President Donald Trump's announcement that he is instituting tariffs on imported steel and aluminum came as a surprise to some although reducing the trade deficit was one of his campaign promises. Dealing with the trade deficit issue is a complicated one since no one factor impacts trade. What is complicating a necessary discussion at the moment is the vitriol in which President Trump's tariff proposal is being discussed. For example, the media repeated commentary that the market would collapse once President Trump signed the tariff executive order; yet the S&P 500 Index closed almost 0.50% higher today.

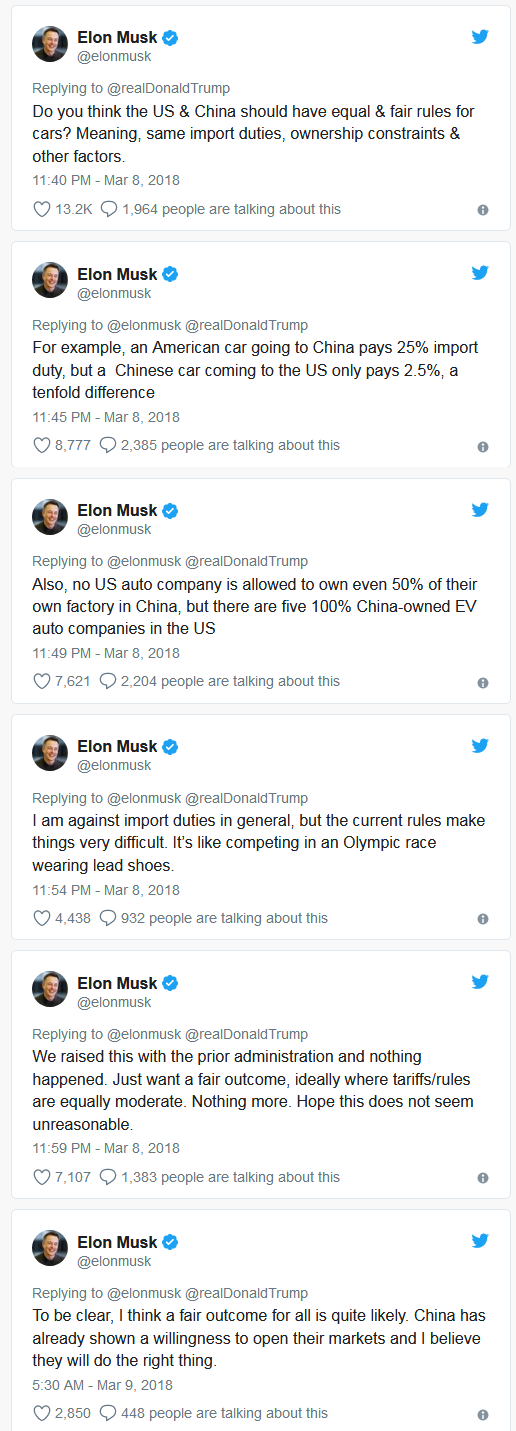

Some believe the trade deficit is harmful while others think it is not problematic. Today's economy is a global one and 'free' trade is likely to be a policy that results in the strongest rate of global growth. However, free trade needs to be 'fair' trade as well. Today, Tesla (NASDAQ:TSLA)'s Elon Musk replied to one of President Trump's tweets that raises the issue of 'free' versus 'fair' trade.

In order to deal effectively with the trade deficit, one needs to know what causes the deficit, and there is no single factor. Everything from exchange rates, budget deficits, personal savings rates and private investment have an influence on the trade deficit. From an economic perspective though, the trade deficit is an issue for a number of reasons, but a key one is the negative impact the trade deficit has on GDP.

GDP is commonly defined as:

- GDP=C + I + G + (X - M)

Where,

- C = private consumption

- I = gross investment

- G = government spending

- (X - M) = exports - imports

In the above equation then, if imports exceed exports, this becomes a deduction from the GDP calculation.

