Here are the Rest of the Top 10:

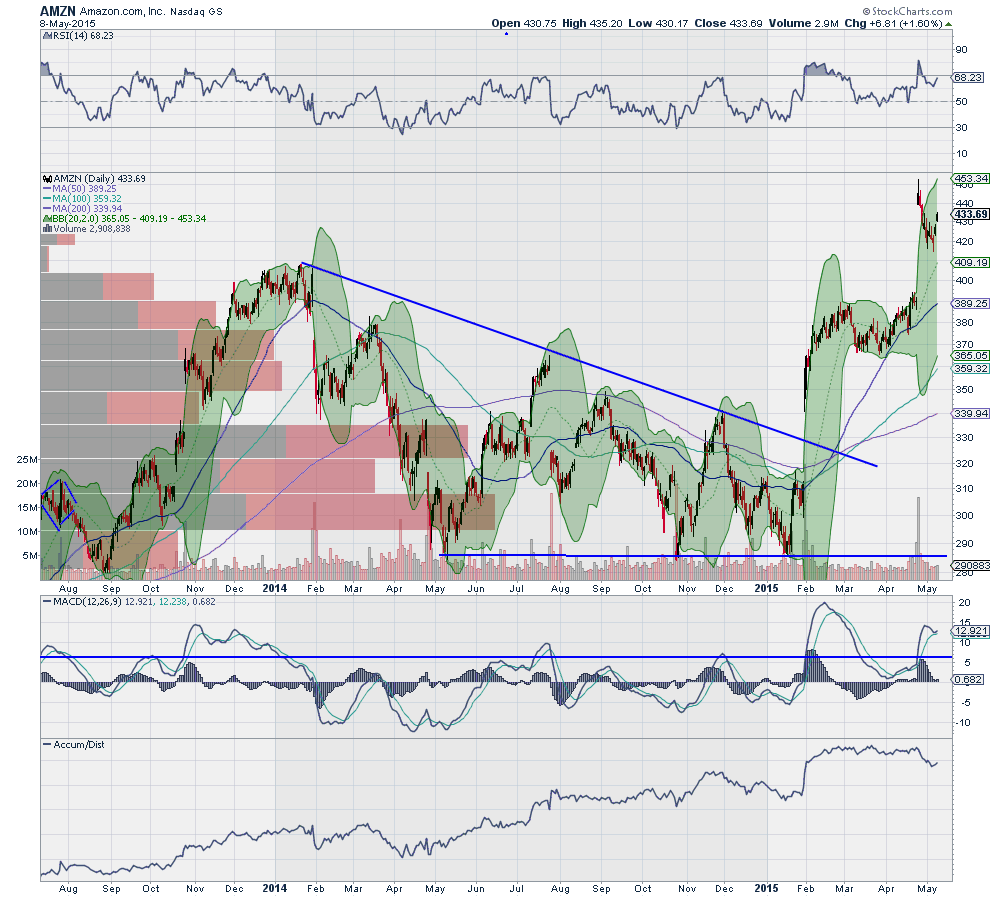

Amazon (NASDAQ:AMZN)

Amazon, AMZN, broke above a descending triangle at the end of January following their earnings report. It consolidated there half way through the move to the target price before taking another leap higher following the April report. that gap up hit the target out of the triangle and then it pulled back. Now moving higher it looks primed for another leg higher.

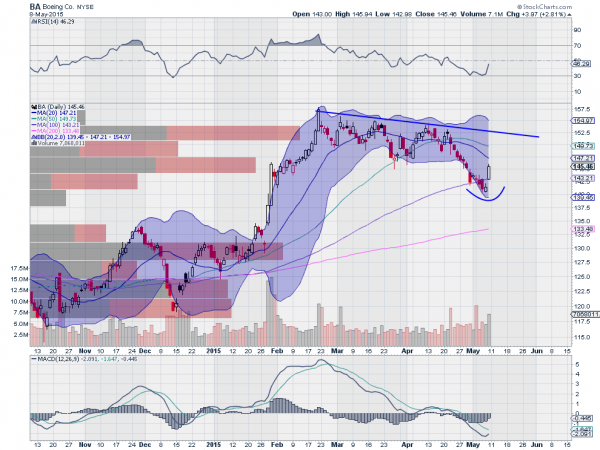

Boeing (NYSE:BA)

