Here are the rest of the Top 10:

Cullen/Frost (NYSE:CFR)

Cullen/Frost has been trending higher since coming out of a consolidation over March and April. The last two weeks saw a minor pause and resistance from over 78. With the RSI in the bullish zone and the MACD trending higher, look for a break above resistance or a pullback to rising trend support and reversal as an entry.

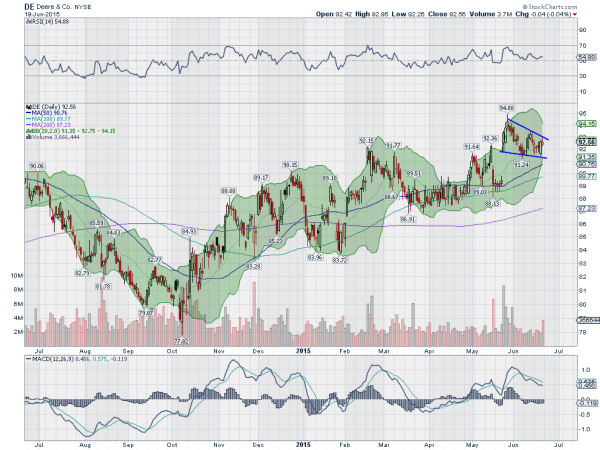

Deere (NYSE:DE)

Deere has had a drift higher since October in a wide range, with some long set backs and consolidations along the way. Currently it is in a falling wedge, with the Bollinger Bands® squeezing. The MACD is retreating as price falls, but the RSI is holding over the mid line in the bullish zone. Watch for a break of the wedge to the upside.

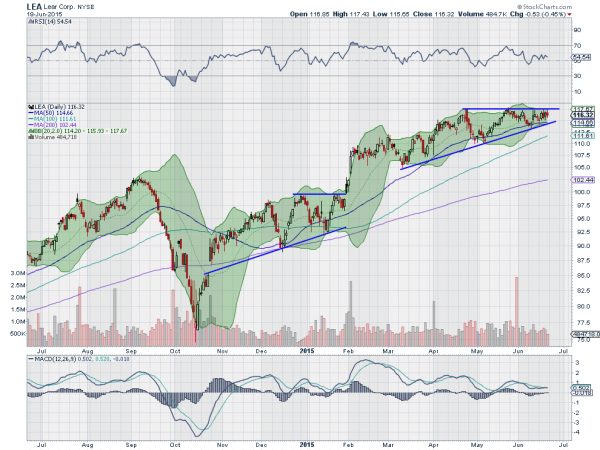

Lear (NYSE:LEA)

Lear moved higher off the low in October. There has been rising trend support forming since March and that has been getting squeezed against resistance since late April, forming an ascending triangle. The RSI is in the bullish zone and the MACD is trying to cross positive. Look for a break of the triangle to the upside.

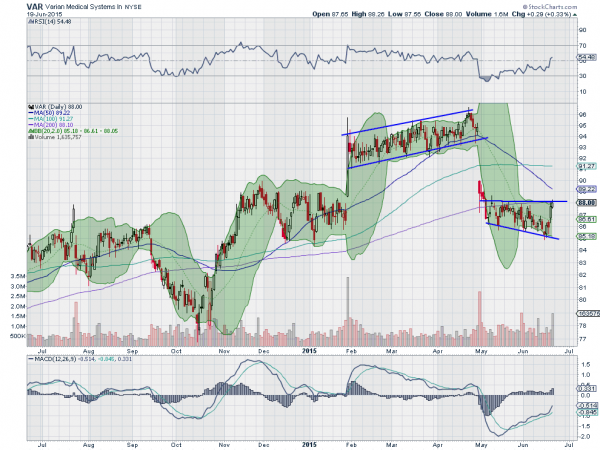

Varian Medical Systems (NYSE:VAR)

Varian Medical Systems had moved higher off of the October low too, leading to a rising channel forming from February through April. It broke that channel to the downside and has since been building an expanding wedge. The price action ended last week at the top of the wedge, with improving momentum from the RSI breaking the mid line and the MACD rising. A break over the wedge has a long way to rise to fill the gap.

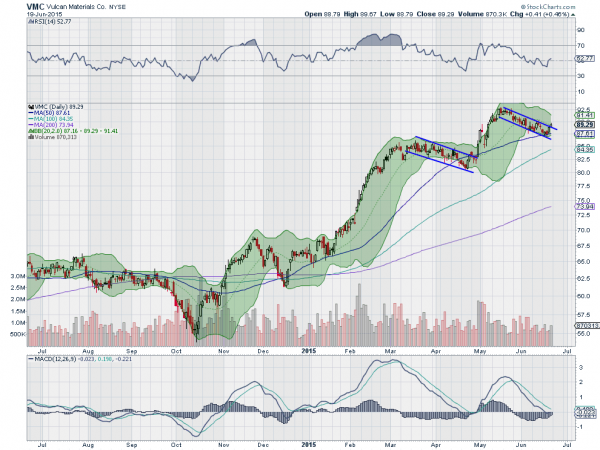

Vulcan Materials (NYSE:VMC)

Vulcan Materials has moved strongly higher off of the low with the market in October. Since March, the price action has seen a long bull flag break to the upside and now another long bull flag. The price peeked over the top of this flag Friday, and has support to run higher from a bullish RSI. The MACD is also turning, looking to reverse its pullback.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, as the markets head out of June Options Expiration and officially into summer, sees equities continue to churn with an upward bias.

Elsewhere, look for gold to be biased to the upside short term in its consolidation, while crude oil consolidates with an upward bias. The US dollar index looks headed lower in its broad consolidation of the long move up, while US Treasuries may be consolidating in their downtrend. The Shanghai Composite may be beginning its long awaited correction, or just doing its 4th 10% plus move lower before another launch higher, while Emerging Markets may be consolidating after their move lower.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. The IWM continues to look the strongest on the short time frame as it sits at all-time highs, with the QQQ strong as well on the weekly timeframe and the SPY stuck in a funk consolidating. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.