Here are the Rest of the Top 10:

Home BancShares Inc (NASDAQ:HOMB)

Home Bancshares, HOMB, dropped from a high in November to a low in February. The drawn out move higher ended in June, short of the November high and started back lower. It then made a higher low at the end of June and started to rise again.

Last week it reached the November high and consolidated before a move lower Friday. The RSI was overbought and reversed lower and the MACD has now crossed down. Look for continuation to participate in the downside…..

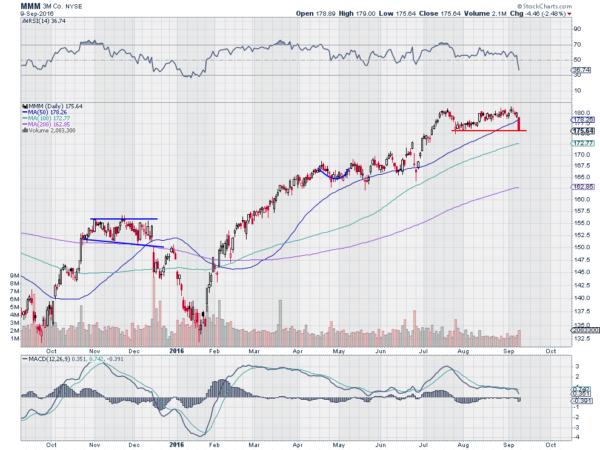

3M Company (NYSE:MMM)

3M, MMM, ran higher off of a January low to a high in July at 182. A quick pullback saw it move back to the high and create a consolidation range. Friday it fell to test the bottom of the range.

The RSI also fell to the bearish zone and the MACD dropped down. Look for a push through the consolidation zone to the downside to participate lower…..

NetApp (NASDAQ:NTAP)

NetApp, NTAP, fell hard and fast from a bounce in November to a low in January. a quick move higher to a March higher then saw consolidation follow for 4 months before a strong move higher began in August. A gap up following earnings then broke the November high and it has been consolidating.

Friday saw it drop back to the breakout level with a RSI falling back through overbought territory while the MACD continued lower after a cross down. Look for a break of support to participate in the downside…..

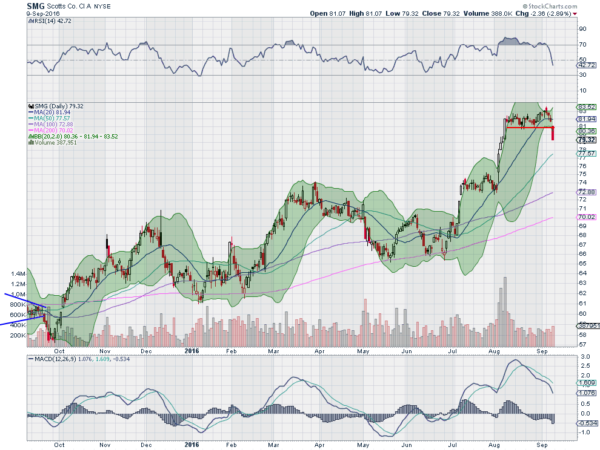

Scotts Miracle-Gro Company (NYSE:SMG)

Scotts Miracle-Gro, SMG, moved higher off of the 200 day SMA at the end of June. A small consolidation and then a second step higher brought it to another consolidation.

It broke that consolidation to the downside Friday though, with a RSI falling to the edge of the bullish zone and the MACD continuing lower. Look for follow through to participate in the downside…..

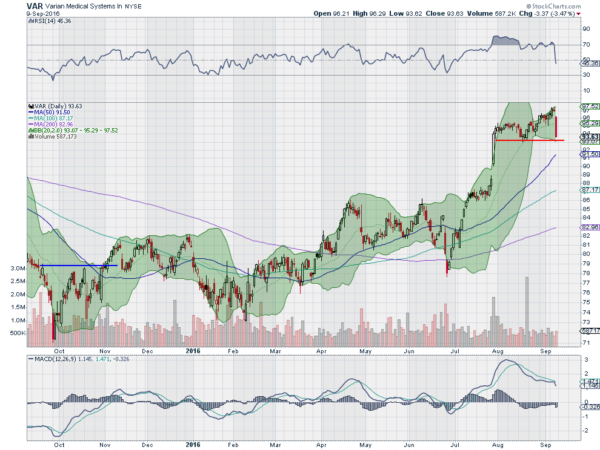

Varian Medical Systems (NYSE:VAR)

Varian Medical Systems, VAR, started a move higher in June that stalled out as it moved into August. A pullback found support and bounced to a higher high and Friday saw it move back lower, to that prior support. The RSI is falling through the mid line while the MACD is dropping. Look for a break below support to participate to the downside…..

Elsewhere look for Gold to move lower in its short consolidation over 1310 while Crude Oil consolidates sideways. The US Dollar Index looks to move higher in the broad consolidation while US Treasuries are biased lower. The Shanghai Composite looks to continue to trend slowly higher while Emerging Markets are biased to the downside in the short term.

Volatility looks to remain at the top of the normal range adding the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all look better to the downside in the short run, but with the SPY and QQQ well outside of their Bollinger Bands, so perhaps ready for a bounce first. The IWM is sitting on its lower Bollinger Band, a good place to bounce if it wants to. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.