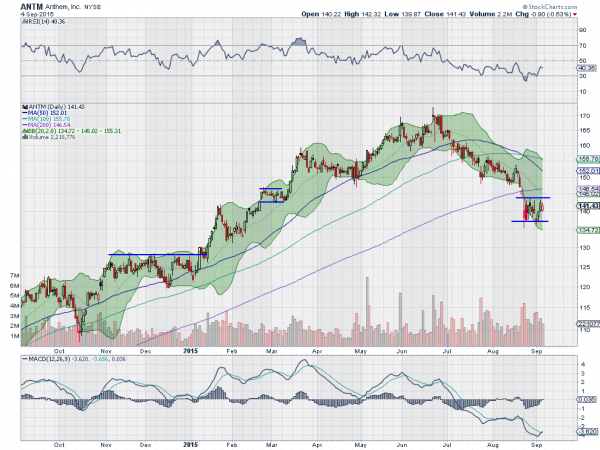

Anthem (NYSE:ANTM)

Anthem has pulled back from a high over 170 over the last 3 months. The recent consolidation in a tight range sets up an opportunity for a trade. With the RSI moving back higher and the MACD crossing up, it suggest to look for a break to the upside. But it could also break to the downside and provide a good trade. Let it tell you which direction to take.

Callon Petroleum (NYSE:CPE)

Callon Petroleum was on watch for a major break down two weeks ago. The 50 day SMA held as support though and it moved back higher. Last week it triggered an Inverse head and Shoulders as it moved back to resistance from April. The RSI is firmly in the bullish zone and the MACD is rising, both supporting further upside toward the Head and Shoulders price objective.

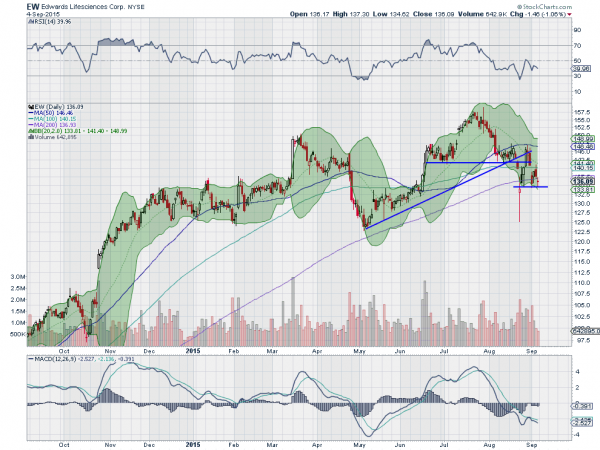

Edwards Lifesciences (NYSE:EW)

Edwards Lifesciences is a large cap heart care company that had a strong run higher from may through mid July. From that point, the stock started a pullback that has erased $25 and seems to be settling. What makes it interesting is the RSI turning lower with the MACD falling, and the strong support lower at 125.

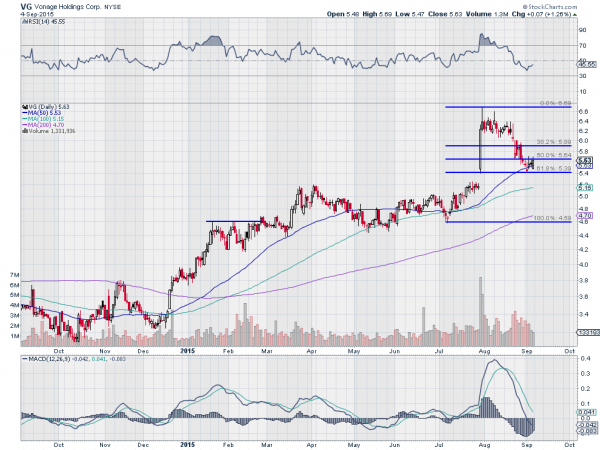

Vonage Holdings (NYSE:VG)

Vonage Holdings rose out of a consolidation that lasted 5 months at the end of July. The jump higher on strong volume quickly pulled back though. Now it has retraced 61.8% of the leg higher and is settling, keeping a gap open below, over the 50 day SMA. The RSI is trying to turn higher while the MACD slows its decline. Look for a move over 5.65 for a trade higher with a natural stop below.

Zillow Group (NASDAQ:Z)

Zillow Group has been declining since mid February, but then found a bottom to start August. The bounce from there is now consolidating at resistance under the falling 100 day SMA, resembling an ascending triangle. The RSI is trending over the mid line while the MACD is rising. Watch for a break of resistance higher to enter.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the holiday shortened week the equity markets have seen consolidation following the damage of the prior week, and traders lining up on both sides looking for a break.

Elsewhere look for gold to continue lower while crude oil has a short term bias to the upside. The US dollar index continues in consolidation with an upward bias, while US Treasuries are also biased higher in the short term. The Shanghai Composite and Emerging Markets are biased to the downside. Volatility looks to remain elevated, keeping the bias lower for the equity index ETFs NYSE:SPY, NYSE:IWM and NASDAQ:QQQ into next week.

Their charts all show short term consolidation in a tightening range as all correlations go toward 1.0 in a crisis or panic. The longer charts show the damage to be limited so far though. The QQQ looks the strongest with the IWM at support and the SPY most vulnerable. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.