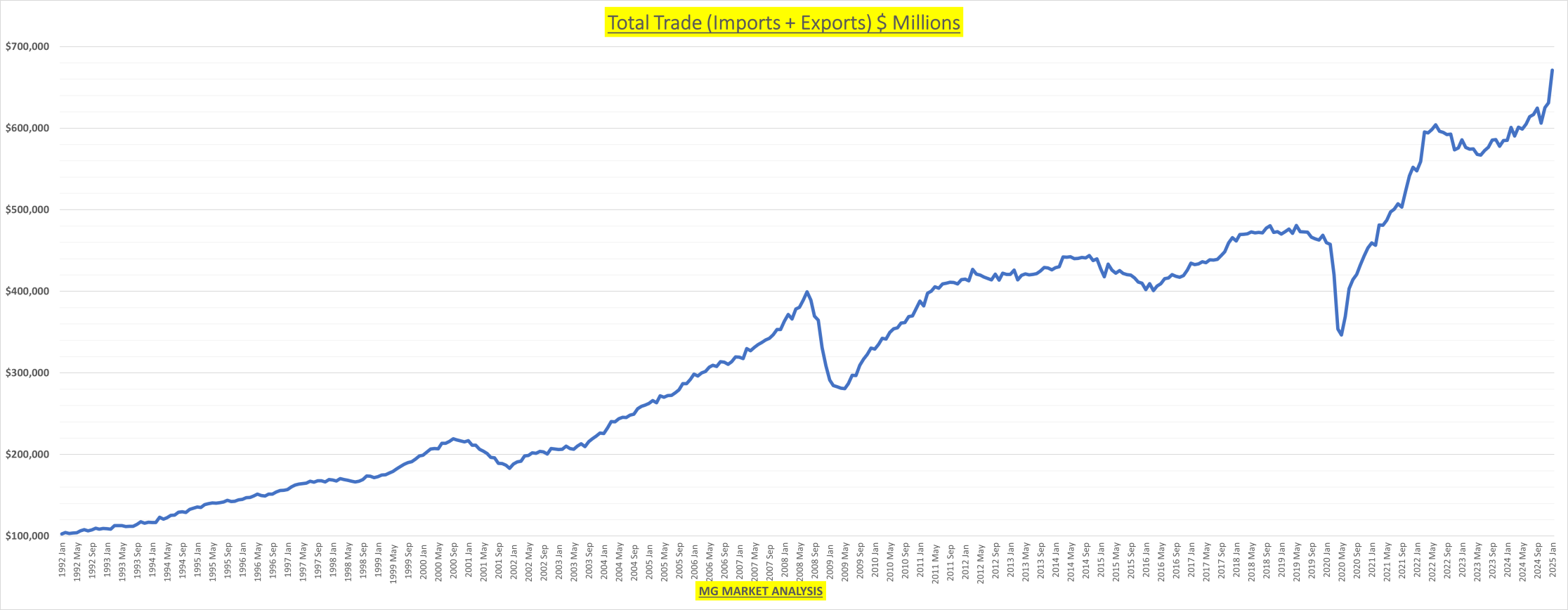

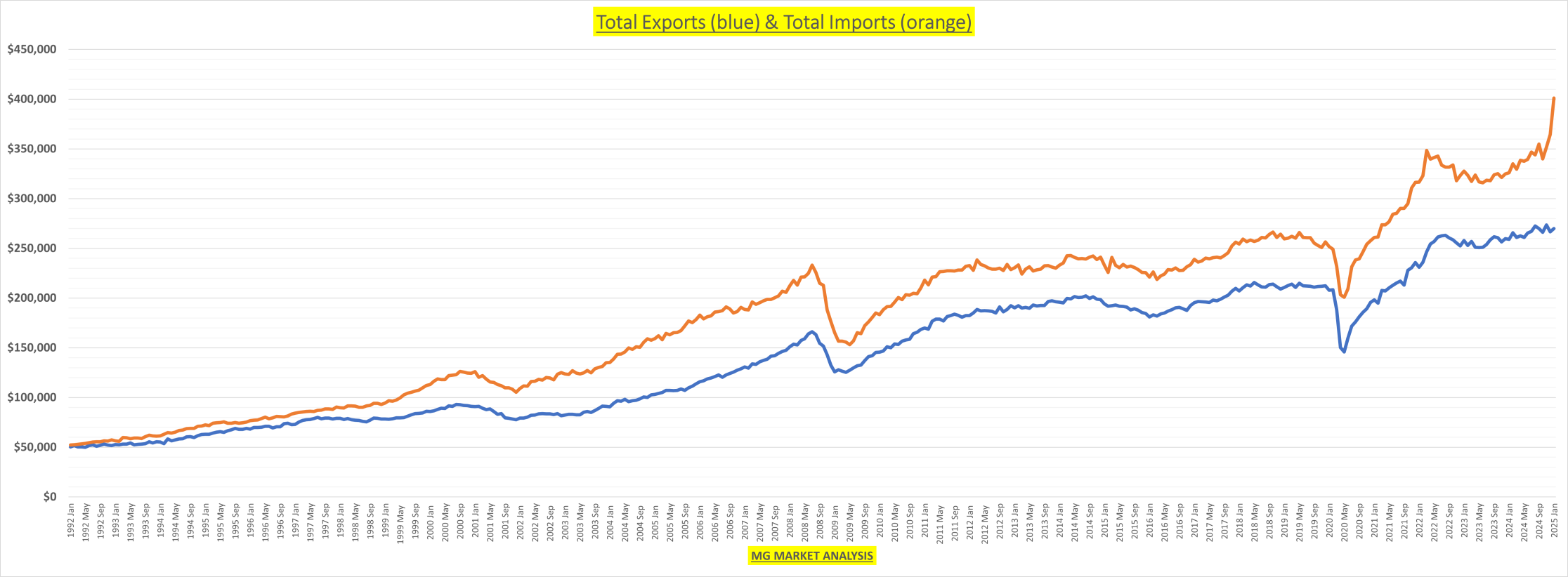

Total trade (imports + exports) came to $671 billion, an increase of $40 billion (+6.3%) for the month and $86 billion (+14.7%) over the last 12 months.

Broken down further, total exports (goods + services) grew to $269.8 billion, an increase of $3.3 billion (+1.2%) for the month, while total imports grew to $401.2 billion, a monthly increase of $36.6 billion (+10.0%).

Imports surging more than exports gets us to the record trade deficit.

