Here are the Rest of the Top 10:

Cigna (NYSE:CI)

Cigna, rose out of a base between 88 and 94 up to another base centered around 102 before starting a move higher in January. The current move is now consolidating under resistance. As it does, the RSI has worked off an overbought condition while remaining bullish and the MACD is level after a pullback.

The Hain Celestial Group Inc (NASDAQ:HAIN)

Hain Celestial, has trended higher, with a few pullbacks along the way, since August. Now it is consolidating under resistance with the Bollinger Bands® tightening. This is often a precursor to a move in price. The RSI has turned back higher and is bullish while the MACD is level after a pullback. Watch for a break out higher.

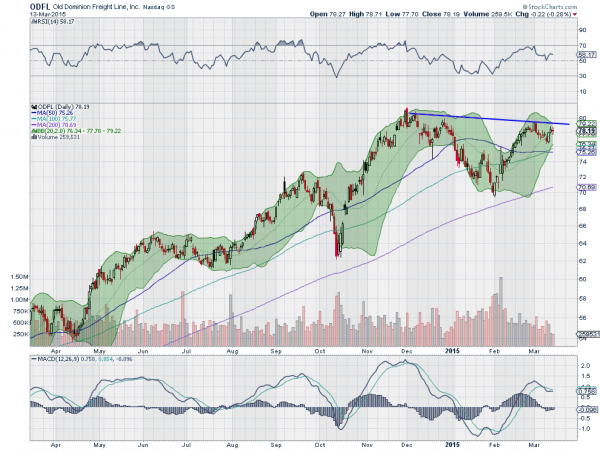

Old Dominion Freight Line Inc (NASDAQ:ODFL)

Old Dominion Freight Line, rose from an April 2014 low with only a pullback along with the market in October. But the last 4 months has seen falling trend resistance, like the neckline of an Inverse Head and Shoulders pattern. The higher low last week suggests it may be ready to break higher. And the bullish and rising RSI supports this. The MACD which is level after a pullback, turning higher would confirm support too.

PerkinElmer (NYSE:PKI)

PerkinElmer, has been a bit of a messy chart but the action sine January has some short term clarity. Rising to resistance and then pulling back a couple of times to higher support each time. It pushed through that resistance Friday on strong relative volume. The RSI is rising and in the bullish zone while the MACD is about to cross up. These support a new leg higher.

Weyerhaeuser Company (NYSE:WY)

Weyerhaeuser, had been in a rising channel or wedge since April 2014 until falling out lower to bring in March like a lion. Now consolidating over support, it has moved back into the Bollinger Bands. The RSI is bearish and holding along the oversold line with the MACD falling. Look for a break lower.

Up Next: Bonus Idea

Elsewhere look for Gold to continue lower along with Crude Oil next week. The US Dollar Index may consolidate in the uptrend but has a clear bias higher while US Treasuries are biased lower. The Shanghai Composite is trying to break consolidation to resume the uptrend while Emerging Markets are biased to the downside still.

Volatility looks to remain subdued but above the low range of the early 2014 keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, but with the wind easing at their backs. Their charts all are consolidating in the short run with the bias to the upside for the IWM while to the downside for the SPY and QQQ. The long term uptrend remains intact for each though. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.