Here are the Rest of the Top 10:

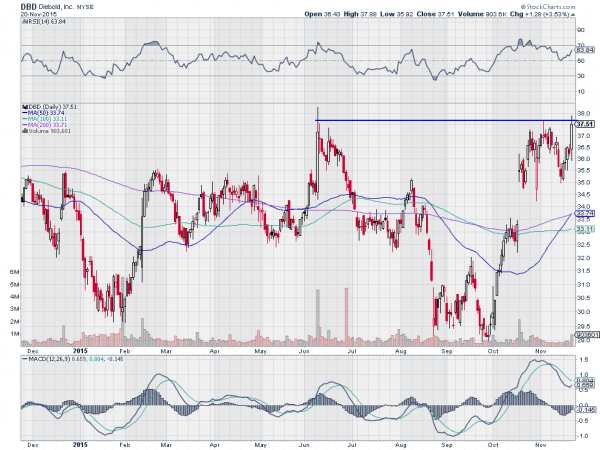

Diebold (N:DBD)

Diebold started a move lower after topping in June over 38 on a big one day move. After a 255 drawdown, it bounced in a ‘W’ fashion, finally heading higher to start October. The move touched the prior high area near 38 but pulled back again. This time it was a shallow pullback though and Friday found the price back at resistance on strong volume. The RSI turned back higher at the mid line and is bullish, while the MACD is about to cross up. Both support more upside.

DexCom (O:DXCM)

DexCom had a long run higher until topping over 102 in September. It pulled back hard with all healthcare related stocks in September finding a bottom after breaking through the 200 day SMA. Since then, it has moved back higher as consolidated at resistance. This price level was important as resistance in August and then support in September. Many battles here. The RSI is trying to move up off of the mid line while the MACD has turned flat after rising to zero. Look for a break higher to participate.

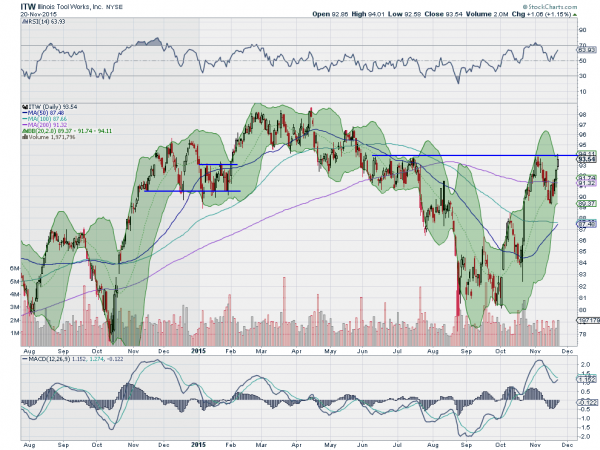

Illinois Tool Works (N:ITW)

Illinois Tool Works went through a long channel lower from March through August before, exploding to the downside with the market at the end of August. After some consolidation, it started back higher in October and is now back at resistance. The RSI is rising and bullish and the MACD is about to cross up. The Bollinger Bands® are starting to open after a squeeze as well. A break above resistance could run to new highs.

Southwest Airlines (N:LUV)

Southwest Airlines had a strong run higher from a base at $8 from the end of 2012. Bags fly free is apparently winning some business. But as the calendar turned into 2015, it started a pullback. The stock retraced 38.2% of the move up and then started back higher. Last week it had made it back to resistance again, and started a small pullback. Momentum is supportive with the RSI in the bullish zone, having reset and turning back higher. The MACD has pulled back a bit and a turn higher would also confirm the upside.

Oshkosh (N:OSK)

Oshkosh pulled back from a double top at 55 in May. It made a double bottom in August and has been consolidating since against resistance. The RSI is trending higher as it consolidates along with the MACD rising. A break over the top triggers a trade opportunity, with a more conservative entry over the 200 day SMA.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the shortened Thanksgiving Holiday week sees the equity markets have moved strongly higher maybe a bit too fast in the short run.

Elsewhere look for gold to continue lower while crude oil consolidates in its downtrend. The US dollar index is consolidating with an upward bias and US Treasuries are moving higher in the consolidation range. The Shanghai Composite looks ready to resume the move higher out of consolidation and Emerging Markets are biased to the upside short term in their downtrend. Volatility looks to remain low adding some wind to the backs of the equity index ETFs N:SPY, N:IWM and O:QQQ.

Their charts look good in the short term, with the SPY and QQQ moving higher and the IWM biased higher in consolidation. Longer term, the SPY and QQQ look ready to attack their all-time highs, while the IWM lags behind. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.