Here are the rest of the Top 10:

Akorn (NASDAQ:AKRX)

Akorn has had a long trend higher since July, but with a wide range.The last bounce off of rising trend support is now at resistance and the gap down level. Momentum indicators support more upward price action, with the RSI slowly rising towards the bullish zone and the MACD rising.

8×8 (NASDAQ:EGHT)

8×8 has been building time testing resistance at 9.10 since the beginning of April. There is a small gap above that and then a lot of open space. The RSI is bullish and rising, while the MACD turned up and is rising as well.

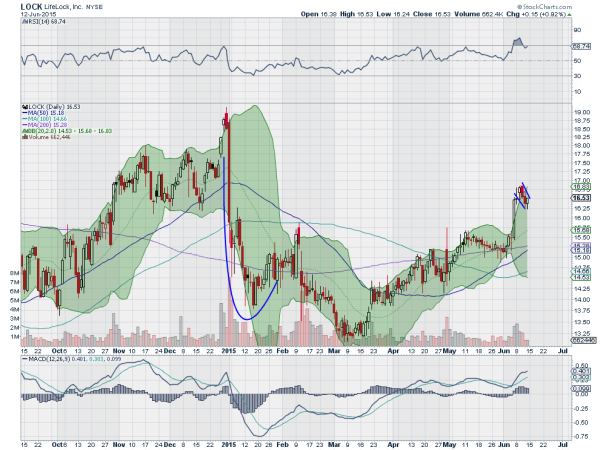

LifeLock (NYSE:LOCK)

LifeLock got smacked down hard to start the new year and settled into a broad range lower afterwards. Two weeks ago, it broke to the upside and has been consolidating in a bull flag since. The RSI is bullish and has worked off the overbought condition, while the MACD is rising.

Macy’s (NYSE:M)

Macy’s pulled back slowly from a high in early April and then rebounded quickly, almost the opposite of the popular stairs up, elevator down meme. Last week, it had moved back to resistance at that prior high and sat with the Bollinger Bands® tightening. Friday tried a push through consolidation that failed, but held at the top. The RSI is bullish and turning up, while the MACD rises, in support of more upside.

PacWest Bancorp (NASDAQ:PACW)

PacWest Bancorp continued the move higher that began at the start of June. The significance is that it pushed through to new highs and out of an ascending triangle. The RSI is strong and rising, while the MACD is also rising.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into June Options Expiration week, sees the Equity markets looking weak in general short term.

Elsewhere, look for gold to continue lower while crude oil consolidates in the uptrend. The US dollar index is also in broad consolidation, but with a downward bias, while US Treasuries are trending lower, but might be ready for a bounce. The Shanghai Composite remains strong and rising, while Emerging Markets are biased to the upside short term in the downtrend.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggest that it will take some work for the SPY and QQQ, which look weak in the short term and flat intermediate, while the IWM trends higher. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.