A few weeks ago – I wrote an article highlighting the four major global indicators that show more economic downside ahead.

And since then – things have only grown more fragile as the Federal Reserve continues aggressively tightening.

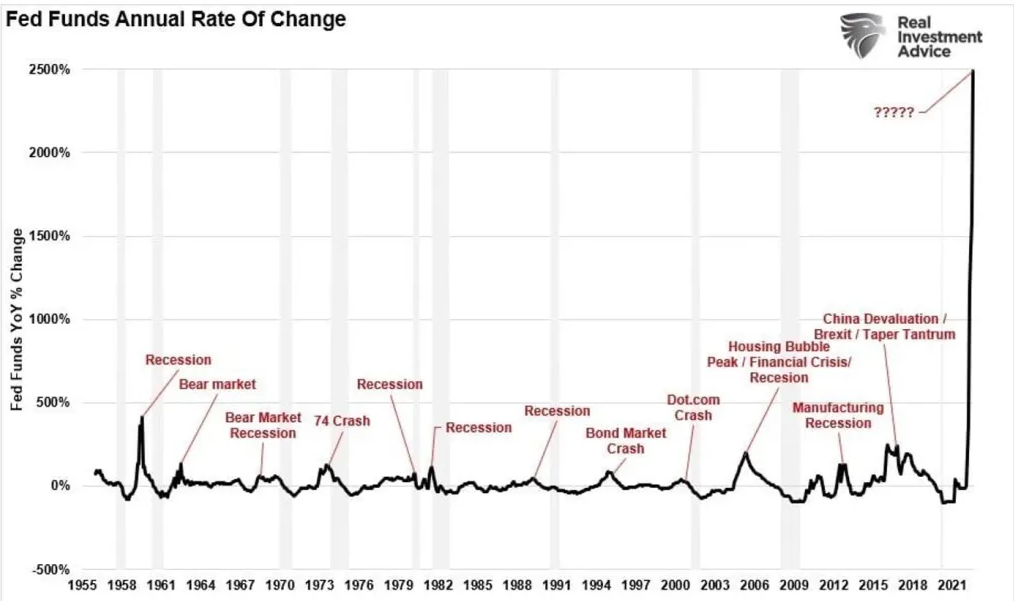

To put it into context – over the last 60 years – each time the Fed tightened, there’s almost always some-kind-of negative financial event.

And the Fed‘s already over-tightened dramatically in 2022. . .

As the chart above points out – it doesn’t usually take much in tightening to trigger some sort-of crisis.

Thus why the very sharp tightening cycle year-over-year is very troubling.

Keep in mind that according to the Austrian Business Cycle Theory (ABCT) – coined by Ludwig Von Mises – easy-money/credit periods (when the Fed eases) cause markets to artificially boom.

That’s because consumers and corporations’ binge on cheap debt. Investors over-pay for not-so-great assets. Liquidity flows drive global markets. And economic growth trends higher.

But as Mises pointed out – much of this ‘boom’ is only fiction. And will always revert into a bust once the easy-money phase evaporates.

And that is exactly what we’re seeing today. . .

Everyone that binged on cheap-debt and received government-fueled-COVID stimulus are now squeezed between higher debt-costs and higher prices (aka inflation).

Even worse – the assets many overpaid for (such as crypto-currencies, equities, etc) have declined sharply year-to-date.

This is only compounding economic downside and deflationary pressures (something the Fed is discounting).

Simply put – the markets post-COVID rode the tailwinds of easy-money and government stimulus. And now – each time the Fed tightens, things grow more and more fragile. . .

But I believe nothing is as fragile today as the collapse in world trade-shipping volumes. Indicating trouble for global growth and asset prices.

For perspective: the cost of shipping goods from China has plunged to the lowest levels in more than two–years. Signaling weaker demand and anemic prospects for growth.

Shanghai ports (a major exporting hub) saw a roughly -9% drop in cargo processed in August compared to last year.

And imports arriving into the U.S. through Los Angeles ports fell its most since the early days of 2020 (during COVID). . .

Keep in mind that only six-months ago, there was no spare capacity for container freights. And after-COVID, shipping companies rushed to increase new freighters to take advantage of booming demand and trade.

But now – shipping companies are rushing to cut excess as freight rates plunge.

