Here are the Rest of the Top 10:

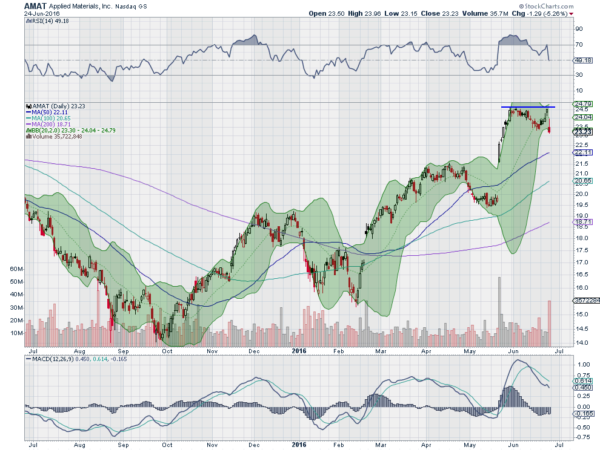

Applied Materials (NASDAQ:AMAT)

Applied Materials moved higher off of a bottom in September. It stalled in December and pulled back with the market in January, but to a higher low. The bounce took it to a higher high in April, before a slight pullback to another higher low. An uptrend forming. The next move up set another higher high in June. But then the consolidation broke to the downside to end last week. Look for continuation Monday to participate lower…..

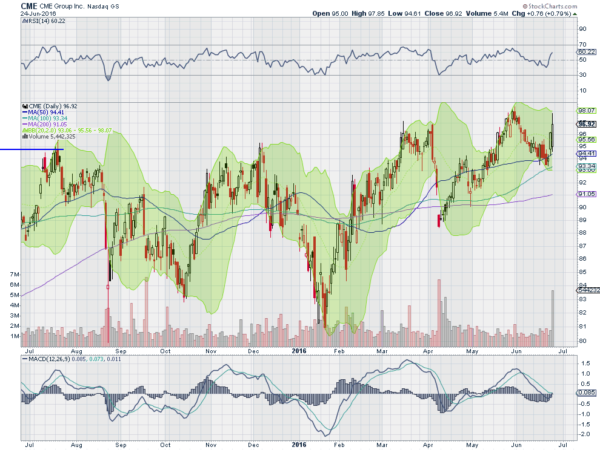

CME Group (NASDAQ:CME)

CME Group has banged its head against the $100 price several times over the last 18 months. What makes it interesting right ow is that with a horrible market Friday it was actually up on the day. It also has some room to that $100 level. The RSI is in good shape too as it held in the bullish zone and is now rising while the MACD is about to cross up. Look for continuation Monday to participate to the upside…..

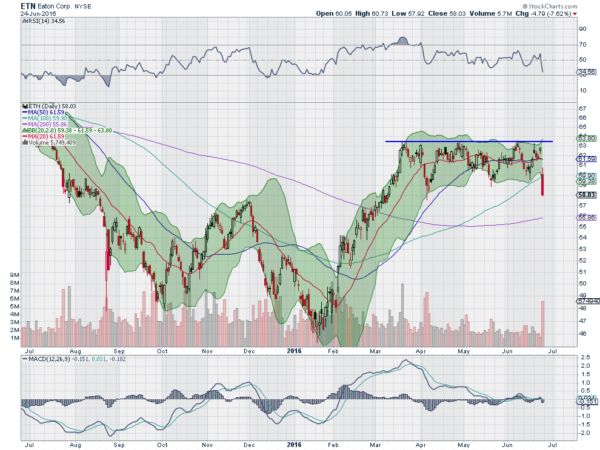

Eaton (NYSE:ETN)

Eaton made a lower low in February, but the movement after that was quite strong to the upside. It added over 35% in 2 months before finding resistance. The next 3 months would be a sideways consolidation. It looked like digestion until Friday when it moved strongly to the downside. Now the RSI is in the bearish zone and the MACD crossed down and falling. Look for continuation to participate to the downside…..

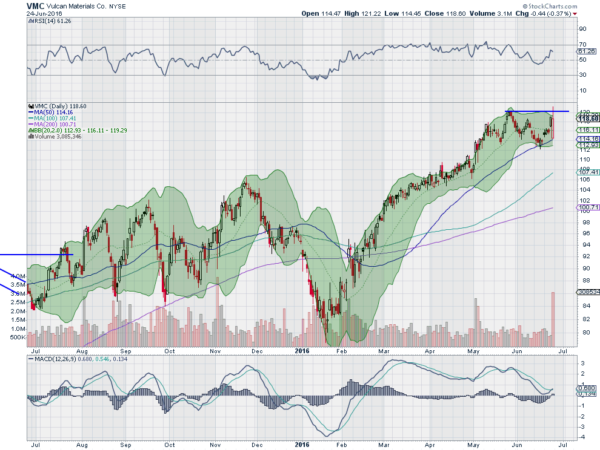

Vulcan Materials (NYSE:VMC)

Vulcan Materials had a strong run higher from a January low. That morphed into a sideways consolidation in May. Since early June the RSI has turned back higher and the MACD is rising, and crossed up last week. Friday saw it sell off sharply at the open to the 50 day SMA, but the strong price action the rest of the day took it back to near unchanged for the day. Look for a break of resistance to participate to the upside….

Vitae Pharmaceuticals (NASDAQ:VTAE)

Vitae Pharmaceuticals gapped higher in March in strong volume. It consolidated that move for 2 months in a wide range before racing higher, closing the gap down from March in the process. Since then it has been consolidating in a very tight range under the 200 day SMA. The RSI is in the bullish range and has reset from an overbought condition. The MACD has also reset lower. Look for a move over resistance to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which saw the week marked by the Cavaliers winning the NBA title, and the Summer solstice ushering in the new season, with all well early in the week, then the Brexit vote changed all that as the equity markets, and all other markets dumped Friday. Leave it to the Brits to screw up a great week (just kidding). With a one day turn now equities look weak.

Elsewhere look for gold to continue higher while crude oil consolidates with a pullback in the uptrend. The US Dollar Index remains stuck in a sideways consolidation while US Treasuries are moving back higher. The Shanghai Composite and Emerging Markets are stuck in consolidative ranges with the Chinese market biased to break the range to the upside while Emerging Markets are biased to break theirs lower.

Volatility looks to remain elevated in the coming week keeping the bias lower for the equity index ETFs SPY (NYSE:SPY), NYSE:IWM and NASDAQ:QQQ. Their charts all look better to the downside in the short term, with the QQQ at intermediate support and the SPY breaking its intermediate support. All 3 printed possible reversal candles though so stay nimble. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.