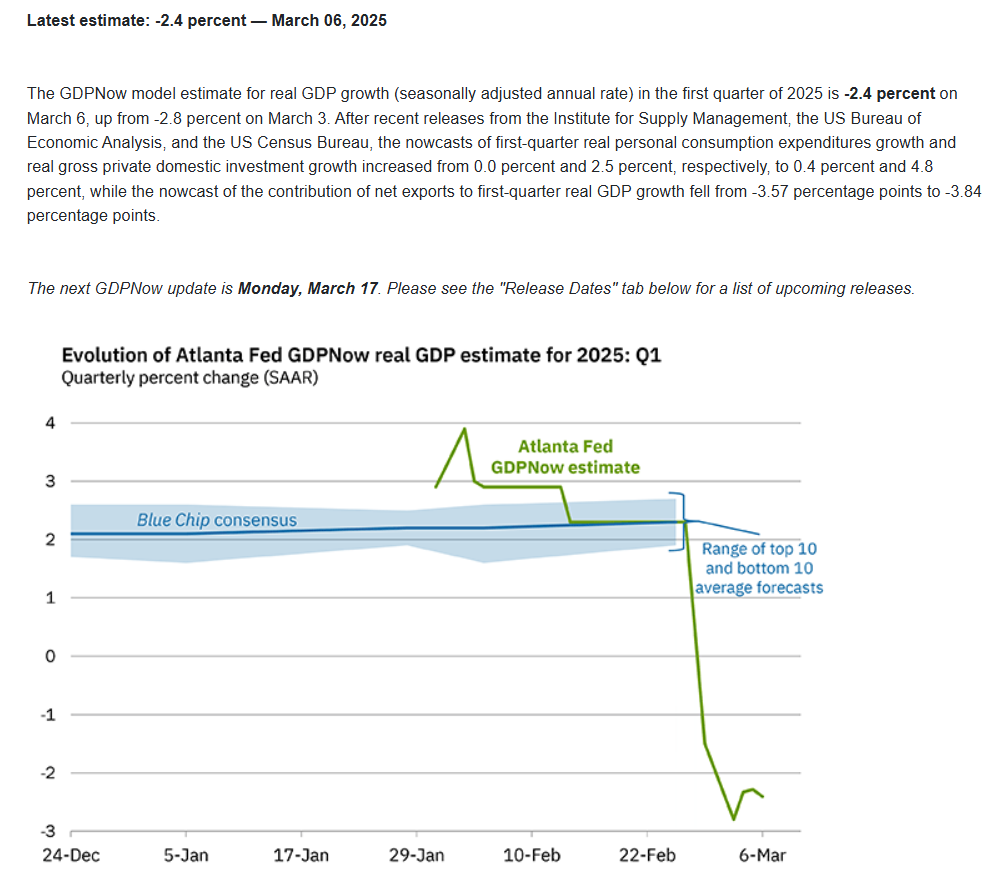

The larger the trade deficit, the bigger the drag on GDP. This led the Atlanta Fed estimates for Q1 GDP to fall dramatically, from as high as +3% to -2.8% practically overnight. The biggest contributor to the decline was obviously the trade deficit, which could just as easily reverse in the quarters ahead.

But consumer spending estimates also fell dramatically as well. They are now expecting spending (which is about 70% of today’s economy) to contribute only 0.4% to Q1 GDP. We still have a month to go, but if results come in line with current estimates, then it would be a sharp decline from Q4, where spending contributed 2.8% to GDP.

So why are we doing this to ourselves?

1) Bring manufacturing back to the US

2) Balance the trade deficit

3) Gain concessions (better trade deals) from trading partners

4) Stop "nearshoring" that looks to get around current tariff restrictions

These are some of the reasons I've seen, in no particular order. It’s worth pointing out that these reasons are being given by the same people who are telling us that other countries are paying these tariffs (which simply isn’t true).

