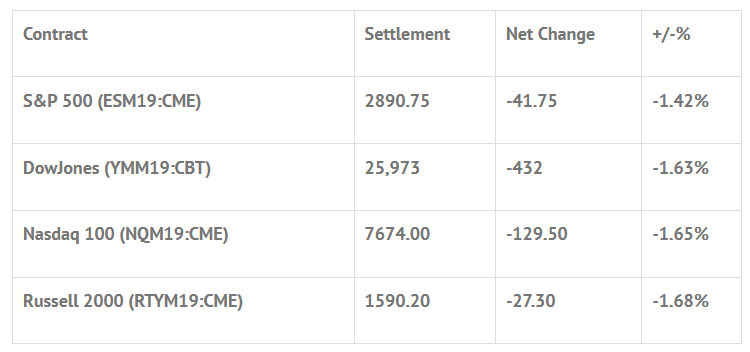

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -1.12%, Hang Seng -1.23%, Nikkei -1.46%

- In Europe 11 out of 13 markets closed lower: CAC -0.20%, DAX +0.08%, FTSE -0.25%

- Fair Value: S&P +0.09, NASDAQ +9.33, Dow -42.18

- Total Volume: 2.79 million ESM & 570 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Lael Brainard Speaks 8:30 AM ET, EIA Petroleum Status Report 10:30 AM ET, and a 10-Yr Note Auction 1:00 PM ET.

