Here are the Rest of the Top 10:

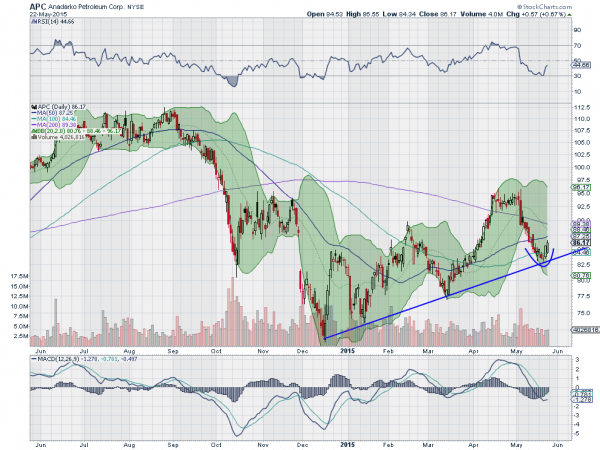

Anadarko Petroleum (NYSE:APC)

Anadarko Petroleum pulled back with the selloff in Crude Oil the second half of 2014. But since December it has been trending higher in a broad rising channel. Last week looks to have marked another bottom in that channel, with a Doji reversal candle confirmed higher and then follow through Friday. The RSI turned back up and the MACD is turning toward a positive cross.

CBOE Holdings Inc (NASDAQ:CBOE)

CBOE retraced about 61.8% of the run higher from July to the peak in January before finding support. Since then it settled sideways for 2 months before starting back higher. The first leg consolidated in a bull flag and broke higher Friday. The RSI is in the bullish zone and rising and the MACD also rising, both supporting more upside.

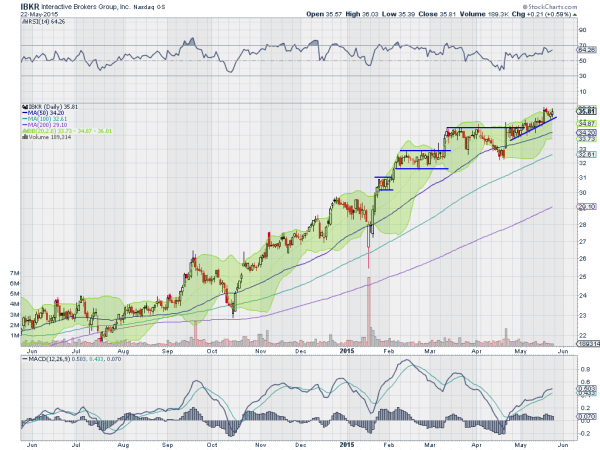

Interactive Brokers Group Inc (NASDAQ:IBKR)

Interactive Brokers has been trending higher since October 2014. The latest leg has been against rising tend support. It touched that again last week and turned back higher. The RSI and MACD are also both rising, supporting the upside continuation.

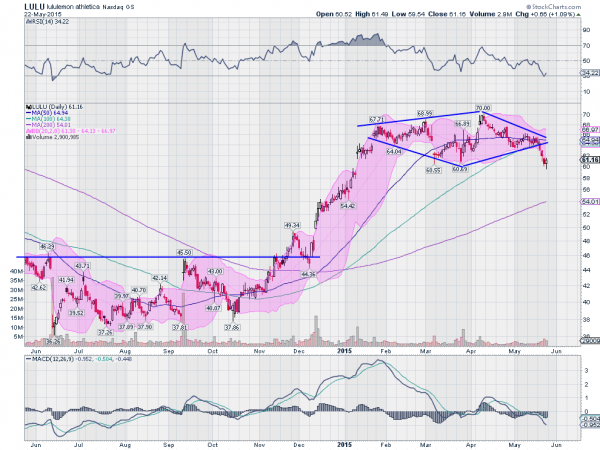

lululemon athletica inc (NASDAQ:LULU)

Lululemon athletica based for a long time in 2014 before a jump higher started in December. That led to consolidation in a Diamond top that is currently breaking down. The RSI is in the bearish zone and the MACD falling as well.

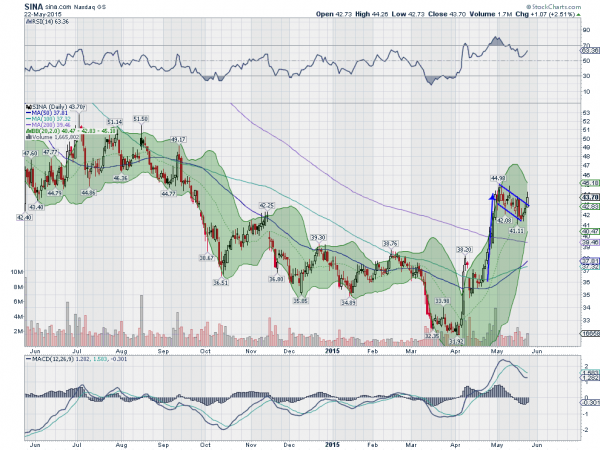

Sina Corporation (NASDAQ:SINA)

SINA peaked in late 2013 and then pulled back throughout 2014. It finally found a bottom in April this year and made its first higher high to start May. Since then it has pulled back in a bull flag. It broke that flag to the upside Friday, and has support from a bullish RSI for more. The MACD has stopped falling as well and is leveling.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the unofficial start of summer sees the equity markets looking positive and better in the longer timeframe than the shorter one.

Elsewhere look for gold to continue to hold near 1200 while crude oil consolidates with an upward bias. The US dollar index is biased to the upside but it is still too soon to declare a reversal higher while US Treasuries are biased lower but showing signs of consolidation. The Shanghai Composite is moving higher in renewed strength and Emerging Markets are biased to the downside in the uptrend, debating whether it is a bull flag or a reversal.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 (ARCA:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts agree with that on the weekly timeframe, but show better strength on the SPY and QQQ on the daily timeframe than in the IWM. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.