Here are the Rest of the Top 10:

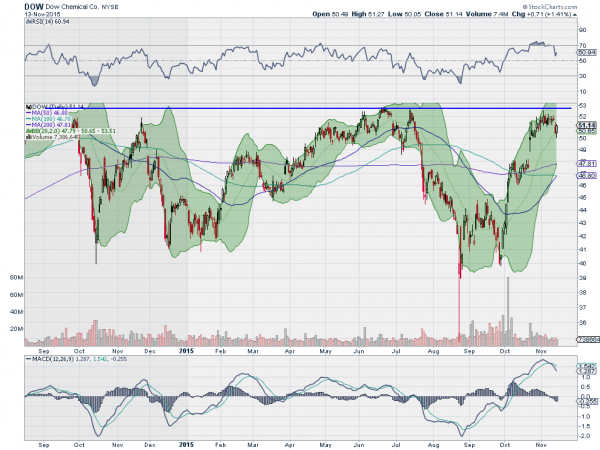

Dow Chemical (N:DOW)

Dow Chemical, DOW, is back up near trend resistance dating back to 2014. It ended last week pulling back from consolidation Thursday, but then printed a bullish reversal candle Friday. The RSI pulled back as well but reversed and is in the bullish zone with the MACD crossed down and falling. Look for a break over the consolidation zone for more upside.

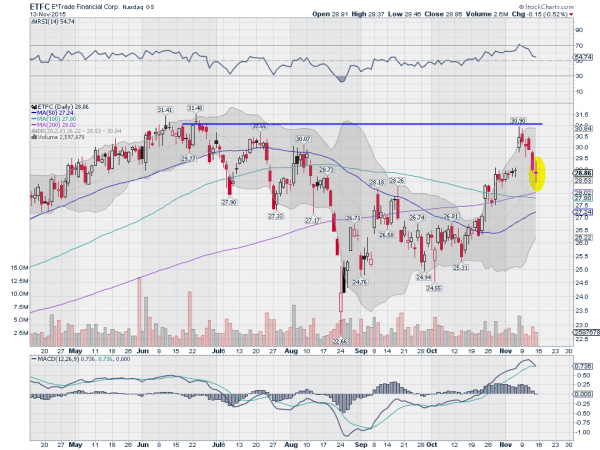

E*Trade (O:ETFC)

E*Trade, ETFC, started the week last week at resistance at 31 and pulled back all week. But Friday it printed a Spinning Top doji. This is often thought of as a reversal candle, but is truly just indecision until confirmed up or down. The RSI is falling but still in the bullish zone, while the MACD is about to cross down. These support continued downside. Monday will tell you which way to look.

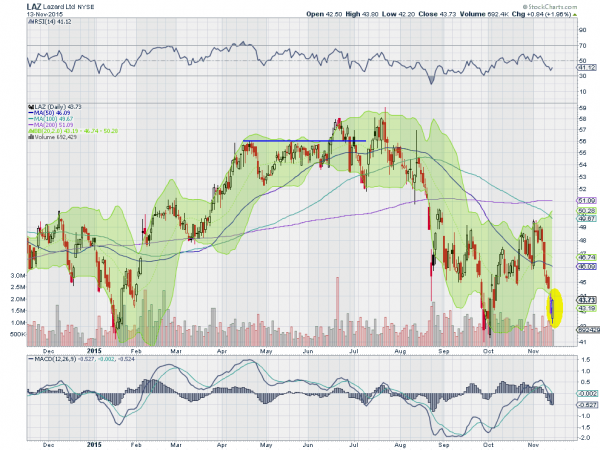

Lazard (N:LAZ)

Lazard, LAZ, fell from broad consolidation in August, with the market. Since then it has made a couple of pushes higher, each time failing. Friday saw the stock probe lower and then recover. Is it ready for another push to the upside?

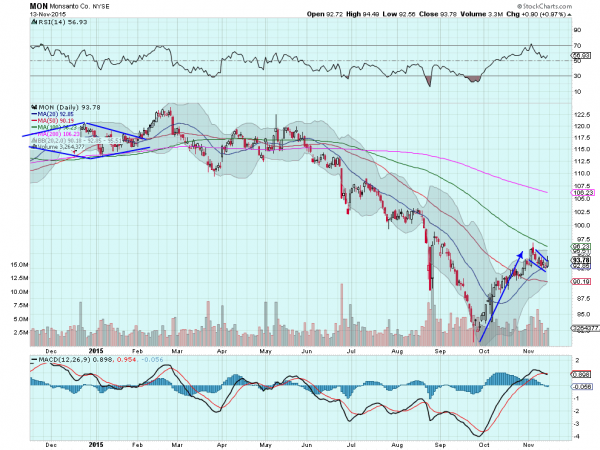

Monsanto (N:MON)

Monsanto, MON, pulled back from a consolidation area around 115 starting in June. It bottomed in September under 82 before the latest move back higher. The stock has built a bull flag last week and may be breaking it to the upside now. The RSI is holding in the bullish zone after pulling back and the MACD is crossed but level. Look for a break of the flag to the upside to consider buying the stock.

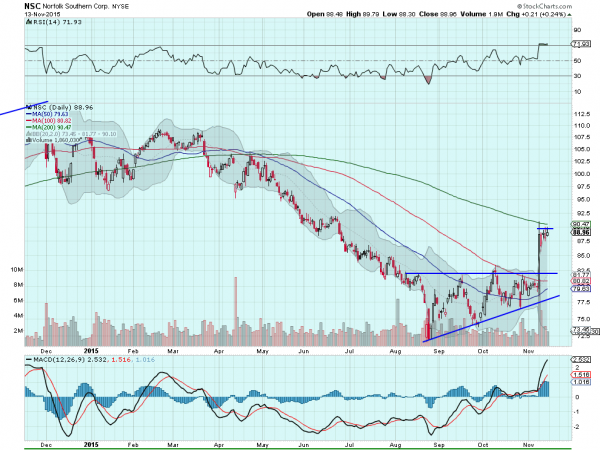

Norfolk Southern (N:NSC)

Norfolk Southern, NSC, broke consolidation to the upside Monday and then consolidated again under 89. The price action is building a bullish consolidation pattern with the RSI firmly in the bullish zone and the MACD rising. Look for a new push higher to participate to the upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into November Options Expiration and the last week before the shortened Thanksgiving holiday, sees the Equity markets have again shown an inability to make new highs, without giving up the positive longer term perspective.

Elsewhere look for gold to continue its downtrend, but with a possible short term reversal while crude oil works lower. The US dollar index looks to continue higher while US Treasuries are biased lower, but also may see a short term reversal. The Shanghai Composite is building energy for another leg higher while Emerging Markets are biased to the downside again.

Volatility looks to remain above the lower range, making things difficult for equities, but looking for a pullback after the spike in short order. The equity index ETFs N:SPY, N:IWM and O:QQQ, all look better to the downside this week. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.