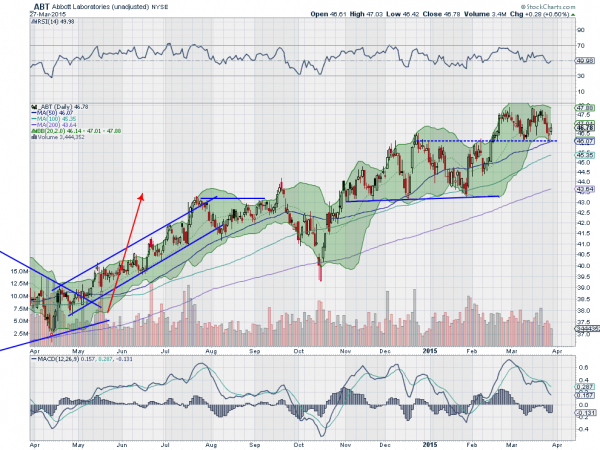

Abbott Laboratories (NYSE:ABT)

Abbott Laboratories, has been a darling of the trading world. It moved higher in February after a broad basing. And since then has been in a range between 46.10 and 48. Friday’s candle confirmed a reversal higher and gives a good entry for a long term position or short term trade.

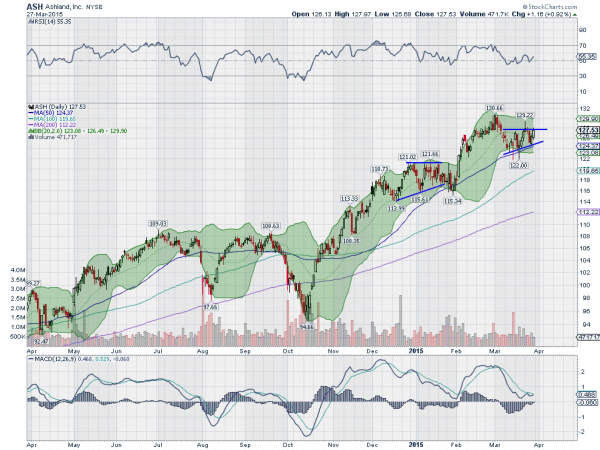

Ashland Inc (NYSE:ASH)

Ashland, moved higher off of the October low and consolidated around 118. After that it made another run higher and has been consolidating since in an ascending triangle. The RSI has held bullish and the MACD is about to cross up for a buy signal.

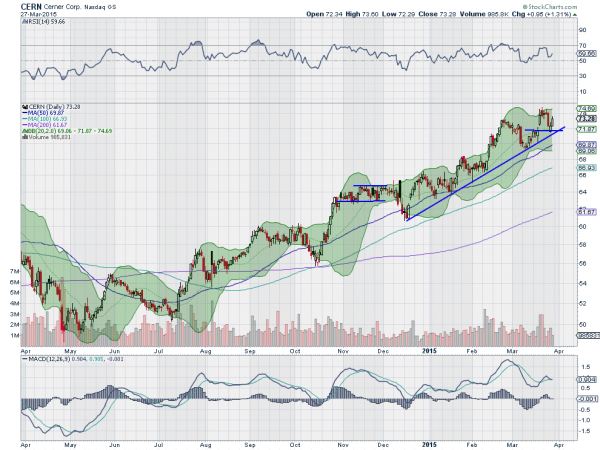

Cerner Corporation (NASDAQ:CERN)

Cerner, has had a strong trend higher since May 2014. The recent activity since December has created trend support and it touched that last week. It also pulled back to close a gap before moving higher Friday. The RSI is bullish and rising and the MACD is pulling back, but appears to be leveling at the signal line.

Dillards Inc (NYSE:DDS)

Dillard’s, had struggled at the 125 level for several months before moving through it in February. That leg higher has created rising trend support which it touched last week. With strong RSI and a MACD leveling at strong levels this could have a lot more in it to the upside.

Banco Santander (MADRID:SAN)

Banco Santander, had been in a falling trend from June 2014 until it accelerated down the first few days of January. Since then it has consolidated in a bottoming process. Last week it made a new higher high, in building a bull flag. The strong and bullish RSI along with the rising and bullish MACD support a continuation higher.

Up Next: Bonus Idea

The Best

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, Heading into Quarter end and a holiday shortened week the Equity markets look short term vulnerable in their long term uptrends.

Elsewhere look for Gold to try higher in its short term uptrend but with trepidation while Crude Oil consolidates back in a channel. The US Dollar Index may continue to consolidate in its uptrend with a bias higher while US Treasuries are biased lower as they consolidate. The Shanghai Composite looks better to the upside in its consolidation and Emerging Markets are biased to the downside in their broad consolidation.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts show a mixed bag with consolidation in the uptrends ion the longer timescale, with the IWM the strongest, while on the shorter timeframe the IWM and QQQ may reverse higher with the SPY still looking vulnerable. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.