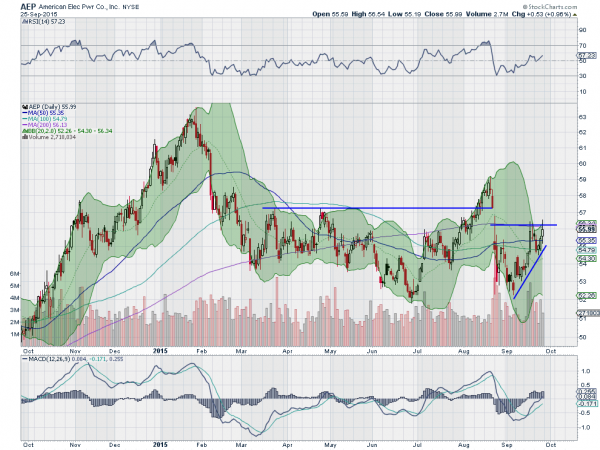

- American Electric Power Company (NYSE:AEP)

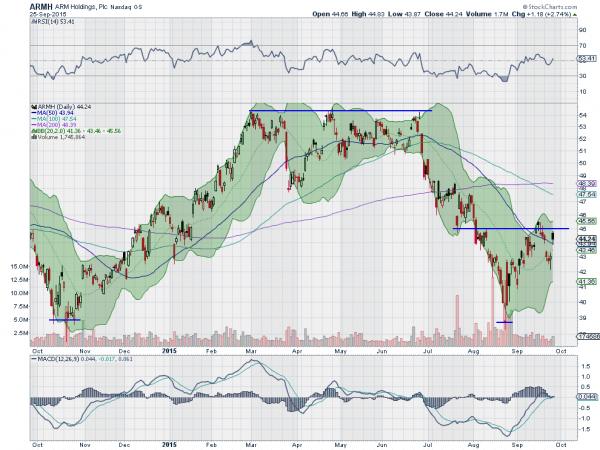

- ARM Holdings (LONDON:ARM)

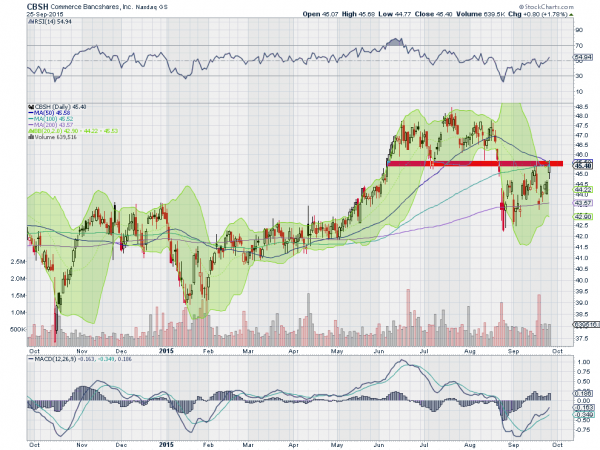

- Commerce Bancshares (NASDAQ:CBSH)

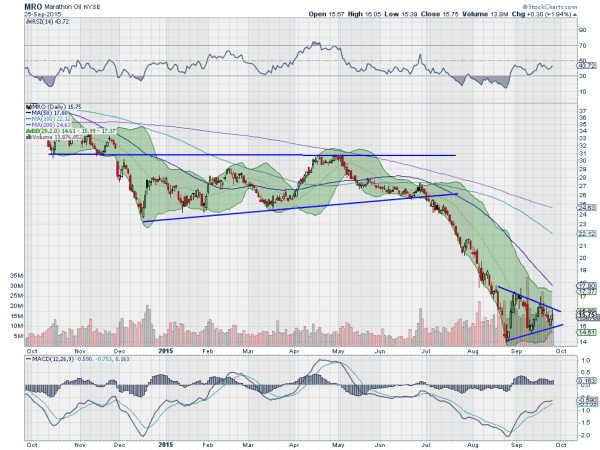

- Marathon Oil Corporation (NYSE:MRO)

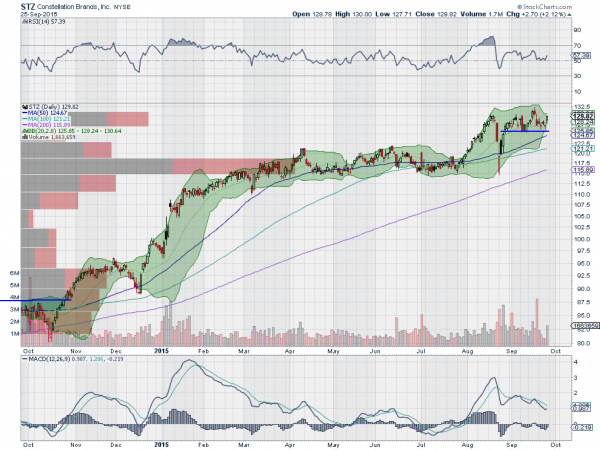

- Constellation Brands (NYSE:STZ)

American Electric Power has moved in a sideways range for most of 2015 until breaking it to the upside in late August as the broad market fell. It pulled back as the market settled and found support at the prior low. Now it is rising again and at resistance with the Bollinger Bands® opening to the upside. It also has support for more upside from the rising and bullish RSI and MACD.

ARM Holdings reached a top in March and built a flat consolidation there until the end of June. It then fell back, eventually finding support at the same price level that began the move higher in October 2014, when the market sank. Now bouncing off of a double bottom it is pushing up to resistance with support for more upside from the rising RSI. The MACD is also avoiding a cross down and turning higher.

Commerce Bancshares fell back from a high base with the market in August. Since then it has started higher with a series of fast moves up and down making higher highs and higher lows. Now it is at prior support, now resistance, and pushing up. The RSI is pushing through the mid line and the MACD is rising in support of a break higher.

Marathon Oil fell out of an ascending triangle in July and overshot the target move to 17. Since mid August it has been consolidating in a symmetrical triangle and has moved into the apex. The RSI is trying to push higher, but still in the bearish zone, while the MACD is rising. Watch for a break of the triangle to follow along.

Constellation Brands rose the first half of 2015 and then consolidated in a tight range for 5 months. It moved higher in August only to be pulled back down and retest that base when the market sank. Now it is consolidating again at a higher base. Friday saw the price push higher and open the Bollinger Bands®. The RSI is holding over the mid line and turned up while the MACD is still falling. Watch for a push to new highs.

ETF Watch

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, as the market closes out the quarter and move into October sees the equity markets still looking weak.

Elsewhere look for Gold to continue in its short term uptrend while crude oil consolidates. The US Dollar Index also looks to continue broad consolidation while US Treasuries are biased lower in consolidation. The Shanghai Composite looks to continue its consolidation in the downtrend while Emerging Markets are biased to the downside. Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s (NYSE:SPY), (NYSE:IWM) and (NASDAQ:QQQ).

Their charts suggest there may be more pain with the SPY looking the worst on the short term basis and the IWM and QQQ possibly catching a break and just consolidating. The longer term all look a bit stronger but nothing to have a party about with more downside risk as well. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.