Here is your Bonus Idea with links to the full Top Ten:

Goldman Sachs (NYSE:GS)

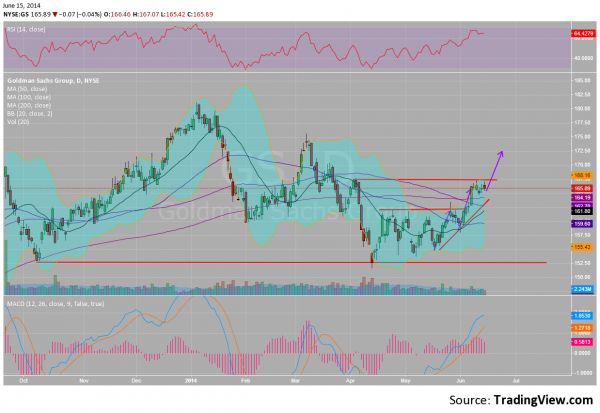

Goldman Sachs found support in April at the October low, making a Double Bottom at 152.50. It consolidated against that and resistance higher at 162 in a series of higher lows until breaking above it 2 weeks ago. Last week was spent consolidating that move at the April highs. While it churned, the RSI continued higher into the bullish zone and the MACD continues to rise. The trend on a short term basis since May has been higher with two $7.50 moves between consolidations. A 3 Drives would target a third move to 172.50. There is resistance higher at 167.50 and 170 followed by 174.40 and 178.80 before 180.75. Support lower may be found at 165 and 162 followed by 160. The company reports July 15th.

Trade Idea 1: Buy the stock on a move over 167.50 with a stop at 165.

Trade Idea 2: Buy the July 165 Calls (offered at $4.00 late Friday) on the same trigger.

Trade Idea 3: Buy the July 11 Expiry 167.5 Calls ($2.12) on the same trigger.

Trade Idea 4: Buy the July 11 Expiry 167.5/June 27 Expiry 170 Call Diagonal ($1.64, buy July and sell June) on the same trigger.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into June Options Expiration week, the equity markets have shown a preference for some consolidation. For next week look for Gold to bounce higher in its intermediate downtrend while Crude Oil figure of speech. may consolidate or pullback in its uptrend. The US Dollar Index looks to continue to move sideways while US Treasuries consolidate in the uptrend. The Shanghai Composite and Emerging Markets are biased to the upside with risk that the Chinese market just moves sideways. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s (SPDR S&P 500) (ARCA:SPY), (iShares Russell 2000 Index) (ARCA:IWM) and (PowerShares QQQ) (NASDAQ:QQQ). Their charts show that the short term downside might continue, but it may be short lived with all biased higher in the intermediate trend. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.