Boeing, BA, had a run higher in February and then pulled back in what looked like a bull flag. That flag broke to the downside two weeks ago, but found a bid under the 100 day SMA and reversed to end the week strong. This looks good for more upside as the RSI is reversing higher and the MACD about to cross up.

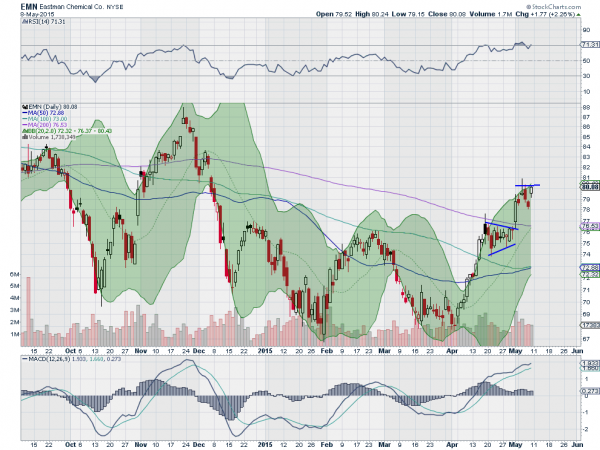

Eastman Chemical Company (NYSE:EMN)

Eastman Chemical, EMN, went through broad consolidation from December to the end of April before a break to the upside. The broad consolidation resembles a ‘W’ bottom with a tighter symmetrical triangle right before it broke to the upside. Now it is consolidating again. The RSI is strong and bullish with the MACD rising and bullish too.

Illumina (NASDAQ:ILMN)

Illumina, ILMN, is consolidating in a symmetrical triangle after moving higher in October. The RSI is turning up and is on the edge of the bullish zone while the MACD is also turning higher. With the move higher towards resistance last week look for a break over the top to enter.

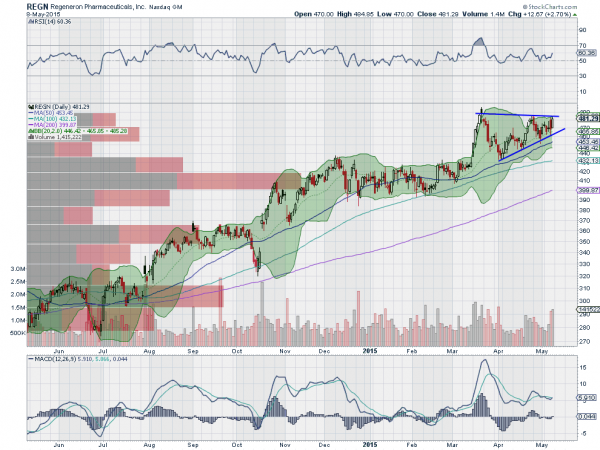

Regeneron Pharmaceuticals Inc (NASDAQ:REGN)

Regeneron Pharmaceuticals, REGN, had a strong move higher in 2014 before consolidating in December and then the first Quarter of 2015. It moved higher then and is settling into a tightening triangle. The RSI remains bullish and the MACD is running sideways after resetting lower. Look for break of resistance to trade it higher.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the May Options Expiration week the equity markets look to have weathered a storm, or at least most of one.

Elsewhere look for gold to continue to move sideways near 1200 while crude oil pulls back in its new uptrend. The US Dollar Index still looks weak while US Treasuries remain biased lower. The Shanghai Composite looks to continue to pullback in its uptrend and Emerging Markets are biased to the downside.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ, despite the ruckus this week. Their charts all continue to look better on the longer timeframe with the SPY and QQQ looking more sideways in the short run while the IWM may take another leg lower. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.