Toyota Motor Corporation (NYSE:TM) engages in collaboration to offer ride-hailing services in Southeast Asian countries. Companies like Toyota Financial Services Corporation (“TFS”), Aioi Nissay Dowa Insurance Co., Ltd. (“Aioi”) and Grab, Inc. (“Grab”), a leading ride-hailing service provider in Southeast Asia, will be coordinating with Toyota in this endeavor.

To realize this project, TransLog driving recorder will be installed in 100 Grab ride-hailing cars for extensive use in the Southeast Asian region. The device is developed by Toyota’s in-house company, The Connected Company. The recorder captures driving patterns and offers telematics services to help drivers manage vehicle positioning.

Installation of these recorders will help Toyota examine driving patterns from the captured images and take steps to offer connected services to its customers, which are user-based insurance, financing programs and predictive maintenance to name a few.

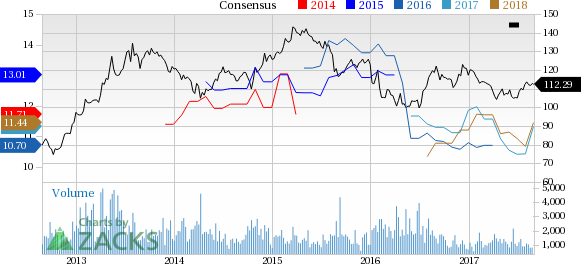

Toyota Motor Corp Ltd Ord Price and Consensus

Per Shigeki Tomoyama, senior managing officer of Toyota and president of the Connected Company, this collaboration with aid the company to explore suitable ways to deliver mobility services to Southeast Asian fleet customers.

Per Financial Times, Toyota will also be investing ¥6 billion ($55 million) in Grab, through Next Technology Fund, set up by its trading arm, Toyota Tsusho Corp.

Toyota is eyeing the emerging markets for sales growth. In January, Toyota and Daihatsu jointly set up an internal company called Emerging-market Compact Car Company to tap in to the compact vehicles sector in key markets. This company plans to develop and launch competitive compact vehicles in the evolving markets with huge growth potential.

Price Performance

Shares of Toyota have gained 3.4% in the last three months, marginally outperforming the industry’s 1.8% increase.

Zacks Rank & Key Picks

Toyota currently flaunts a Zacks Rank #1 (Strong Buy).

A few other automobile stocks with the same bullish rank are Allison Transmission Holdings Inc. (NYSE:ALSN) , Renault (PA:RENA) SA (OTC:RNLSY) and Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) . You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has a long-term growth rate of 11%.

Renault has a long-term growth rate of 4.6%.

Volkswagen has a long-term growth rate of 8.9%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

RENAULT SA (RNLSY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research