I have my doubts as to how well tariffs can achieve any of this. But I'm keeping an open mind.

Businesses will adapt to whatever disruptions you throw their way. If they can navigate COVID, then they can certainly survive tariffs. How severe and for how long the disruptions will last is anyone's guess. Don't even try to make sense of it all.

If you are diversified, stay the course. If it gets ugly, sell some fixed income (or use the cash that is paying 4%+), and buy stocks on sale.

The S&P 500 fell 3% for the week. We came very close to hitting the 50-week moving average before getting a bounce on Friday.

The market has stalled ever since hitting the measure move target, matching the size of the prior bull market from 2020-2022. A larger-than-expected correction wouldn't be required.

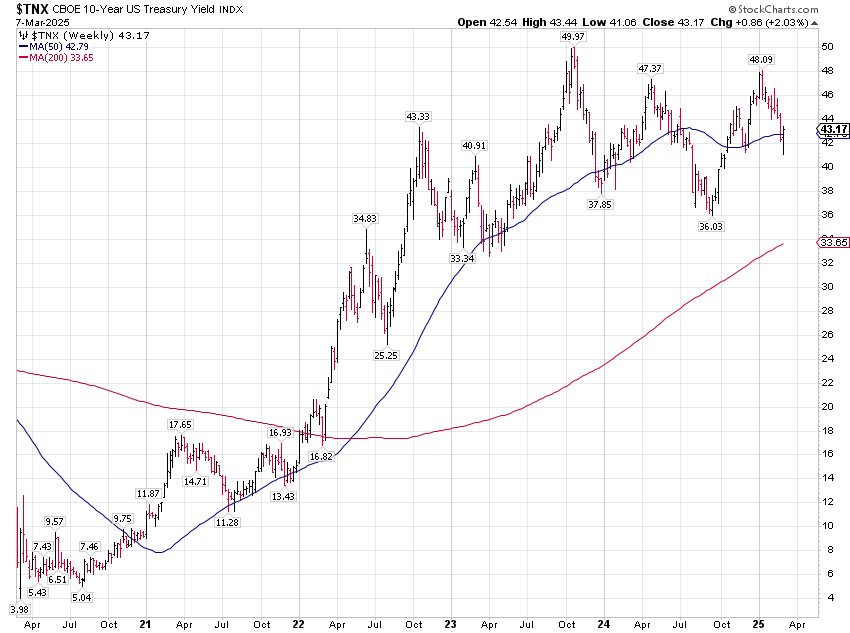

10-year treasury rate

Interest rates moved up to 4.32% this week, after falling in each of the last 5 weeks from as high as 4.8%.

If rates can stay down for a while, it would help take some pressure off of mortgage rates and maybe open up more buying/selling activity.

