Here are the Rest of the Top 10:

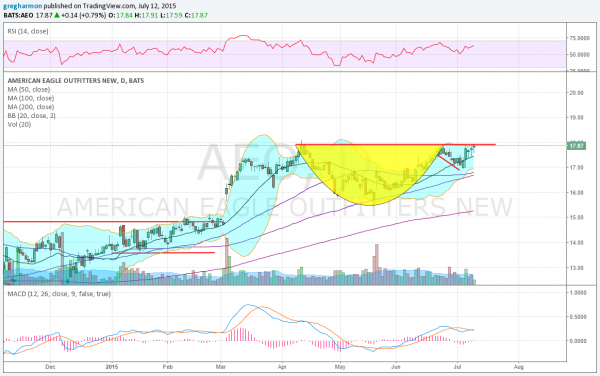

American Eagle Outfitters (NYSE:AEO)

American Eagle Outfitters had a long pullback through 2013 and the first half of 2014. That reversed and it has been trending higher, nearly revealing 18 in April. The shallow pullback touched the 100 day SMA and moved back up to the prior high. Some short consolidation and a third touch and peek above resistance makes it interesting. The RSI is in the bullish zone and rising, while the MACD is crossed up and rising as well. The Cup and Handle pattern targets a move to 20.50, and there is resistance at 18.75 and 19.65 before 20.65 and 21. Support lower comes at 17.40 and 17. Short interest is high at 19.2%. Enter long on a move over 18 with a stop at 17.40. As it moves over 18.50, move the stop to break even and then to a 60 cent trailing stop over 18.65. Take off 1/3 on a stall at 21 or higher. As an options trade, consider the July 31 Expiry 18 Calls (offered at 45 cents late Friday) and trade them like the stock trade (using the stock price as a trigger, stop and target). Give it more time with the August 18 Calls (85 cents), and offset some cost by selling the August 17 Puts (50 cents) with large open interest above at 18.

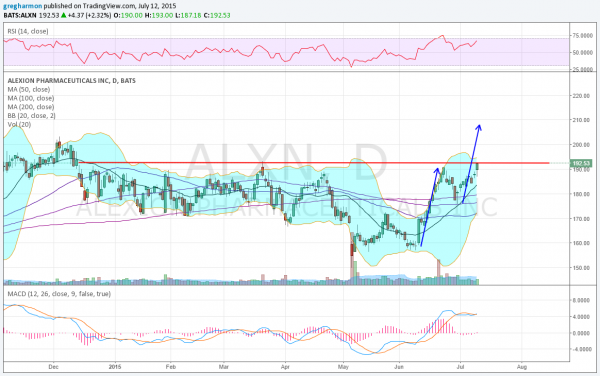

Alexion Pharmaceuticals (NASDAQ:ALXN)

Alexion Pharmaceuticals pulled back from a high in December over 200. It started as a broad consolidation, but then lost support and dropped to a new low in May. Since then, it has bounced and is now testing resistance of that broad consolidation range again. The RSI is bullish and rising, while the MACD avoided a cross down and is rising as well. There is resistance above at 192.75 and 201 before a Measured Move higher to 210. Support lower comes at 190 and 186.25, followed by 176.60. Short interest is moderate at 3.5%. Enter long on a move over 193 with a stop at 187. As it moves over 196, move the stop to break even and then to a $6 trailing stop over 199. Take off 1/3 on a stall at 210 or higher. As an options trade, consider the July 192.5 Calls ($3.20) for a short term trade, and offset some cost by selling the July 185 Puts (55 cents). Give it more time with the August 195/210 Call Spread ($5.40), and sell the August 180 Puts ($4.00) to lower the cost. Note that the company reports July 23, so you might add a July 24 Expiry 180 Put just prior to the report.

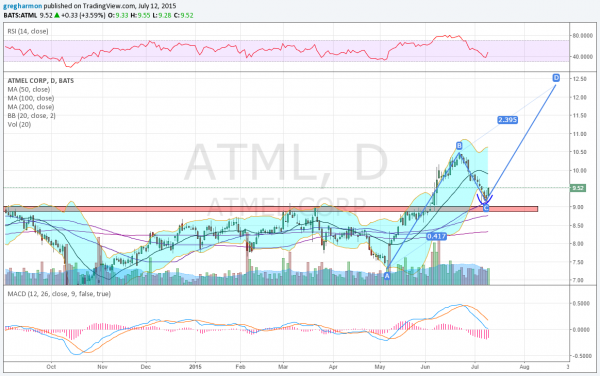

Atmel (NASDAQ:ATML)

