Here are the Rest of the Top 10:

Adobe Systems (O:ADBE)

Adobe Systems, ADBE, has had a strong climb higher since the August low. It is currently consolidating under 89 in that move but extended from the trend line higher. The RSI is bullish but flat while the MACD is about to cross down. It may be time to pullback and digest some of the gains. Look for both the break out and the failure.

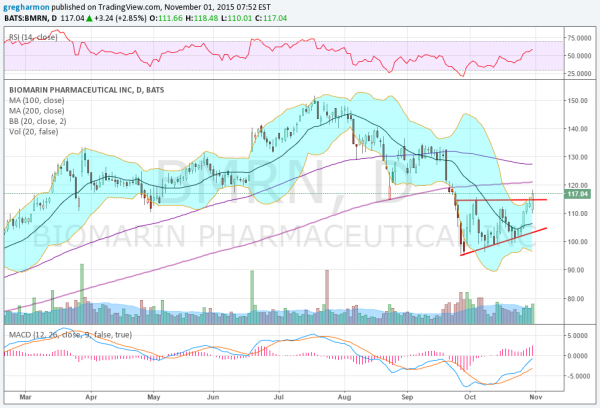

BioMarin Pharmaceutical (O:BMRN)

BioMarin Pharmaceutical, BMRN, reported earnings last Thursday after the close and printed a bullish engulfing candle higher Friday. This pushed the stock over the top of an ascending triangle, and it now has a target to the upside of 135, about the top of the previous consolidation range. The RSI is rising and bullish with the MACD rising as well.

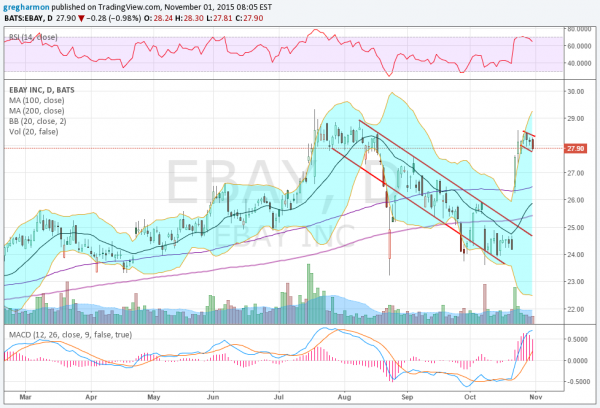

eBay (O:EBAY)

eBay, EBAY, had been in a falling channel until it reported earnings October 21st after the close. It then launched higher, and is now consolidating. The consolidation is happening in a bull flag in the range of the prior top from July. The RSI is bullish but rolling lower while the MACD is leveling. Look for both the break out and the failure.

Fortune Brands Home & Security (N:FBHS)

Fortune Brands Home & Security, FBHS, started higher when it broke a descending triangle in July to the upside. It met the target of 50.50 quickly and kept going to 52.85. It fell hard with the market from there and then moved to resistance again. Another fall back has shown that the 100 and 200 day SMA’s are acting as support now, a long term bullish signal. Since late September it has made a higher low and a higher high, the definition of an uptrend, but printed a bearish candle Friday with a long upper shadow. Look for both the break out and the failure.

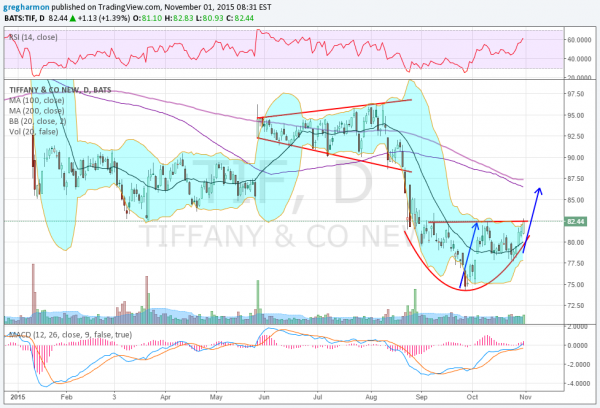

Tiffany (N:TIF)

Tiffany, TIF, fell from an expanding wedge consolidation zone in the low 90’s to an eventual bottom at 75. Since then it has pushed higher and has found resistance at 82.50. The rounded bottom has given a higher low and a Measured Move to 86.60, near the 100 and 200 day SMA’s. The RSI is rising and bullish with the bullish and rising MACD.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into November, sees the equity markets have regained a lot of ground lost over the summer but remain mixed.

Elsewhere look for gold to move lower while crude oil consolidates with an upward bias. The US Dollar Index is biased to the upside in consolidation, while US Treasuries look to mark time sideways. The Shanghai Composite looks to continue consolidation around 3400 with an upward bias while Emerging Markets are biased to the downside.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts are mixed though. The QQQ remains the strongest and within a day’s move to new all-time highs, while the SPY seems extended and may need to consolidate or pullback first. The IWM continues to lag and is mired in consolidation. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.