The forex markets have been in risk-off mode over the past day, as concerns grow about Japan’s woefully limited economic package and as oil prices plunge, stoking fears that global growth is stagnating.

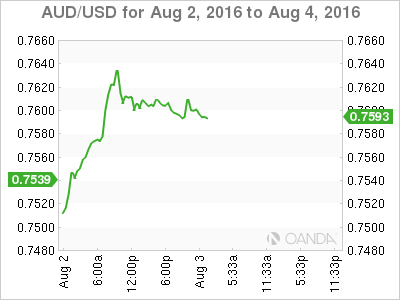

Australian Dollar – Bond Flow Appreciation

If a month ago I had suggested that the Australian dollar would rally 100 pips post an RBA rate cut and the WTI would be trading below USD 40.00, you would have thought I was mad, yet so it is in this brave new world of central bank easing, followed by hard-to-explain currency strength.

While it could be easy to write the current Australian dollar rally off due to the yen’s impact on broader USD weakness, but there’s more at play.

There are different dynamics in play post-Brexit as “real” global interest rates continue their fall; the chase for yield being the dominant theme. From this perspective, the Australian dollar (AUD) is a clear winner. The country’s triple-A credit rating, coupled with a 1.8% 10 Year coupon, is attracting waves of foreign investor capital as global “core” interest rates fall.

The RBA rate cut was widely anticipated, which partially explains the muted reaction to the announcement. However, because investors shied away from the USD after last week’s shocking US Q2 GDP, this likely cushioned the AUD from a larger kneejerk selloff.

The lack of forward guidance raises the obvious question, will a weak Q3 CPI lead to a November rate cut? Currently, the market is calling yesterday a ‘one and done’ move for the remainder of 2016. With a lack of USD appetite, on that bias alone we could see the AUD march higher over the near term.

However, as Friday’s US non-farm payrolls loom, it is more likely that traders will taper ahead of Friday, taking precautions against a larger than expected US payroll number.

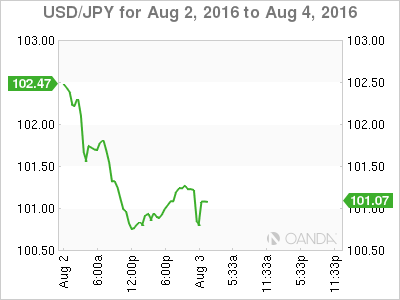

Japanese Yen – No Meaningful Stimulus

The USD/JPY pair is showing few encouraging signs of improvement. The yen remains underpinned by the disappointment of the Bank of Japan’s (BOJ) insipid stimulus efforts and together with weak US GDP expectations, the markets were left underwhelmed, all but opening the trapdoor for a test of 100 USD/JPY.

To what extent USD/JPY will see any near-term support may be an all-in play on Friday’s NFP, but ultimately, without any meaningful and sustained stimulus commitment from Japan’s policy makers, the outlook for the USD/JPY looks extremely vulnerable.

The market, in its typical fashion, has overreacted by pricing out further BOJ rate cuts, which play to a stronger Yen. What is worrisome is that traders could remain in a troubled state as the BOJ reviews the current stimulus formula within the framework of what is essentially ineffective monetary policy. One can only imagine the tumultuous events in store leading up to September’s BOJ meeting.

In early trade this morning, the USD/JPY has been influenced by comments from Japan’s Ministry of Finance (MoF) chief Asakawa who stated, the MoF “would act properly if there are speculative moves.”

I expect Japan’s policy makers to be increasingly vocal about intervention as we near ¥100, but intervention in the current markets will result in providing better levels for investors to by Yen; any real attempts at intervention will be quickly faded.

A turnaround in USD/JPY at this stage will only occur if some form of Helicopter Money gets tabled or, equally improbable, there is a shift in Federal Reserve Policy.

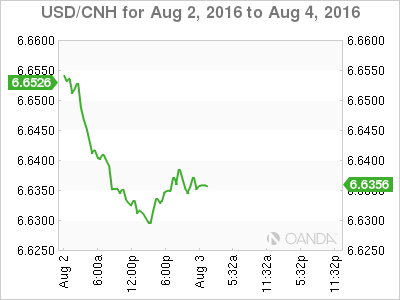

Yuan – Regional Investor Inflow

The USD bulls appear to be tossing in the towel for August and USD/CNH sentiment is being driven by the EUR and JPY strength. August is typically a strange month in Emerging Markets as speculative flows move to the sideline and activity is primarily driven on the back of real money flows.

However, from an entire flow perspective, with added stability to the RMB complex, investors should continue to add to their long CNH exposure, especially with the Feds apparently all but side-lined through 2016.

Look for broader USD movements to guide sentiment, especially with regional risk sentiment looking fragile in early trade.

MYR – Slippery Oil prices

The ringgit continues to see outflows on the back of weaker oil prices, despite pockets of keen interest in EM Asia.