New 52 week lows are once again dominating US market breadth

Source: Short Side of Long

Source: Short Side of Long

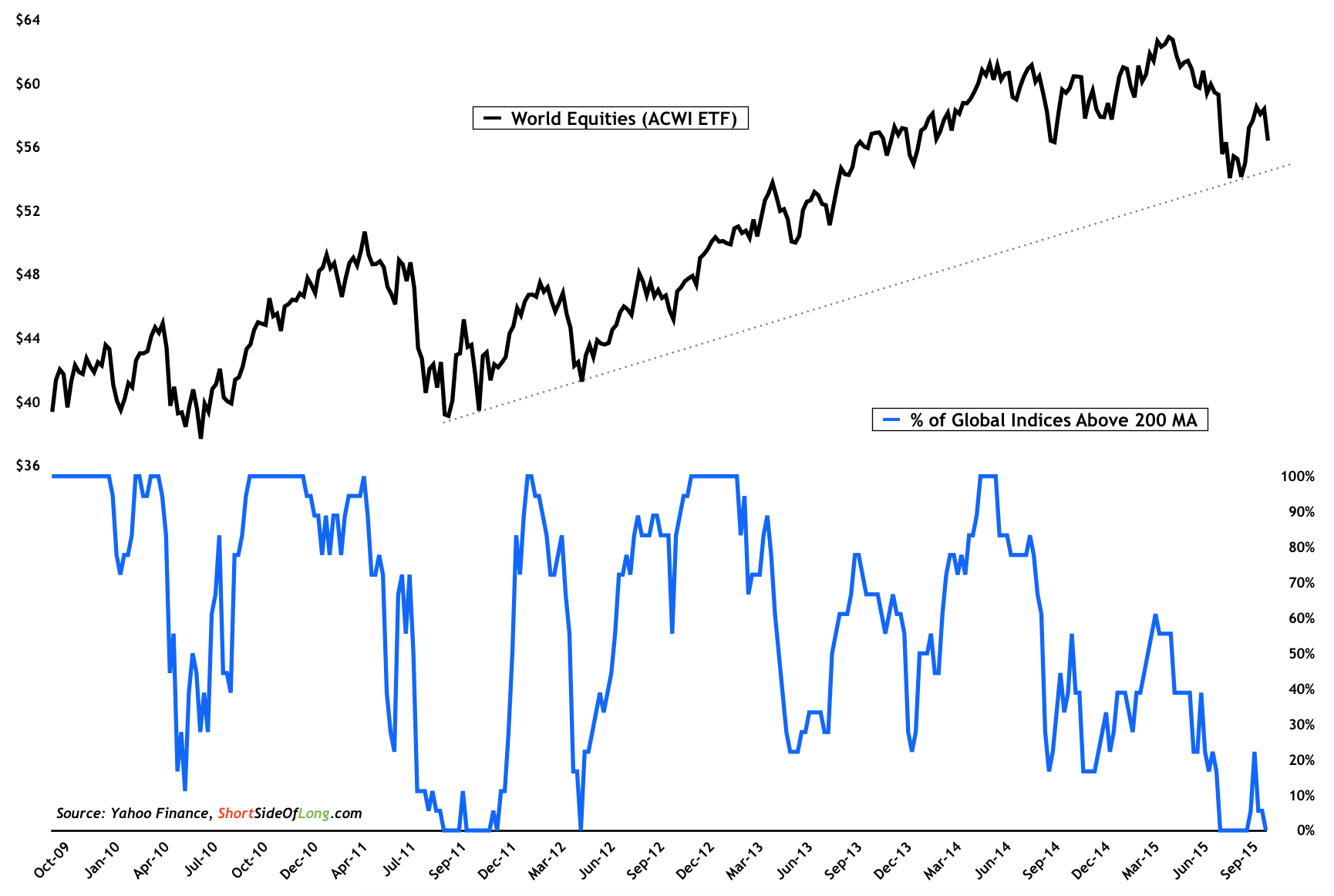

Last week was yet another tough week for financial assets, including equities. Global stocks (iShares MSCI ACWI (O:ACWI)) declined 3.4% while US equities (SPDR S&P 500 (N:SPY)) also fell for the first week in many by 3.6%.

Emerging Market equities (iShares MSCI Emerging Markets (N:EEM)) continued their underperformance by selling off 5.0%, while European equities (SPDR Euro Stoxx 50 (N:FEZ)) lost 3.7%. Volatility jumped 40.1%, the majority of it occurring during the last three days of the week.

