5 trade ideas excerpted from the detailed analysis and plan for premium subscribers:

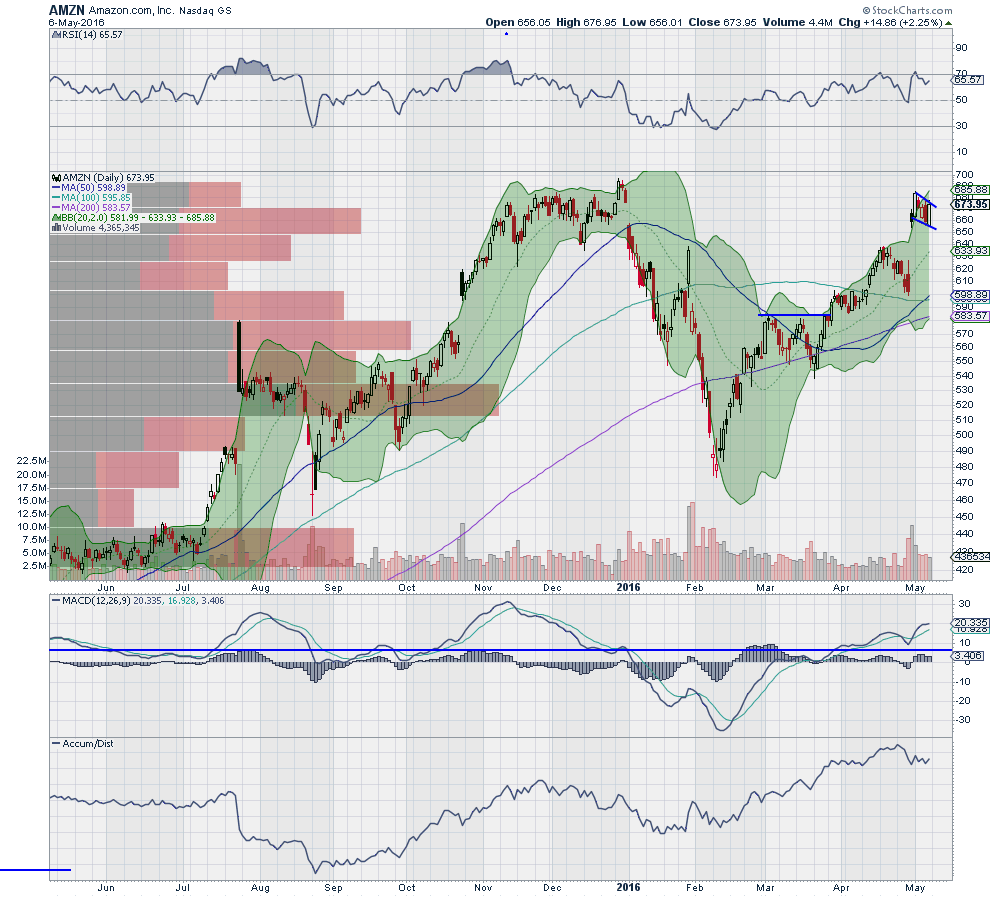

Amazon (NASDAQ:AMZN)

Amazon reported earnings a little over a week ago and blasted higher. It held the gap last week with a slight pullback on declining volume. This is the definition of a bull flag. Momentum remains strong too. The RSI is in the bullish zone and the MACD is rising. Look for a break of the flag higher to participate in more upside…..

Bloomin Brands (NASDAQ:BLMN)

Bloomin’ Brands dropped from a consolidation in August last year. The stock found a bottom in November and has been consolidating since. In March it looks to have started a reversal higher with a series of higher highs and higher lows. It ended Friday pressing against resistance from October and over the 200 day SMA. Look for a break higher to participate…..

Commerce Bancshares (NASDAQ:CBSH)

Commerce Bancshares broke out to new highs in April, reaching a peak near 47.50. It fell back from there to retest the breakout level last week, and saw a solid bounce off of it Friday. This happened as the RSI turned back higher off the mid line and the MACD is falling. Look for follow through Monday to the upside to participate…..

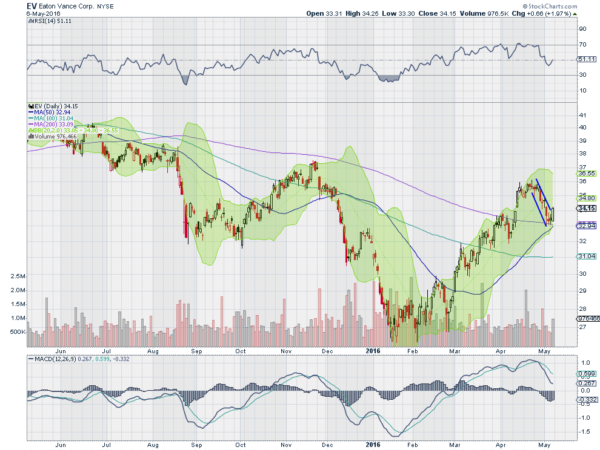

Eaton Vance (NYSE:EV)

Eaton Vance ended a pullback in January and started moving higher. The advance fell short of the November high when it topped out in April and it pulled back. The bull flag found support at the 50 day SMA and had a strong candle higher Friday, perhaps a reversal. The RSI would support it as it remains in the bullish zone but the MACD continues lower. Look for continuation higher Monday to participate to the upside…..

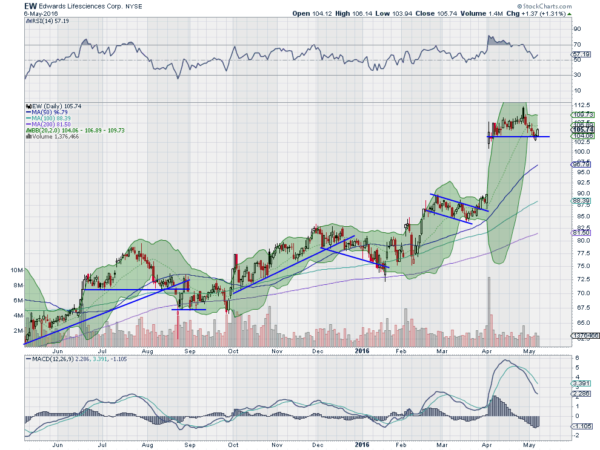

Edwards Lifesciences (NYSE:EW)

Edwards Lifesciences was in a channel trending higher that began accelerating in February. It gapped higher to start April on positive drug trial results and has held the gap. A retest of the bottom of the new range last week held and it looks ready for another push higher. The RSI has reset lower and held in the bullish zone while the MACD is falling. Look for a move over Friday’s high to participate to the upside…..

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday, which heading into next week sees equities continuing to look better to the downside short term after a week lower, but with a glimpse of promise from the Friday action.

Elsewhere look for gold to resume its uptrend while crude oil moves higher as well. The US Dollar Index is set to continue the bounce while US Treasuries consolidate with an upward bias. The Shanghai Composite continues to consolidate with a bias lower and Emerging Markets are biased to the downside.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), despite the moves lower. Their charts suggest more short-term downside though, with the QQQ looking the worst.

Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.