Here are the Rest of the Top 10:

Fifth Third Bancorp (O:FITB)

Fifth Third Bancorp, FITB, dropped hard in August from a consolidation zone. The next few months saw a failed attempt higher and then some consolidation before a move higher in mid October. That found resistance at the prior zone of importance and pulled back. It made a higher low and moved back up through the zone last week. The RSI is rising and bullish and the MACD is rising, both supporting further upside.

Huntington Bancshares (O:HBAN)

Huntington Bancshares, HBAN, also dropped hard with the market in August and then consolidated for a couple of months. The rise that began in October met resistance at the pre-drop level and pulled back to a higher low at the 20 day SMA, before rising to test it again. The RSI is bullish and rising and the MACD is flat but positive. A new high is an entry signal.

Old Dominion Freight Line Inc (O:ODFL)

Old Dominion Freight Line, ODFL, has been in a downward channel since March, with the exception of a small period riding the top of the channel as support in August. The price action may have changed in September though as it has been moving sideways since then. Into the new week the price is pressing against resistance with the RSI pressing against the bullish zone. The MACD is bullish and rising. Look for a move over that resistance to participate.

PerkinElmer (N:PKI)

PerkinElmer, PKI, fell lower with the market in August then took a second leg down in September. A 25% drop in all, before a strong run higher to the prior resistance zone. After a small pullback the price reversed back up and is testing that resistance again. The RSI is bullish and rising and the MACD is crossing up after a short pullback of its own. Look for a push through the resistance as a signal to participate.

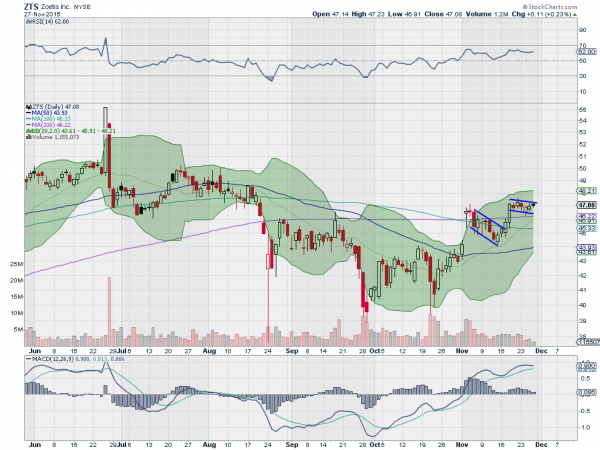

Zoetis Inc (N:ZTS)

Zoetis, ZTS, spiked 10% higher in June only to reverse and more the very next day. It then embarked on a downward journey finding a double bottom near 40 in October. Since then it has been slowly rising and looks ready for more. The RSI is in the bullish zone while the MACD is rising, both supporting more upward price action. Look for a break of consolidation to participate higher.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into December sees the equity markets looking solid and maybe with new leadership.

Elsewhere look for gold to continue lower while Crude Oil builds a bear flag in its longer downtrend. The US Dollar Index is breaking out to multi-year highs while US Treasuries consolidate with a short term bias higher. The Shanghai Composite broke consolidation to the downside and may be resuming the downtrend, while Emerging Markets are moving lower after failing at resistance.

Volatility looks to remain subdued and possibly fall keeping the bias higher for the equity index ETF’s N:SPY, N:IWM and O:QQQ. The SPY and QQQ paused this week and the IWM has taken over leadership in the short term. All look positive on the intermediate term chart. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.