Here are the Rest of the Top 10:

Cigna (NYSE:CI)

Cigna has been in a strong trend higher since mid 2012. What makes it interesting now in that trend is that it is giving a possible entry point against good support for a strong reward to risk trade. Currently, it is pulling back in a bull flag. The RSI is bullish. The MACD is pulling back, but already turning flat. Friday, the price moved higher in the flag, showing a support level and testing the falling trend resistance. A break of this triggers a long trade.

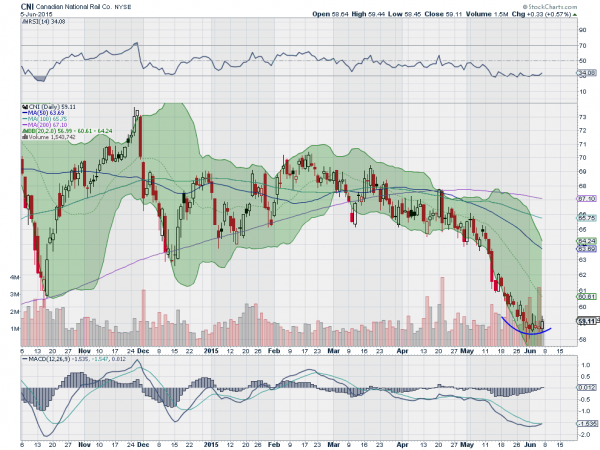

Canadian National Railway (NYSE:CNI)

Canadian National Railway has sold off since falling out of a broad consolidation in April. Now it is showing support and some strength Friday. The MACD is confirming this as it moves to cross up, while the RSI is still running along the oversold level. Notice how extended the price is from the moving averages.

Hanesbrands (NYSE:HBI)

Hanesbrands has been moving higher, but found resistance in mid March. After consolidating, it fell to the 50 day SMA and bounced. Now, a rounding consolidation suggests it may be ready for another leg higher. The RSI is in the bullish zone and rising, while the MACD is also rising, both supporting more upward price action.

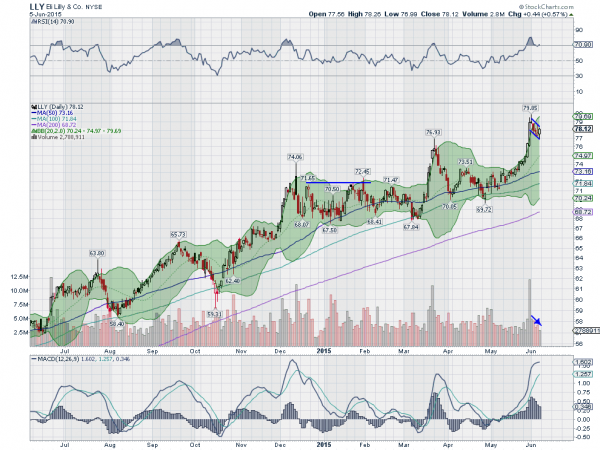

Eli Lilly (NYSE:LLY)

Eli Lilly has trended high for a long time. The recent strong move up in May has now turned into a pull back in a bull flag. This is resetting the overbought RSI and moving the price back into the Bollinger Bands®. Look for a break of the flag, as in the Cigna trade above, as your entry against the flag low as a stop.

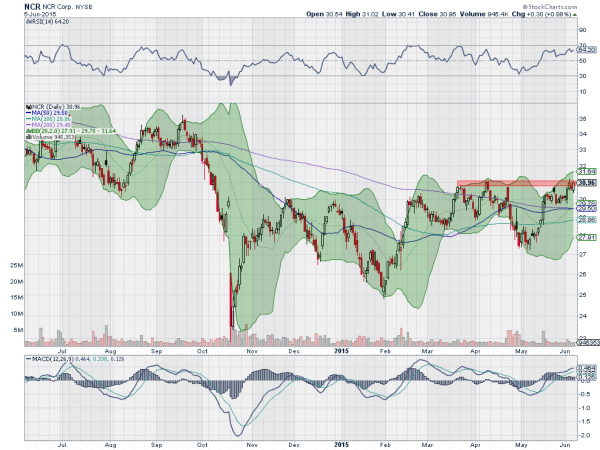

NCR (NYSE:NCR)

NCR fell sharply from September into the October low in 2014. Since then, it has recovered, but found resistance between 30 and 31. What makes it interesting for a trade is that the past 3 months has built an Inverse Head and Shoulders pattern, and it is back testing the neckline. The RSI is bullish and the MACD is rising, both supporting continued upward price action.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into next week, sees the equity markets continuing to look a bit vulnerable on the daily timeframe but strong on the weekly timeframe.

Elsewhere, look for gold to continue lower while crude oil consolidates with a slight downward bias. The US dollar index also is in broad consolidation with an upward bias, while US Treasuries look to continue lower. The Shanghai Composite is back off to the races higher with a chance of consolidation, while Emerging Markets look to continue to the downside.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggest that the IWM is strong and taking over leadership, while the QQQ looks strongest on the longer timeframe. The SPY may need more sideways consolidation before resuming higher. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.

Original post