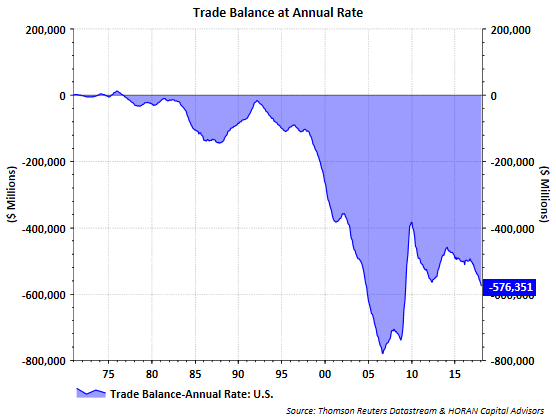

The trade deficit for the US is certainly one that seemingly is getting larger. On Wednesday the monthly deficit figure was reported at -$56.6 billion and was larger than the high end of the consensus estimate. The below chart of the annual trade deficit puts the deficit into clearer focus.

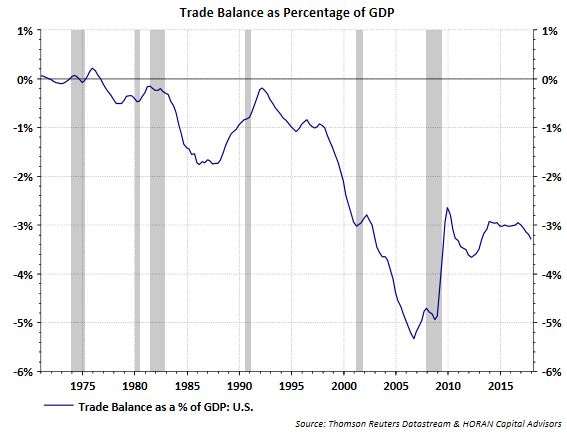

As the US economy continues to grow though, looking at the deficit as a percentage of GDP is important. Since the end of the financial crisis in 2009, as a percentage of GDP, the trade deficit has remained mostly around -3%.

On a big picture basis though, in a paper by James McBride titled, The US Trade Deficit: How Much Does It Matter?, he notes

The fundamental cause of a trade deficit is an imbalance between a country’s savings and investment rates. As Harvard's Martin Feldstein explains, the reason for the deficit can be boiled down to the United States as a whole spending more money than it makes, which results in a current account deficit.

This means the country borrows from foreign governments to fund the shortfall and this foreign source of credit will end at some point.

As noted in the McBride paper,

- More government spending, if it leads to a larger federal budget deficit, reduces the national savings rate and raises the trade deficit. A portion of the budget deficit is effectively financed through a rise in the total amount Americans borrow from abroad.

- A stronger Dollar makes US exports more expensive. The net effect is a widening of the trade deficit. And, if the US economy is strengthening, consumers have more income to use to buy more imported goods, again increasing the trade deficit.

Trade tariffs under a President Trump are not a new type of policy. According to an article by Marcus Nunes titled, Don Trump: Meek Inheritor of the Forgotten Reagan Protectionist Legacy?, Nunes notes that under President Reagan,

- The share of US imports subject to some form of trade restraint increased from 12% in 1980 to 23% in 1988.

- President Reagan slapped a 100% tariff on Japanese consumer electronics. And a 50% tariff on Japanese heavy motorcycles, as a favor to Harley Davidson, hog-makers. Forgotten today, Harley was about to go under. Reagan rode to the rescue, and Harley Davidson survives to this day. I guess if you like American-built huge motorcycles, protectionism has its merits.

- Reagan was such a ferocious protectionist that Milton Friedman wrote that the one-time actor was 'making Smoot-Hawley look positively benign.

The economy during the Reagan years seemed pretty good with average GDP growth of 3% during his term.

Tariffs are not new and when they have been used in the past, each occurrence has not resulted in Armageddon. Having a conversation or evaluation of trade practices could lead to positive outcomes. Many once vibrant manufacturing oriented cities in the Midwest have business districts that have become near ghost towns.

And certainly all manufacturing is not coming back to the US and some may have moved overseas for good reasons; however, reviewing trade practices and their potentially negative impact on US companies seems like a worthwhile endeavor. The steel industry is another example. The US steel industry's woes seem somewhat self-inflicted, and tariffs may simply delay the inevitable.

Importantly though, the US trade deficit is sufficient enough in size that it does warrant evaluating the causes and potential solutions. The Elon Musk reference above certainly seems to raise a valid issue, that of free trade versus fair trade. What seems to be clear, at a minimum, is the fact that there are some trade issues that might need to be dealt with on a targeted basis.