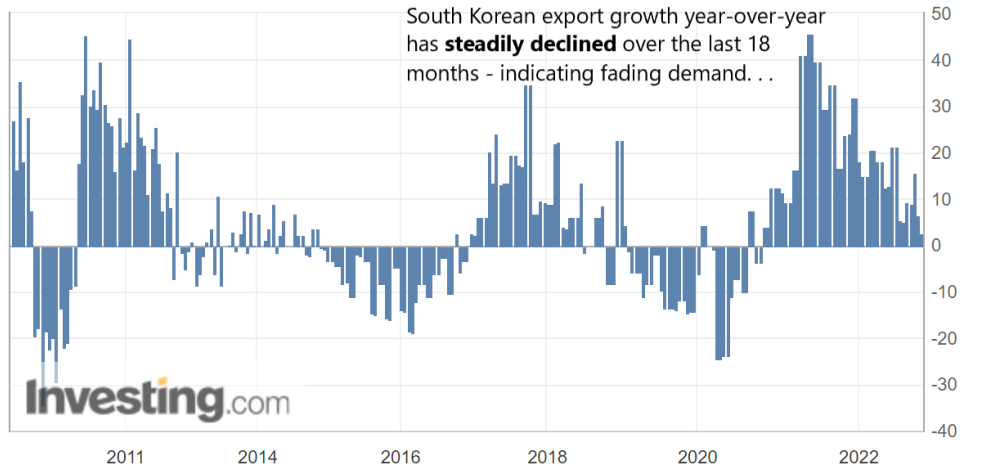

Making matters worse – South Korean export growth (aka SKEG; a major leading-indicator) – fell in September to its weakest point in almost two-years. . .

South Korea is Asia’s fourth largest economy. And is historically considered a canary-in-the-coal-mine for signaling global trade and earnings recessions. (I’ve written about the significance of South Korean exports many times. Read here for more context).

Thus with both South Korean and Chinese trade-volumes in decline – it doesn’t bode well for the global economy.

Another troubling sign for world trade came with FedEx's (NYSE:FDX) disappointing numbers due to falling shipment volumes.

FedEx (a major international transporter) sharply missed its earnings and revenue estimates. (Earnings-per-share missed by -33%).

In fact, the FedEx CEO – Raj Subramaniam – said that he believes the economy is going to enter a ‘worldwide recession’.

The CEO also said that: “. . .we’re seeing that volume decline in every segment around the world, and so you know, we’ve just started our second quarter. . . The weekly numbers are not looking so good, so we just assume at this point that the economic conditions are not really good. . .”

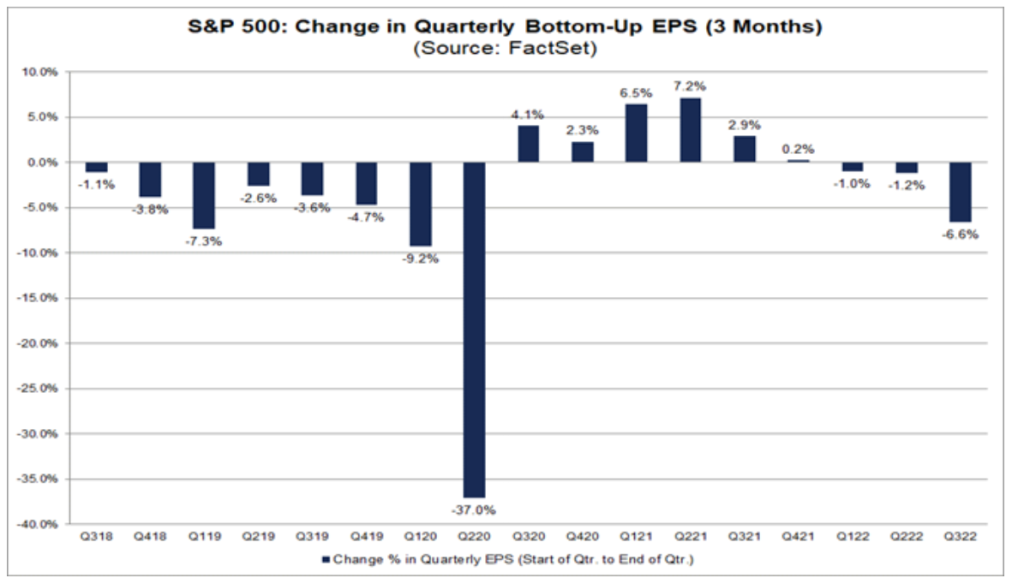

No wonder there’s been a sharp decline in S&P 500 quarterly earnings (i.e. the three-month %-change) over the last year.

Many firms are beginning to cut growth forecasts. And instead price in negative growth.

All this – such as Fed tightening and sinking shipping demand and declining exports – point towards a looming earnings recession. . .

So – in summary: world shipping volumes continue to decline, and so will the corporate profits that depend on it.

No doubt this will have ripple-effects (aka unintended consequences) throughout various sectors and markets.

This is happening at a time when the Fed’s aggressively tightening – putting even greater pressure on asset prices and economic growth.

Or – putting it simply – the Fed’s over-tightening into an amplifying global slowdown.

It appears things are in vicious feedback-loop lower.

For instance: Fed tightening kills marginal demand. Leading to falling consumption and asset prices. Leading to eroding shipping/export volume, and so on.

It’s hard to see such negative trends reverse – especially when growth at-the-margin is quickly fading.

This is why I believe there’s much greater risk for deflation in 2023 than what the market’s pricing in.

Squeezed consumers, higher debt-costs, falling asset prices, and sinking trade-volumes signal a potentially sharp drop in global demand.

Thus when looking at the bigger-macro picture all-together – and the long run – there’s plenty of reasons to be nervous.

The black swans are lurking.