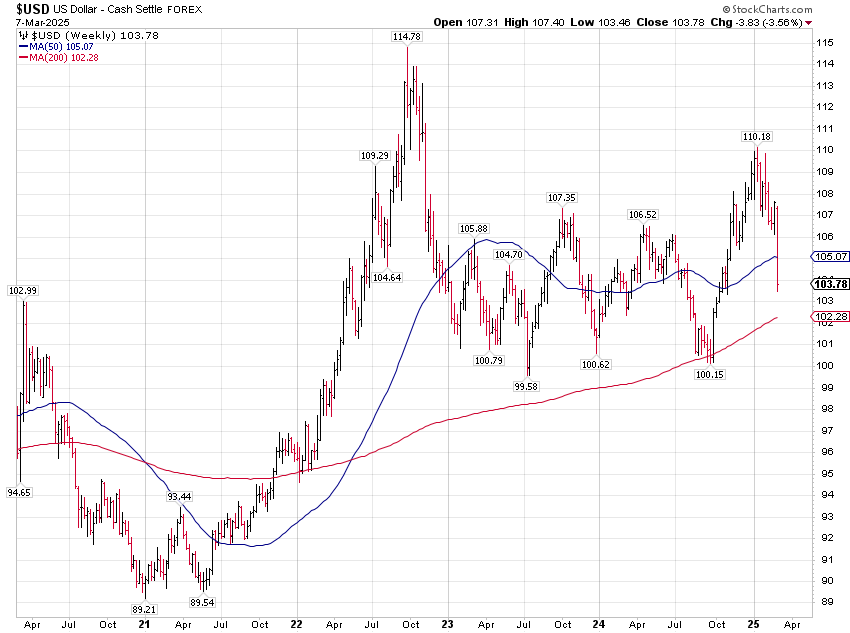

The US dollar fell 3.5%, a pretty sharp decline for a currency. The textbooks tell us that the currencies of the country issuing tariffs should increase.

Which means this move lower may have more to do with the declining economy (and as a result, lower interest rates).

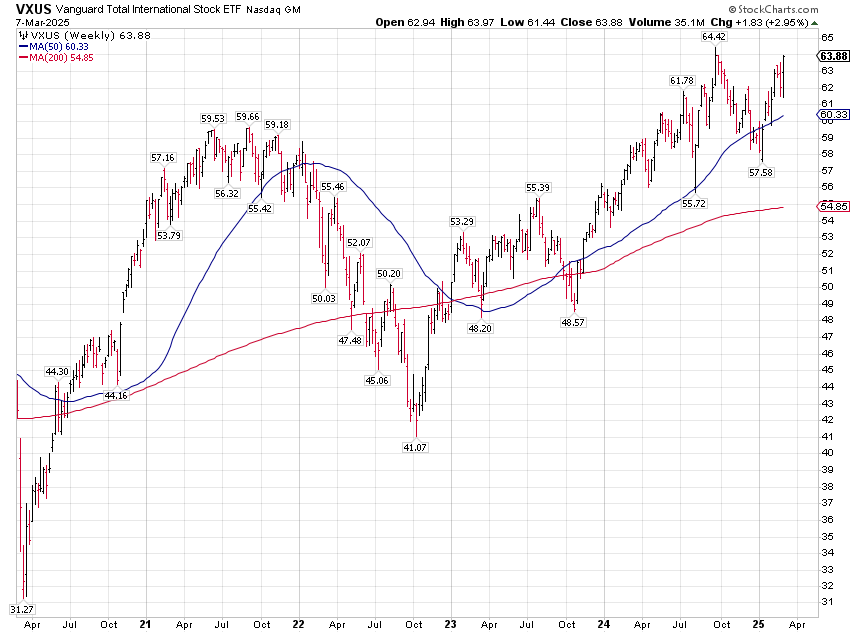

As a result of the falling dollar, total international stocks) rose almost 3% for the week. Getting close to making an all-time high.

Hold on; it's likely to be a bumpy ride for a while. We no longer have valuations on our side. So the economy & earnings will need to carry the markets going forward. The fact that the economy is starting to show some cracks is the reason for some concern. Proceed with caution.

This Week:

For economic data, we have small business optimism and JOLTS (job openings and labor turnover survey) on Tuesday, CPI measure of inflation on Wednesday, and the preliminary consumer sentiment and inflation expectations report on Friday.

Around 98% of S&P 500 companies have now reported Q4 results. But there are still a few key ones left. Oracle (NYSE:ORCL) reports Monday night, and Adobe Systems Incorporated (NASDAQ:ADBE) reports Wednesday night.