Remember the warm up drills you would do in gym class as a kid or before a game. Touch and Go’s we called them. Run from the baseline to mid court and touch the line reverse and go back to touch the baseline then reverse to the far baseline. Designed to loosen up the muscles for the bigger exertion to come.

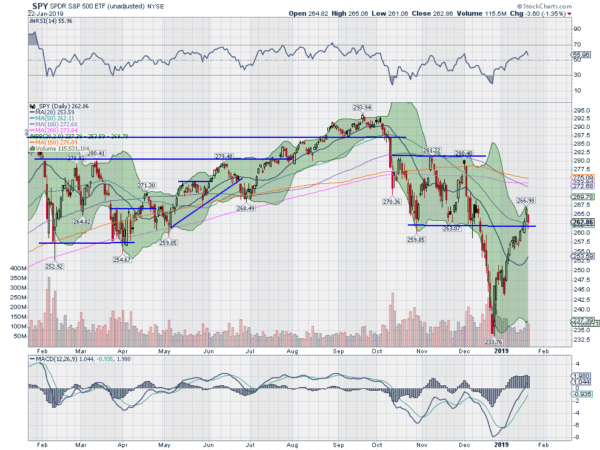

Markets can be like that as well. And perhaps the S&P 500 is doing a touch and go right now. The chart below shows the S&P 500 ETF ($SPY) moving higher off of the Christmas Eve low. At the end of last week it broke back above the bottom of a prior channel where it consolidated through October and November. It was losing that channel that led to the fast breakdown so reclaiming it is important.

Tuesday it started to pullback in that move. And the bottom of the pullback retested the channel bottom. It held that touch and closed back higher on the day. Wednesday in the pre-market the ETF is continuing higher. A possible retest and continue, a touch and go. This kind of price action, retesting a special price area and then moving on, happens all the time. The question now is will it continue?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.