Here are the Rest of the Top 10:

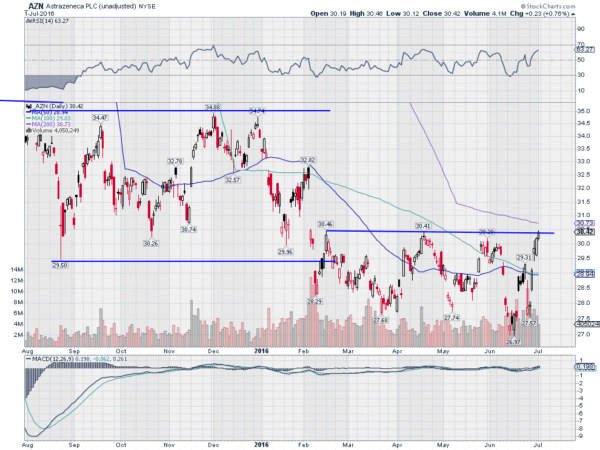

AstraZeneca PLC (NYSE:AZN)

AstraZeneca, AZN, has been moving sideways in a channel since falling below a prior channel in February. Friday saw the price move back to the top of the range with strong momentum behind it.

The RSI is in the bullish zone and rising while the MACD is turning up. The 200 day SMA is above and it has not connected with that since January. Look for a break over the top of the range to participate in the upside…..

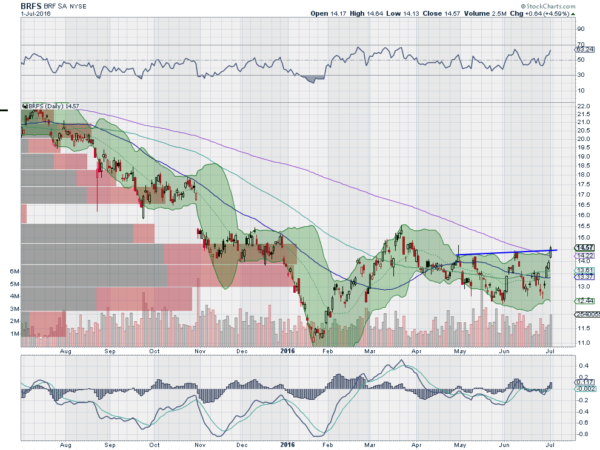

BRF SA (NYSE:BRFS)

BRF, BRFS, formerly Brasil Foods, fell from a double top in the summer of 2014. It found a bottom with the market in January and has drifted, mostly sideways, since. The price action since May has seen rising trend resistance and it ended the week peeking over that Friday.

It also moved over the 200 day SMA for the first time since January 2015 Friday. The RSI is bullish and rising and the MACD is crossed up and rising, both supporting more upside. Look for continuation to participate to the upside…..

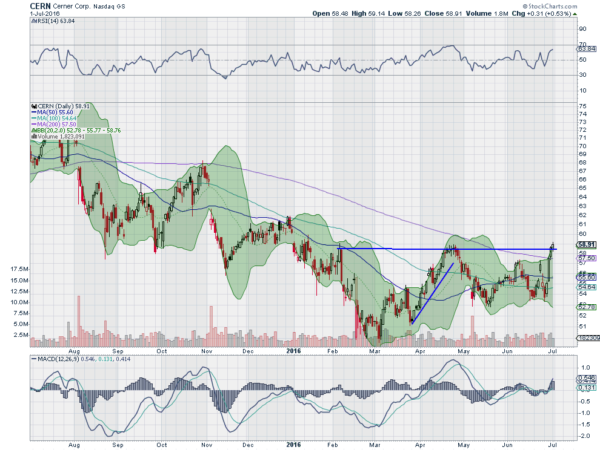

Cerner Corporation (NASDAQ:CERN)

Cerner, CERN, morphed from a long trend lower into a consolidating bottom in February. The bottoming process has been playing out for 5 months here as well. Friday saw a continuation higher to resistance after it moved over the 200 day SMA Thursday for the first time since August 2015.

The RSI is rising and in the bullish zone while the MACD moves higher, both supporting further upside price action. Look for a break above resistance to participate to the upside……

Ironwood Pharmaceuticals Inc (NASDAQ:IRWD)

Ironwood Pharmaceuticals, IRWD, had been moving sideways for months when it broke higher in November. That proved to be a failed break out and it dropped lower precipitously to a bottom in February. It was a quick bottom with a “V” shaped recovery to the SMA confluence before a move higher in May.

It pulled back slightly to the lower Bollinger Band® and started higher again, to short term resistance last week. The RSI held in the bullish zone and is rising while the MACD is about to cross up. Look for a break of resistance to participate to the upside…..

Marathon Oil (NYSE:MRO)

Marathon Oil, MRO, finally started its bottoming process in January, setting a double bottom in February, confirming it at the start of March. With the push higher in April it seemed ready to race higher, but met resistance as it moved over the 200 day SMA. It pulled back the 50 day SMA and bounced slowly rising back to resistance.

Another pullback and it turned back higher. As this was happening the 50 day SMA crossed above the 200 day SMA in a Golden Cross. Friday saw a move over resistance that has support for move upside from the rising and bullish RSI and MACD. Look for a hold over prior resistance and continuation to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the holiday shortened week sees the equity markets showing some strength with a strong rebound.

Elsewhere look for Gold to continue higher while Crude Oil consolidates with a bias lower. The US Dollar Index is also consolidating but with a bias higher while US Treasuries are set to continue higher. The Shanghai Composite looks to continue its bottoming process and Emerging Markets look to continue higher in consolidation.

Volatility has fallen back and looks to remain in the normal zone keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all agree with this on the shorter timeframe, and the IWM on the longer timeframe, while the SPY and QQQ remain in consolidation longer term. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.