Here are the Rest of the Top 10:

Coach Inc (NYSE:COH)

Coach, COH, continued higher off of a low in September 2015, until reaching a high in April. It pulled back from there to the 100 day SMA and found support, creating a new consolidation zone. Last week it moved back to the top of the range on a strong day Friday. As it did the RSI is in the bullish zone and rising and the MACD is moving higher. The Bollinger Bands® are also opening to the upside…..

DaVita HealthCare Partners Inc (NYSE:DVA)

DaVita HealthCare, DVA, rose strongly off of a bottom in February. It has since rounded into consolidation near the November high. It pulled back to the lower Bollinger Band and then bounced, leaving it at the May high on Friday. The RSI is rising and bullish while the MACD is crossed up and rising. Look for follow through over resistance to participate in the upside…..

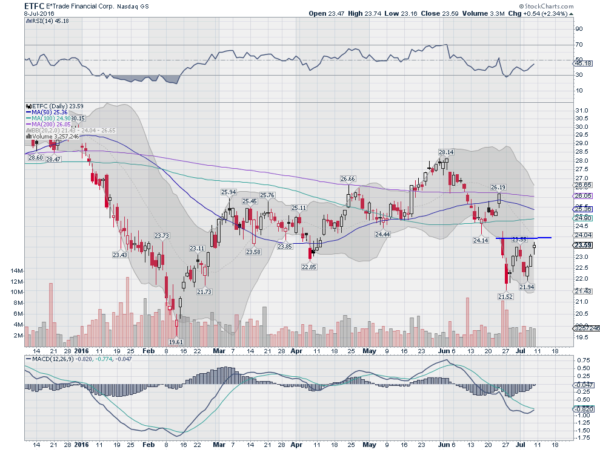

E-TRADE Financial Corporation (NASDAQ:ETFC)

E*Trade Financial, ETFC, was in a slow rising channel until it gapped lower with the Brexit vote. A sharp 2 day fall found support nearly 20% lower and has been consolidating in a wide range since. Friday saw a higher high in the RSI and a MACD move to where a cross up is imminent. Look for a move over resistance to participate in the upside…..

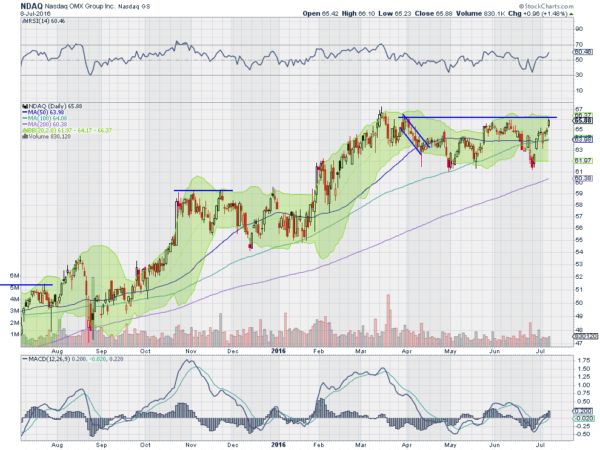

Nasdaq Inc (NASDAQ:NDAQ)

Nasdaq, NDAQ, moved higher off of the August low and consolidated for 3 and a half months before moving up again. It has consolidated for nearly 4 months since the last move now. It ended Friday at the top of the latest consolidation with support for more upside from a rising and bullish RSI and MACD. Look for a break of consolidation to participate to the upside…..

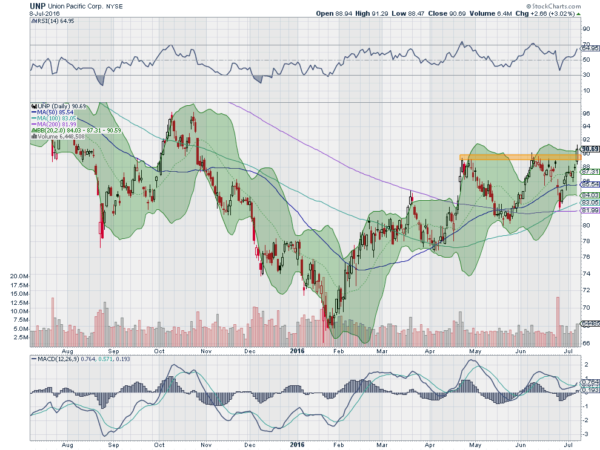

Union Pacific (NYSE:UNP)

Union Pacific, UNP, made a bottom in January and drove higher. It stalled at its 100 day SMA in March before continuing on to touch the 200 day SMA and be reflected lower. It found support at the 50/100 SMA cross and started higher, topping in April.

Another pullback found support and rebounded to that prior high and then it did it again in June, ending Friday with a push to a higher high. The RSI is in the bullish zone and the MACD is crossed and rising. Look for continued upward movement Monday to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into July Options Expiration week sees the equity indexes are strong and looking for new highs.

Elsewhere look for Gold to continue higher but perhaps see a short term pullback first, similar to the picture for Crude Oil. The US Dollar Index looks to continue higher toward the top of the broad consolidation while US Treasuries are continue higher but with some caution as they are getting extended.

The Shanghai Composite and Emerging Markets both look better to the upside in their consolidation ranges. Volatility looks to remain subdued and possible moving lower keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ).

Their charts agree, with the SPY looking for new all-time highs quickly, the IWM chasing and the QQQ looking to break a range by making a new 2016 high. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.