Here are the Rest of the Top 10:

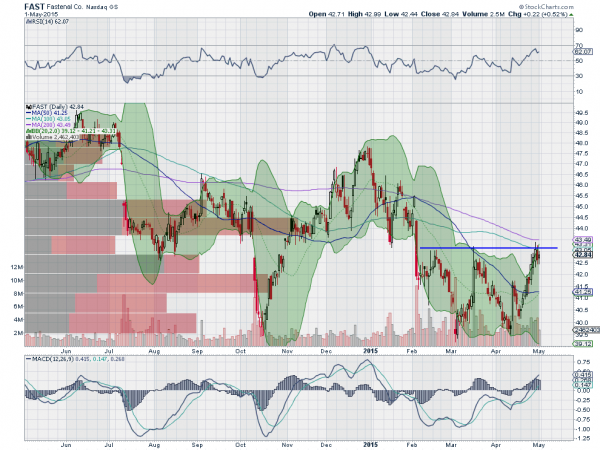

Fastenal Company (NASDAQ:FAST)

Fastenal pulled back hard in October with the market. It then had an equally fast bounce before settling into a Head ans Shoulders top pattern. it broke below the neckline with a strong move lower in early February and nearly hit the price objective of at 39.10, falling just 10 cents short. Price action since February has been a ‘W’ bottom and it is testing resistance at the top of the ‘W’ now. The RSI is bullish and rising while the MACD is also rising, both support a break through higher.

The Goodyear Tire & Rubber Company (NASDAQ:GT)

Goodyear Tire & Rubber is back at the resistance range that has held it 3 times in the past. This time it arrives after a series of higher lows. The RSI is in the bullish range and rising and the MACD is crossed up and rising, supporting upward price action.

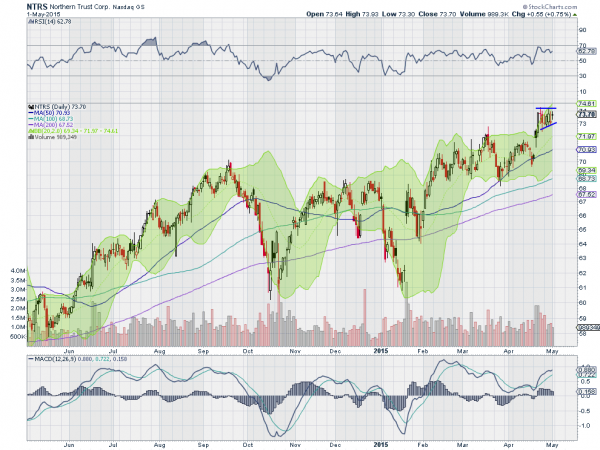

Northern Trust (NASDAQ:NTRS)

Northern Trust had a run higher through most of 2014 before a ‘W’ that completed in February. After some consolidation it rose again and is now in a tightening consolidation. The Bollinger Bands® are pointing higher, allowing a move up, while the RSI is bullish and the MACD rising.

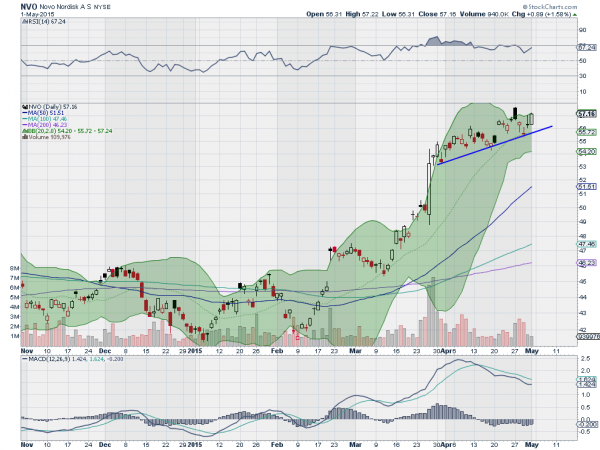

Novo Nordisk (COP:NOVOb)

Novo Nordisk, consolidated through the end of 2014 and into the first two months of 2015. It started higher in March and has slowed the pace in a steady trend up since the beginning of April, against rising tend support. The MACD has been diverging lower while the RSI is bullish.

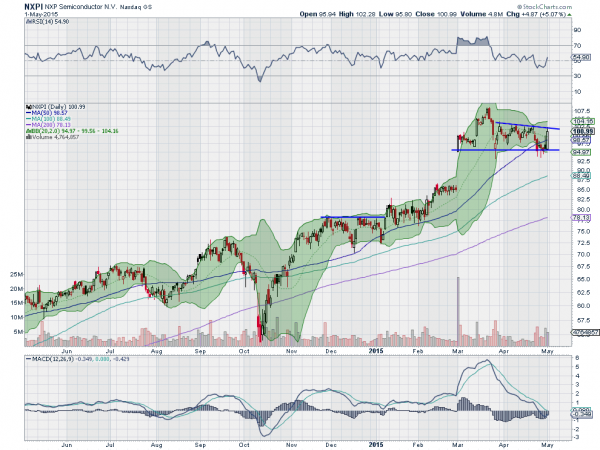

NXP Semiconductors NV (NASDAQ:NXPI)

NXP Semiconductor jumped off of the October bottom into a consolidation zone in December. it took some baby steps higher in January and February before a gap higher. Since then it has consolidated again in a descending triangle, with a wide strong candle Friday that tested both ends of the triangle range. The RSI has turned back up after making a lower low while price made a higher low, a Positive RSI Reversal. The MACD is falling though.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into May sees the equity markets continuing to look better on the longer timeframe but a bit shakier on the shorter timeframe.

Elsewhere look for Gold to consolidate with a downward bias while Crude Oil continues higher. The US Dollar Index has pulled back to a critical level where a reversal could be expected but more downside a character change while US Treasuries continue to be biased lower. The Shanghai Composite may finally be consolidating in its uptrend while Emerging Markets are showing some downside risk due to a wider consolidation.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 (ARCA:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts look a bit vulnerable in the short term despite the support and moves higher Friday, with the IWM the weakest and the SPY and QQQ in consolidation zones. The QQQ chart looks the best on the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.