Here is your Bonus Idea with links to the full Top Ten:

The CBOE has gone through a massive transformation. When first established in 1973, the trading pits may have looked a lot like this picture. Now over 95% of the order flow at the Exchange is electronic. It’s local neighbor, the Merc, shut down floor trading recently. So how is this transformation effecting the company and its stock price? Things are looking good.

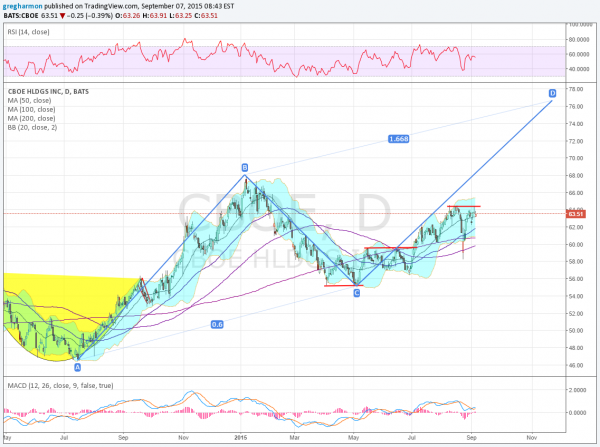

The chart below shows a Cup and Handle that formed over last summer. The price move higher exceeded the target at 66 before starting a pullback. That retreat found support in a double bottom in May and was stair stepping higher until 2 Monday’s ago. Dropping with the market, the price found support at the 100 day SMA and rebounded. Now it is back at that resistance again.

In the intermediate and longer term, the chart looks good for more upside. A break over resistance at 64.35 carries a target of 66.30 on a Measured Move, as well as from a Positive RSI Reversal , both off of the June low. The longer term sees a AB=CD pattern that targets a move to 76.70.

But in the short term, the price printed a Shooting Star reversal last week. This does not give a target lower. In fact, the drop could have ended Friday, but it does suggest a tight stop for the short run for any long side trade. The RSI has moved back into the bullish zone and the MACD is crossed up and rising, both supporting more upside price action.

There is resistance higher at 64.35 and then 67.80. Support lower comes at 62.10 and 60.30 followed by 59.60 and 58.75. The company is expected to report earnings next on October 30th, and the stock pays a dividend yield of 1.45%. The short interest in the stock is moderate at 2.7%.

Looking at the options chains reveals very large open interest in a tight range from 57.5 to 60 on the Put side in September. There is sizable, but smaller open interest on the Call side from 57.5 to 67.5 but peaking from 62.5 to 65. October open interest is just starting to build. December sees a similar distribution as September with large concentrated open interest at 60 on the Put side, but dispersed from 55 to 70 on the Call side.

Trade Idea 1: Buy the stock on a move over 64.35 with a stop under 62.

A straight stock trade.

Trade Idea 2: Buy the stock and add a September 62.5/60 Put Spread/October 67.5 Covered Call Collar (10 cent cost on the dollar).

Adding protection for the stock trade through September Expiry.

Trade Idea 3: Buy the October 62.5 Call ($2.90).

A controlled risk, limited capital method for participating in the upside in the stock.

Trade Idea 4: Buy the October/December 67.5 Call Calendar ($1.15) and sell the December 57.5 Puts ($1.10).

A leveraged options strategy for almost no cash outlay, with risk of ownership on a move down to 57.5 and intermediate term upside, looking for the stock to remain under 67.5 through October Expiry.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the Holiday shortened week the equity markets have seen consolidation following the damage of the prior week, and traders lining up on both sides looking for a break.

Elsewhere, look for gold to continue lower while crude oil has a short term bias to the upside. The US dollar index continues in consolidation with an upward bias while US Treasuries are also biased higher in the short term. The Shanghai Composite and Emerging Markets are biased to the downside. Volatility looks to remain elevated, keeping the bias lower for the equity index ETFs NYSE:SPY, NYSE:IWM and NASDAQ:QQQ into next week.

Their charts all show short term consolidation in a tightening range as all correlations go toward 1.0 in a crisis or panic. The longer charts show the damage to be limited so far though. The QQQ looks the strongest, with the IWM at support and the SPY most vulnerable. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.