Here are the Rest of the Top 10:

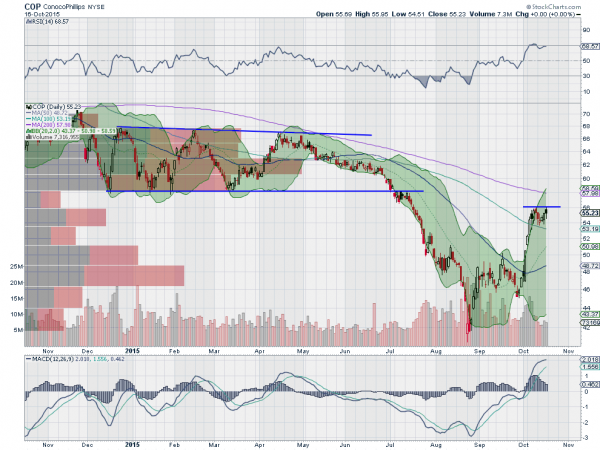

ConocoPhillips (N:COP)

ConocoPhillips started lower in May and then support in July. It fell hard from there to bottom with the market in August. After a quick bounce, it consolidated between 46 and 48 for September before moving higher in October. A touch at 56 knocked it back a little into consolidation, but it is back at resistance again. With a bullish RSI and rising MACD, watch for a break of resistance to enter.

Discover Financial (N:DFS)

Discover Financial went through a long sideways consolidation from March until August, when it fell lower. It consolidated in a range, like the market, in September, before moving higher 2 weeks ago. The rise met resistance at the top of the August range and was knocked back slightly, but is moving back to that high again. It has support for more upside from the rising and bullish RSI and MACD.

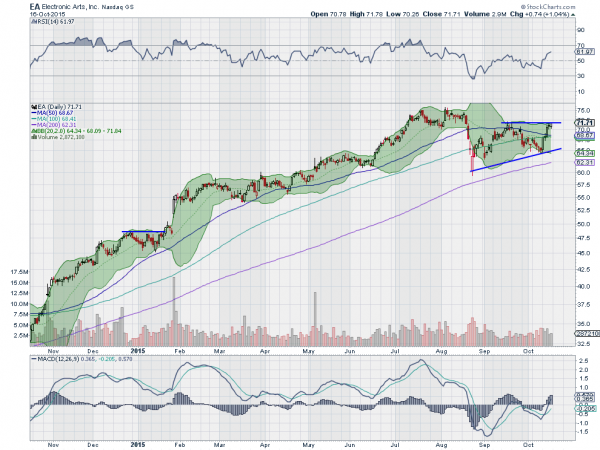

Electronic Arts (O:EA)

Electronic Arts has been a strong stock moving in a trend higher all year. It took a hit when the market fell in August, and has been recovering in an ascending triangle since. Friday saw it press up against the top of that triangle. As it hits there, the RSI is rising into the bullish zone and the MACD is rising, both supporting more upside.

Jazz Pharmaceuticals (O:JAZZ)

Jazz Pharmaceuticals had been in a slowly rising trend until it started lower in August. The stock bounced after the August market bottom but then quickly resumed its path lower until the end of September. Since then it has been building higher lows against resistance, and peeked over the top on Friday. The RSI is moving up and near a push through the mid line with the MACD rising.

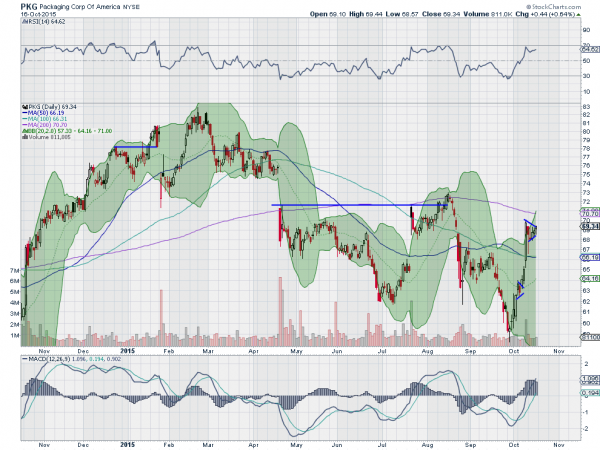

Packaging Corporation of America (N:PKG)

Packaging Corporation of America made a top in February and then fell back in a couple of steps in to a low to start July. The bounce from there just cleared the prior high and moved into the gap before failing and reversing lower again in August. A second step lower in September was bought quickly and it has risen fast since. The RSI is bullish and the MACD rising in support of a break of the current consolidation to the upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, with October Options Expiration behind sees the Equity Markets looking stronger.

Elsewhere look for gold to pullback in the short term in its uptrend, while crude oil rises. The US dollar index is biased lower in consolidation, while US Treasuries have a short term bias higher in their consolidation. The Shanghai Composite and Emerging Markets are biased to the upside with risk of the Emerging Markets hitting long term resistance.

Volatility is back to the normal range and falling putting the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. After strong back halves of the week, the SPY and QQQ look as if they may be ready to reverse the downward August trend and resume higher, while the IWM remains in a consolidation zone. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.