Abbott Laboratories (NYSE:ABT)

Abbott Laboratories, ABT, spent two months consolidating near 46 before falling to its lows in February. From there it trended higher 2 months before a crash down at the end of April. The trend lower after the dump exhausted mid May and it started back higher. Now the RSI is pushing through the mid line and the MACD is crossed up and rising. With the Bollinger Bands® opening look for continuation to participate in the upside…..

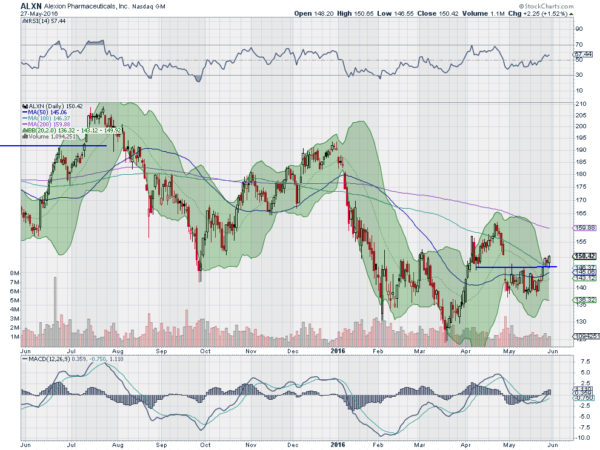

Alexion Pharmaceuticals (NASDAQ:ALXN)

Alexion Pharmaceuticals, ALXN, pulled back from a move higher in December to a February low. After a small bounce it dropped to a lower low in March before wit found what may be the bottom. A rise through April printed a higher high and the pullback into May a higher low. Last week saw it move above resistance and nearly close the gap. With the RSI rising and near the bullish zone and the MACD moving higher it has support for more upside. Look for continuation to participate to the upside…..

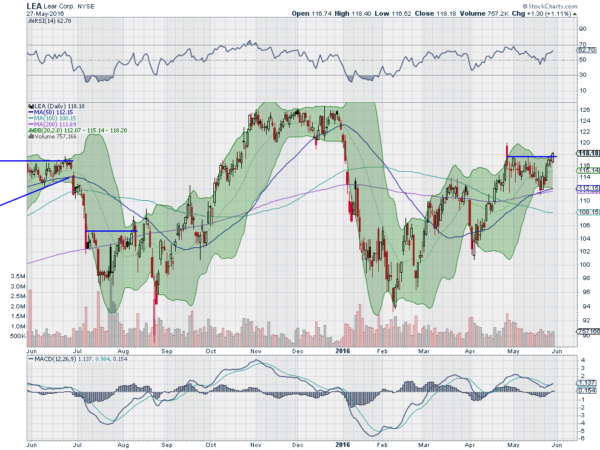

Lear Corporation (NYSE:LEA)

Lear, LEA, had a sharp decline in January that slowed in February finally bottoming mid month. It has rebounded from there in a few steps higher. This left the price at the end of last week testing prior resistance from May after a quick revisit to the 50 and 100 day SMA’s. Friday started a push higher. The RSI and MACD are bullish and rising supporting more upside. Look for continuation to participate in that upside…..

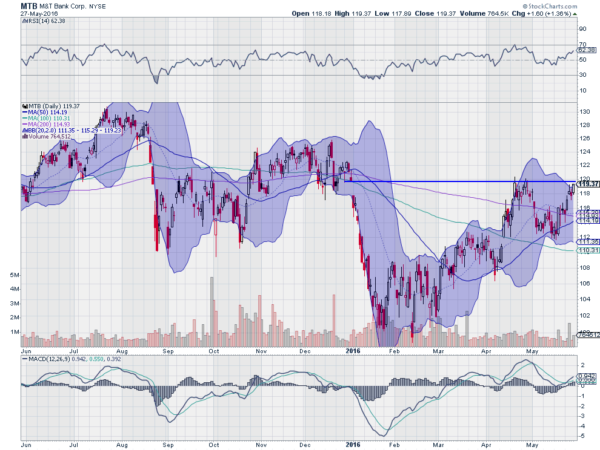

M&T Bank (NYSE:MTB)

M&T Bank, MTB, started the year to the downside in a steep decline. Since finding a bottom in January it has slowly trended higher in a wide range. The high in April closed the January gap and then it pulled back to a higher low. The reversal now sees the price at resistance again. With a rising and bullish RSI and a MACD that crossed up and is rising there is support for more upside. Look for a break of resistance to participate…..

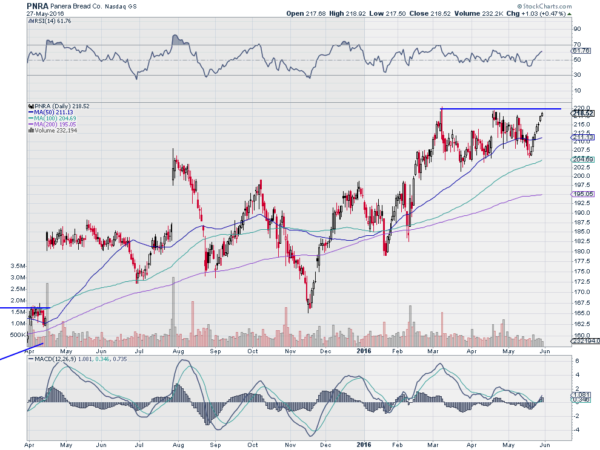

Panera Bread (NASDAQ:PNRA)

Panera Bread, PNRA, had only a minor pullback in January. And since then it rocketed up to new highs at 220 in March. It has consolidated since then, hitting resistance and then pulling back to higher lows. The RSI is in the bullish zone and rising and the MACD is crossed up and rising supporting more upside. Look for a break of resistance to participate to the upside…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the markets head into the Memorial Day Weekend and the unofficial start of Summer, equities are looking strong, but not quite free of caution.

Elsewhere look for Gold to continue lower while Crude Oil continues to the upside. The US Dollar Index looks to improve while US Treasuries continue to consolidate. The Shanghai Composite is also in consolidation mode but with a downward bias while Emerging Markets are biased to the upside in the short term.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts also suggest more upside, and are stronger looking on the weekly timeframe, with rising pennants on the daily timeframe giving minor caution of a short term pullback or consolidation. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.