Here are the Rest of the Top 10:

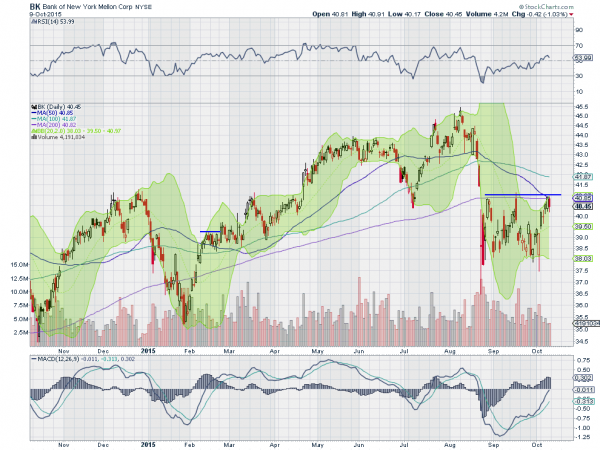

Bank of New York Mellon (N:BK)

Bank of New York Mellon is printing a Death Cross, with the 50 day SMA crossing down through the 200 day SMA. Yet this stock looks primed for a move higher. The price action since the August low shows three touches at resistance. Friday pulled back but held near that resistance. The momentum indicators RSI and MACD are both bullish and rising, supporting more upside. And the Bollinger Bands® are opening to allow the move. Watch for a break of resistance to participate.

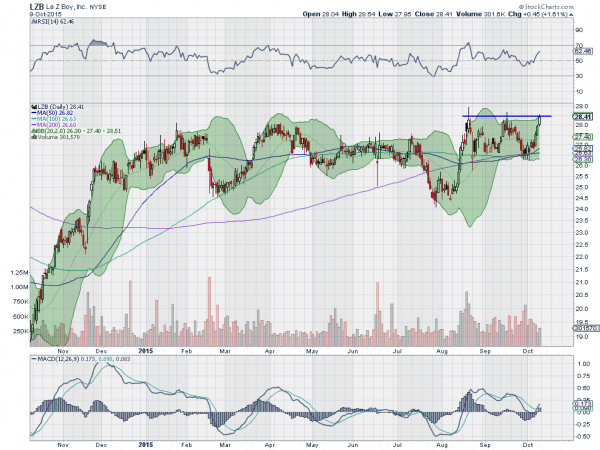

La-Z-Boy N:LZB

La-Z-Boy has held up like a rock through the market turmoil, remaining near all-time highs. Friday was the 3rd touch at resistance. It has support to push through for another leg higher from the rising RSI and MACD, which just crossed up. Consider buying it on a new high print.

Northrop Grumman (N:NOC)

Northrop Grumman had a run higher through the end of 2014 and into the first quarter of 2015, but then stalled. But it has moved mainly sideways in a range since. The move Friday though takes it back to resistance at the all-time high with the Bollinger Bands opening. It has support for more upside from the rising RSI and MACD as well. Momentum is on its side. Look for a new high to participate.

Royal Bank of Canada (N:RY)

Royal Bank of Canada has trended lower for a long time, the last leg from May through to the August low. Since that low, it has consolidated in a wide range and found resistance at about 57. That was until last week, when it made a higher high over the top. The Bollinger Bands are opening higher and the RSI has moved into the bullish range, while the MACD continues higher. Look for continuation higher to participate.

Tractor Supply (O:TSCO)

Tractor Supply spent a year in a rising trend before pulling back with the market and establishing a low in August. Since then, it has consolidated in a range under 89. That range was broken to the upside last week and bodes for continuation higher. The rising and bullish RSI and MACD support a move higher, as does the Bollinger Bands opening to the upside.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into October Options Expiration week sees the equity markets looking stronger, but they have not sent the all clear signal yet.

Elsewhere look for gold to continue its short term uptrend while crude oil does the same but might encounter resistance. The US dollar index has a short term bias lower for the week in the broad consolidation, while US Treasuries are biased lower short term as well. The Shanghai Composite looks to continue in consolidation while Emerging Markets are biased to the upside.

Volatility looks to return to more normal levels, relieving the downward bias on the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts all show strength continuing into next week, but with the SPY the strongest followed by the QQQ and then the IWM on the longer term look. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.