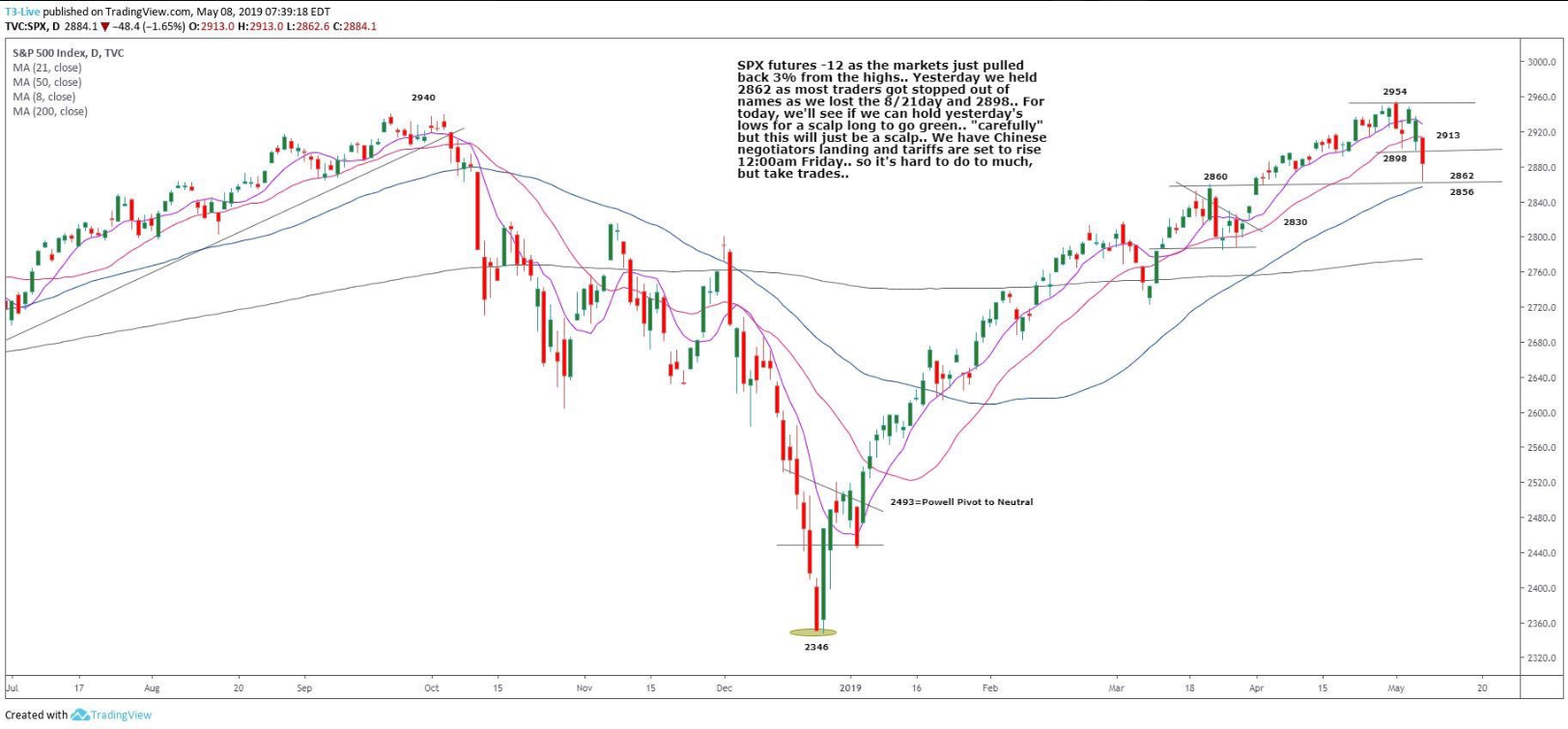

S&P 500 Futures: #ES Down 5 Of The Last 6 Sessions

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -12 as markets lost momentum levels ahead of trade Talks. Now we see if 2850-2862 area can be a spot for an active bounce (with care).

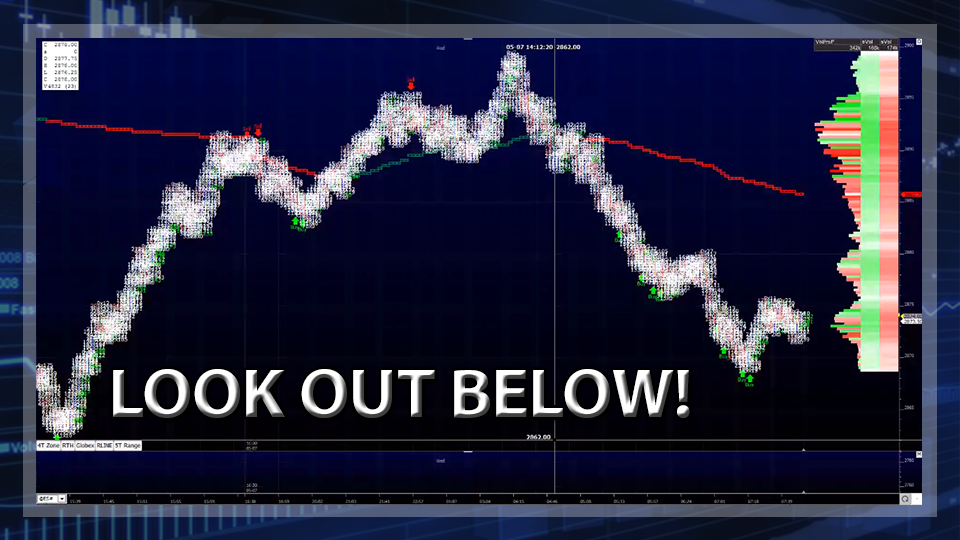

During Monday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2930.50, a low of 2902.75, and opened Tuesday’s regular trading hours at 2906.00.

After popping up to 2910.75 on the 8:30 CT bell, the ES turned lower, and didn’t look back. Trend days down are rare, but they do happen, yesterday was proof of that. The selling pressure was persistent, and by 10:00 the benchmark equity futures contract had traded down to 2884.25, 46 handles off the Globex high.

After a little back and fill up to 2895.00, the futures once again turned lower, setting its sights on Sunday nights Globex low at 2883.50. After running stops down to 2881.50, the bias began to shift, and the ES began to rally.

By 11:30 the futures had traded back up to 2895.50. You could tell that traders felt more confident putting on long positions. That confidence, however, would prove to be short lived, due to a 12:00 sell program that triggered a break down to new lows at 2871.00, and eventually 2867.00.

Going into the final hour, the futures did a little more back and fill up to 2878.25, and when the 2:45 cash imbalance reveal came out showing $356M to sell, it had traded back down through the low to 2862.50.

Heading into the close, a strong wave of buying came in, and the ES exploded 23 handles higher to print 2885.25 on the 3:00 cash close, and ended the day at 2890.75 on the 3:15 futures close, 28 handles off the low, but down -41.75 handles on the day, or -1.42%

In the end, the overall tone of the ES was weak most of the day, and strong on the close. In terms of the days overall trade, total volume was high, with 2.8 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.