Atmel broke above resistance June (was a winning Top 10 Pick then) and rose to 10.50. Since then, it has pulled back, retracing most of the break out before a reversal Friday. The RSI has also turned up and the MACD is falling, but may be starting to flatten. The pullback nearly reached the 50 day SMA, and now creates an AB=CD pattern that targets a run to 12.35. There is resistance above at 9.70 and 10.50, followed by 11, 11.25 and 12.50 all from 2011. Support lower comes at 9.15 and 9 before 8.50. Short interest is moderate at 3.4%. Enter long now (over 9.15) with a stop at 9.15. As it moves over 9.85, move the stop to break even and then to a 45 cent trailing stop over 10. Take off 1/3 on a stall at 12.33 or higher. As an options trade, consider the July 9/10 Call Spread (60 cents) with large open interest at the 10 Strike this week. Sell the July 9 Put (10 cents) to gain more leverage. Give it more time with the August 9/10 bull Risk Reversal (15 cents).

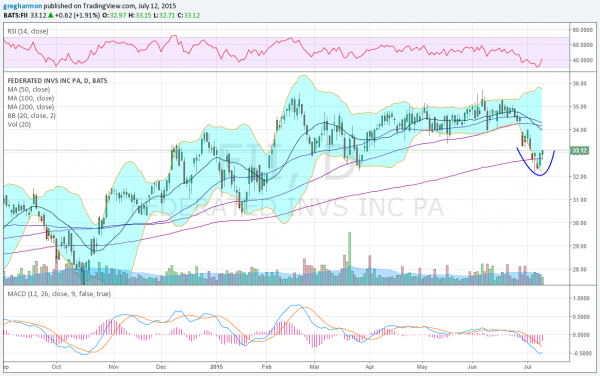

Federated Investments (NYSE:FII)

Federated Investments has had a long trend higher. It is one of those stocks where you have been looking for an entry for a while to follow this trend, but the stock has not given one since March. That looks to have changed last week, with the reversal higher off of the 200 day SMA. The RSI is turning up as well, with the MACD left to reverse. There is resistance higher at 33.15 and 34, followed by 34.50 and 35.30. Support lower comes at 32.25 and 31.30, followed by 30.35. Short interest is elevated at 87.6%. Enter long now (over 32.25) with a stop at 32.25. As it moves over 33.50, move the stop to break even and then to a 75 cent trailing stop over 34. Let the stop take you out at some point in the future. Options are very thin, but you could use the August 35 Calls (45 cents) or October 35 Calls (80 cents) for a defined risk trade

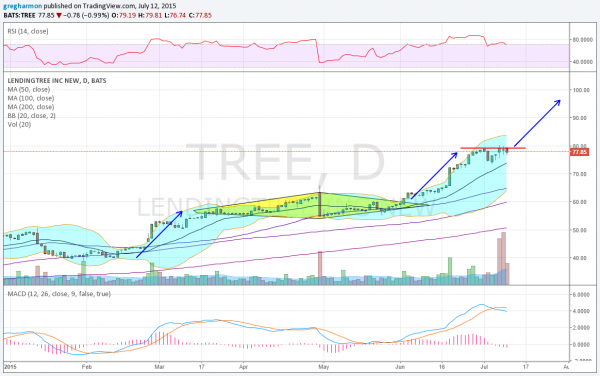

Lending Tree (NASDAQ:TREE)

Lending Tree moved out of a consolidating range in June and started higher. The price is now consolidating again at 80, as the RSI moves sideways in the bullish zone and the MACD works lower. The very large volume Wednesday and Thursday suggest a move may be coming. The consolidation was a Diamond continuation and the new consolidation is occurring at the target price. A break higher would target a move to 96.50. There is resistance at 80 and then free air above. Support lower comes at 76.60 and 74.40. Short interest is high at 16.5%. Enter long on a move over 80, with a stop at 76.50. As it moves over 82, move the stop to break even and then to a $3 trailing stop over 83. Take off 1/3 on a stall at 96.50 or higher. There are no options for this name.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into July Options Expiration week, sees the equity markets still looking vulnerable short term in their longer term uptrends.

Elsewhere, look for gold continue to test the downside, while crude oil also turns lower. The US dollar index seems ready to move higher in its consolidation, while US Treasuries are biased lower in their consolidation. The Shanghai Composite and Emerging Markets are both bouncing, and need to be watched carefully to see if the moves are real.

Volatility looks to remain in the elevated range of this low level, continuing to lessen the tail wind for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts show the IWM looking the best short term, as they all try to hold and reverse higher, while the QQQ and IWM look good longer term, as the SPY is weakest. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.