After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the first full week of June sees the Equity Indexes looking solid.

Elsewhere look for gold to bounce higher in consolidation while crude oil consolidates its move higher, holding at the round number 50. The US Dollar Index looks better to the downside short term in its broad consolidation while US Treasuries are strong and look to move higher. The Shanghai Composite has a short term bias higher and may have broken a long term pattern to the upside while Emerging Markets are continue to move up.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). There charts show some variation in the short run with the IWM leading to the upside, perhaps catching up, while the QQQ has a short term upward bias in consolidation and the SPY looks to be muddled in consolidation after its move higher. Use this information as you prepare for the coming week and trad’em well.

***Special note. All of last week’s Top 10 Premium are still in play except for Alexion that ran higher.***

Cash America International Inc (NYSE:CSH)

Cash America International, CSH, moved higher from a shallow pullback to start the year. It spiked at the end of April and quickly pulled back, drifting lower since. The last 3 weeks it has been consolidating around a 50% retracement of the range, until Friday. Then it broke above the range to the upside. The RSI is rising and the MACD has crossed up, both positive reinforcement for a move higher.

There is resistance at 39.25 and 40.65 followed by the top of the spike at 44.77. Support lower comes at 37 and 35.70 followed by 34.85 and 33.85. Short interest is moderate at 3.4%. Enter long on a move over 37.10 with a stop at 36. As it moves over 38 move the stop to break even and then to a $1 trailing stop over 38.10. Take off 1/3 on a stall at 44.7 or higher. Options spreads are too wide to use for this trade.

Dunkin Brands Group Inc (NASDAQ:DNKN)

Dunkin’ Brands, DNKN, chart is nearly identical to Cash America. A rise from the January low to a top in April, followed by a pullback of 50% where it is consolidating. The RSI turned up at the end of last week and the MACD crossed up. There is resistance at 44.30 and 45.50 followed by 47.50 and 48.75 before the top at 49.59. Support lower comes at 43 and 40.90. Short interest is high at 12.9%.

Enter long on a move over 44.60 with a stop at 43. As it moves over 45.30 move the stop to break even and then a $1.20 trailing stop over 45.50. Take off 1/3 on a stall at 49.59 or higher. As an options trade consider the June 42.50 Calls (offered at $2.25 late Friday) and trade them like the stock trade (using the stock price as a trigger, stop and target).

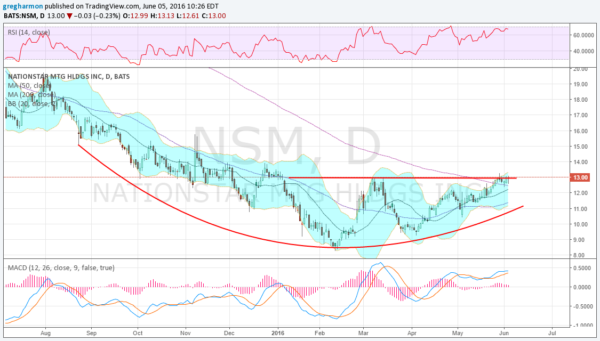

Nationstar Mortgage Holdings Inc (NYSE:NSM)

Nationstar Mortgage, NSM, has gone through a rounding bottoming process. Last week saw it move over the 200 day SMA and hold there, at the March high. The RSI is in the bullish zone and the MACD is positive and rising, both supporting a push through resistance. There is resistance at 13 and 14 followed by 15 and 16.85 before 18.35 and the July 2015 high at 19.75. Support lower comes at 12.20 and 11. Short interest is high at 10.8%.

Enter long on a move over 13.10 with a stop at 12.20. As it moves over 13.75 move the stop to a 70 cent trailing stop and take off 1/3 on a stall at 19.75 or higher. As an options trade consider the June 13 Calls (55 cents) and trade them like the stock trade. Give it more time with the July 13 Calls (95 cents).

Rockwell Automation (NYSE:ROK)

Rockwell Automation, ROK, moved lower from July 2015 until finding a bottom in January. A strong trend higher retraced 61.8% of that move before morphing into consolidation the last 3 months. Friday saw it reach the top of the consolidation with the Bollinger Bands® opening higher. The RSI is into the bullish zone and the MACD is rising. A break of the range sees resistance above at 118.25 and 123 followed by 127 and then the Measured Move gives a target of 140. Support lower comes at 115.25 and 110. Short interest is moderate at 5.7%.

Enter long on a move over 118.25 with a stop at 115. As it moves over 120 move the stop to break even and then to a $3 trailing stop over 121.25. Take off 1/3 on a stall at 140 or higher. As an options trade consider the July 115 Calls ($5.50) and trade them like the stock trade. Sell the July 110 Puts (85 cents) and or the June 120 Calls (85 cents) to lower the cost.

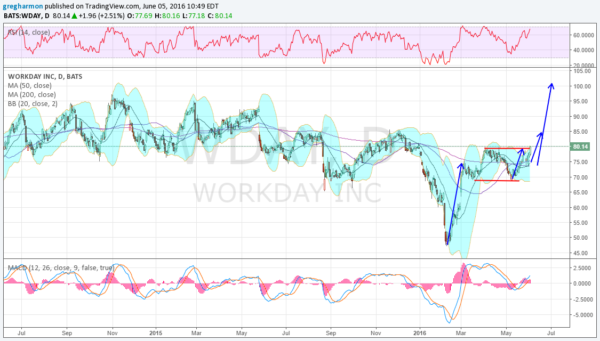

Workday Inc (NYSE:WDAY)

Workday, WDAY, dove lower to start the year, finding support in February. After a quick move higher it developed a wide sideways channel between 69 and 79. Friday saw it move above that channel, and close at the high of the day. This gives a short term target on a Measured Move to 85 and longer term to 100. The RSI is in the bullish zone and rising while the MACD is also moving higher. There is resistance at 81.35 and 85 before 92.60 and 95 then 97. Support lower comes at 79 and 75. Short interest is high at 14.8%.

Enter long now (over 79) with a stop at 77. As it moves over 81 move the stop to break even and then to a $2.50 trailing stop over 82.50. Take off 1/3 on a stall at 100 or higher. As an options trade consider the June 80 Calls ($1.90) and trade them like the stock trade. Give it more time with the July 80 Calls ($3.40) and sell the June 77.5 Puts (75 cents) to lower the cost.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.