Here are the Rest of the Top 10:

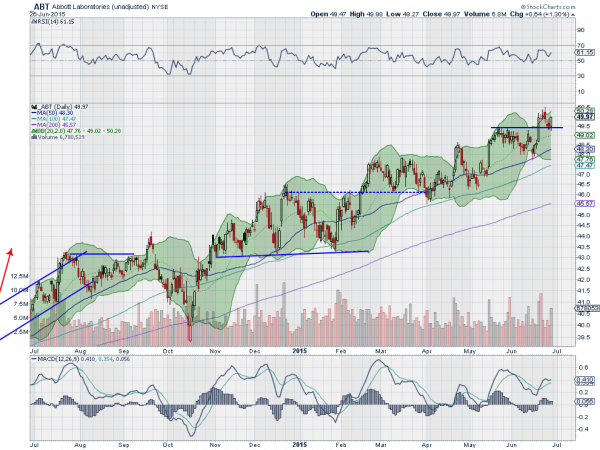

Abbott Laboratories (NYSE:ABT)

Abbott Laboratories has shown steady progress higher since the October market low, with several ‘steps’ along the way. Two weeks ago, it broke above resistance to start another step higher, and pulled back to retest the break out level last week. It held and is now moving back higher. The momentum indicators are positive, with the RSI in the bullish zone and the MACD rising and looking to avert a cross down.

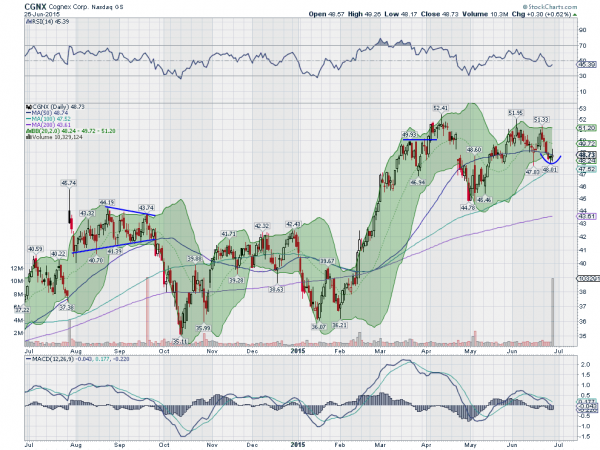

Cognex (NASDAQ:CGNX)

Cognex rose from a double bottom at 36 to a peak at 52.41 in April. From there, it created the familiar ‘V’ recovery and has stalled. Friday put the stock at the lower Bollinger Band® with a second bottoming candle in a row, a Spinning Top Doji. With the RSI holding in the bullish zone, look for a reversal higher to get involved.

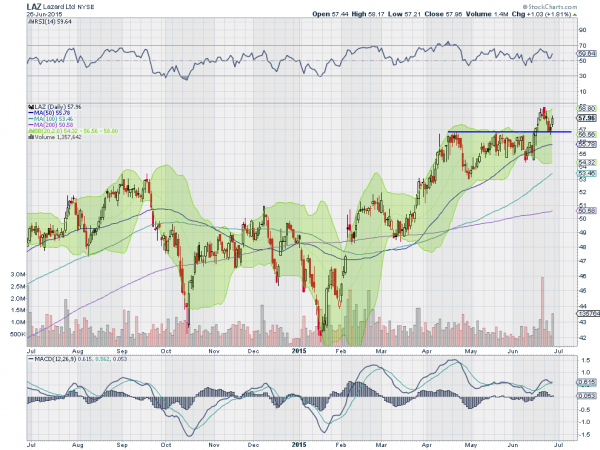

Lazard (NYSE:LAZ)

Lazard also printed a double bottom, near 42, and has been rising since mid January. With a consolidation under resistance at 57 from April through mid June, it finally broke above 2 weeks ago. What makes it interesting is that it then back tested the breakout and held, reversing back higher Friday.

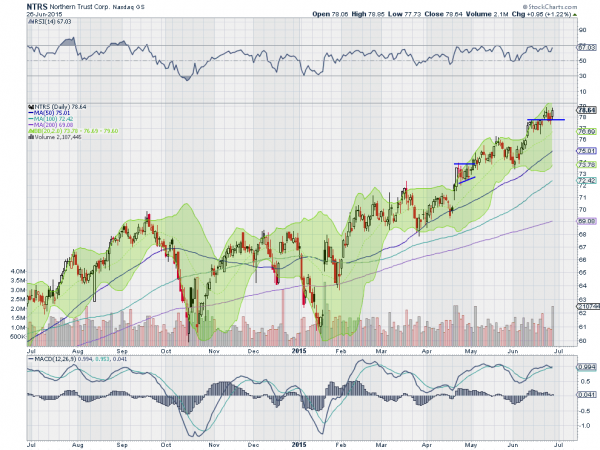

Northern Trust (NASDAQ:NTRS)

Northern Trust looks very similar to Lazard, with the double bottom and run up to resistance. It broke above that resistance last week, and then consolidated with a drifting pullback that held above the break point, and reversed up Friday. The RSI is bullish and the MACD is avoiding a cross down, giving the upward bias.

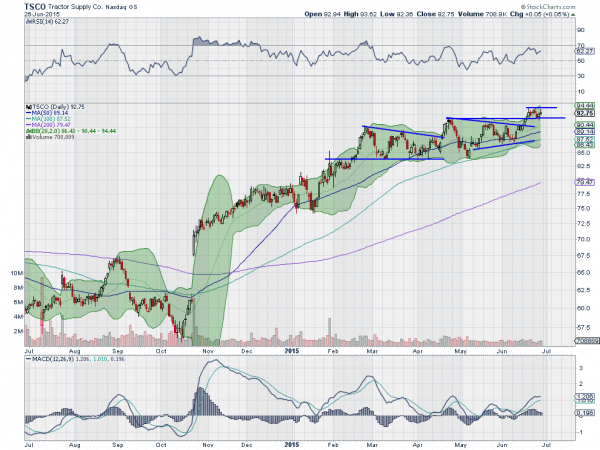

Tractor Supply (NASDAQ:TSCO)

Tractor Supply first appeared as a trade idea 2 weeks ago, as it broke above a symmetrical triangle. It has been consolidating that break out in a channel since, but well short of the target move. The RSI is bullish and rising, while the MACD is also rising, both supporting more upside price action.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the holiday shortened week, sees the equity markets continuing to look better on the longer timeframe, with some vulnerability on the short timeframe.

Elsewhere, look for gold to continue consolidation with a downward bias, while crude oil consolidates with an upward bias. The US dollar index continues to move sideways in broad consolidation after the uptrend, while US Treasuries are biased lower. The Shanghai Composite may finally be in the long awaited correction, while Emerging Markets are biased to the downside.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts continue to show the SPY and QQQ moving similarly on the shorter timeframe, while the IWM was stronger until late in the week. The rotation may be starting out of the small caps again. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.