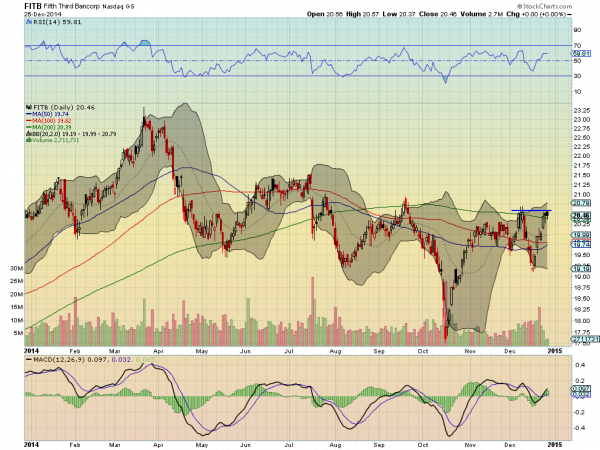

Fifth Third, (NASDAQ:FITB)

Fifth Third, FITB, bounced off of a bottom in October and is back at resistance. The latest move takes it over the 200 day SMA and a push higher could change the consolidation to an uptrend. The RSI and MACD both support more upside.

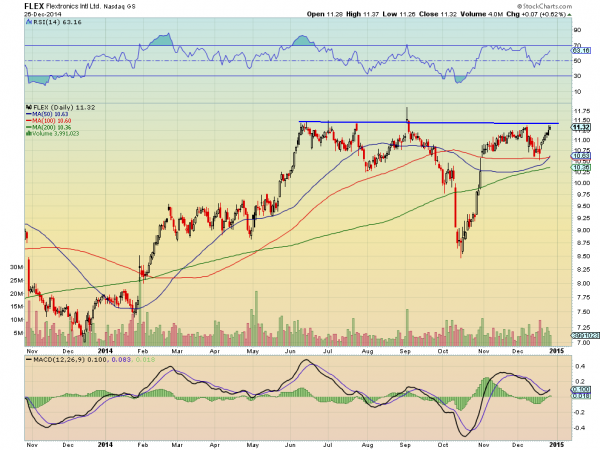

Flextronics, (NASDAQ:FLEX)

Flextronics, FLEX, is at resistance since June after a pullback to the break out range from earlier this year. The RSI is in the bullish range and rising and the MACD is crossing up, a buy signal.

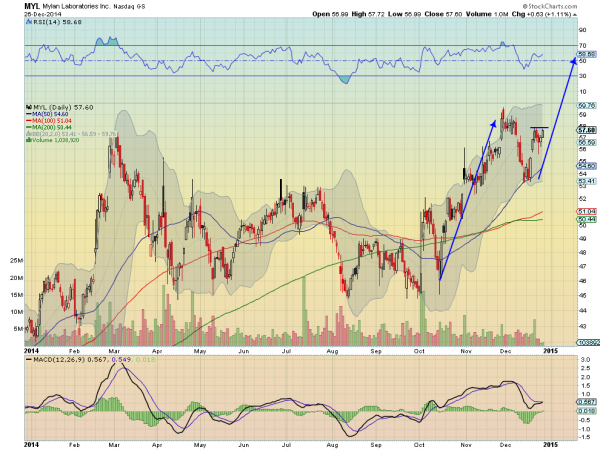

Mylan, (NASDAQ:MYL)

Mylan, MYL, moved higher out of a bottom and consolidation in October to a new high to end November. After a pullback it is moving higher again and now consolidating with a MACD about to cross up and a RSI pushing on the bullish zone.

Panera Bread, Ticker: (NASDAQ:PNRA)

Panera Bread, PNRA, has built a Cup and Handle since April, and is now triggering over the lip of the cup. The RSI is supporting a continuation higher as is the rising MACD.

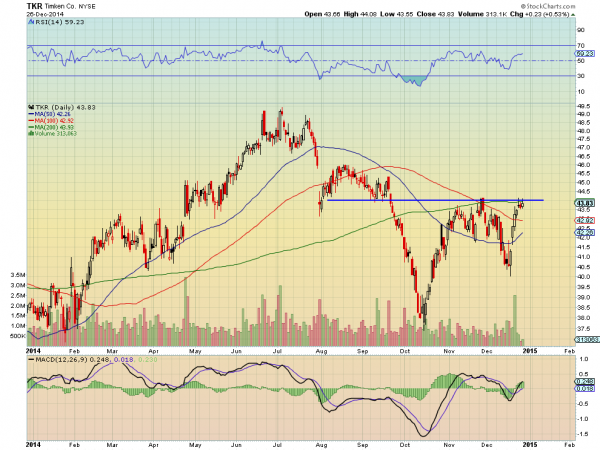

Timken, (NYSE:TKR)

Timken, TKR, pulled back hard from a top this summer to a low in October. The rebound reached prior support before falling and is now back at that level from a higher low. The MACD is rising and the RSI on the edge of a move into the bullish zone as it pushed higher.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for this week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed last Friday which, heading into the last week of 2014, sees the equity markets looking positive, with a possible major rotation into small caps under way. Elsewhere look for Gold to bounce hold between 1180 and 1200 in its downtrend while oil builds a base near 55. The dollar looks to continue higher while US Treasuries are biased lower in the short run, within their uptrend. The Shanghai Composite sits at resistance but with a strong look and could just keep moving up while (ARCA:Emerging Markets) are biased to the upside in their downtrend. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s (ARCA:SPY) (ARCA:IWM) and (NASDAQ:QQQ), despite the moves higher. Their charts look solid as the SPY sits at all-time highs and the QQQ at 14 year highs. The IWM may be breaking a 14 month range to the upside, which could trigger a major rotation into small caps. Use this information as you prepare for this coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.