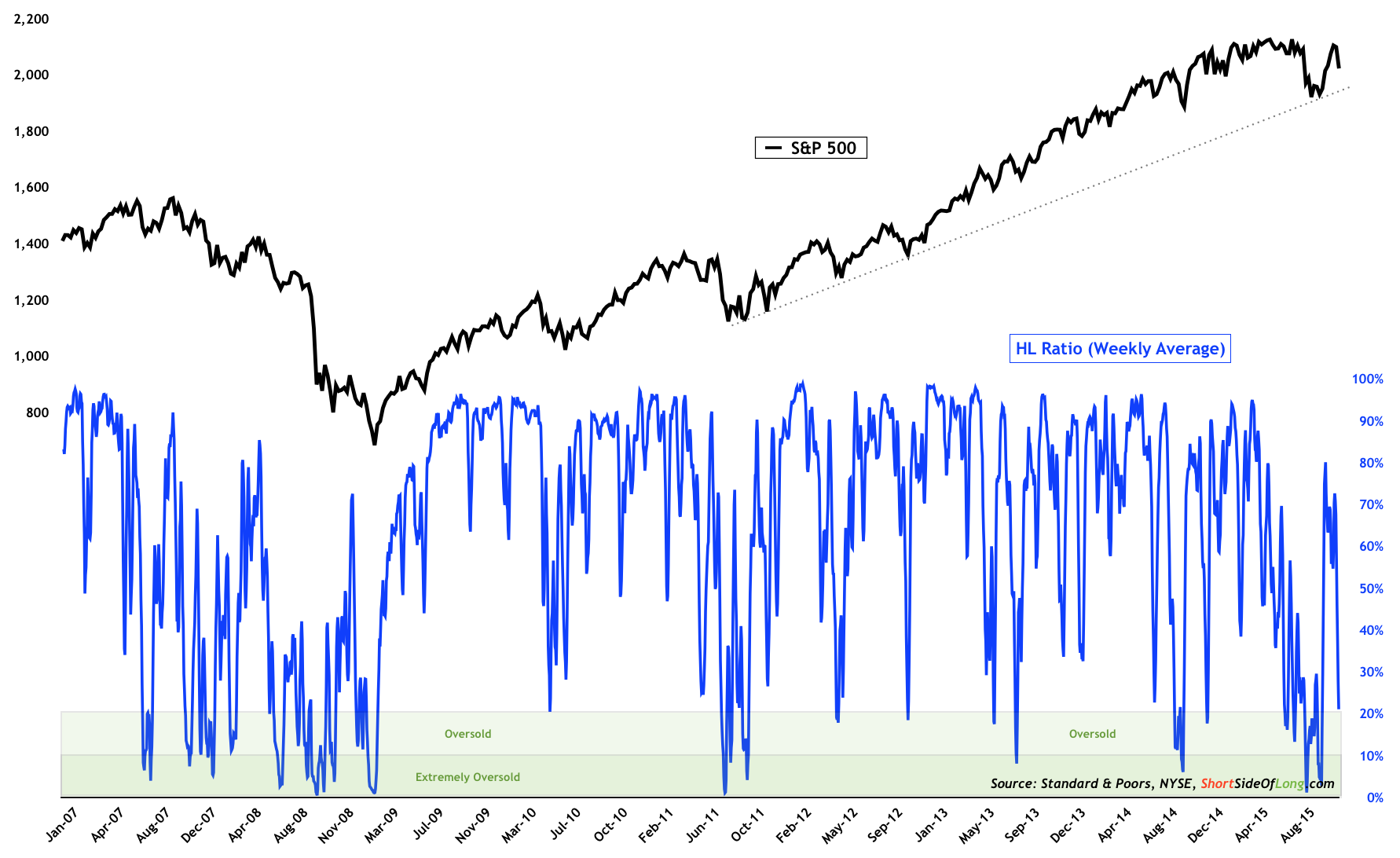

From the short term perspective, US stocks are becoming oversold yet again, and we might see a rebound rally at some point in the not so distant future. S&P 500 itself is now down 7 out of the last 8 trading days, so if we see more selling during Monday and/or Tuesday, we could find ourselves with at least a temporary bottom.

On Thursday, the NYSE posted 168 issues reaching 52 week new lows, while on Friday this reading jumped even further to 227. Some of the new lows are occurring in important corporations and sectors such as American Express Company (N:AXP), Anadarko Petroleum Corp (N:APC), ArcelorMittal (N:MT), Archer-Daniels-Midland (N:ADM), Chipotle Mexican Grill (N:CMG), Deutsche Bank (N:DB), Dollar General (N:DG), Gap (N:GPS), IBM (N:IBM), Kohl`s (N:KSS), Macy`s(N:M), Nordstrom Inc (N:JWN), Tiffany (N:TIF), Time (N:TIME), United States Steel (N:X) and Wal-Mart (N:WMT) amongst others.

Furthermore, the percentage ratio of 52 week new highs relative to 52 week new lows stands at 21% vs 79% respectively (refer to chart above). Finally, global stock indices (the most important ones) are all once again trading below their respective 200 day moving averages.

No important global stock market indices above their 200 day MAs

Source: Short Side of Long

Source: Short Side of Long