Here are the Rest of the Top 10:

Cepheid, Ticker: O:CPHD

Cepheid, CPHD, has been moving sideways in a channel since a gap down in October. The RSI has climbed into the bullish zone but may be rejecting while the MACD is leveling after a rise. Last week saw the price bounce off the top of the range. Continuation Monday can be followed lower.

Dunkin’ Brands, Ticker: O:DNKN

Dunkin’ Brands, DNKN, fell from a high at 56 in July, losing over 28 before a bounce near 40 in October. Since then it has been consolidating. At the start of December it moved back over the 50 day SMA and that has acted as support since. The RSI is holding over the mid line while the MACD is leveling. Look for a move over resistance to participate to the upside.

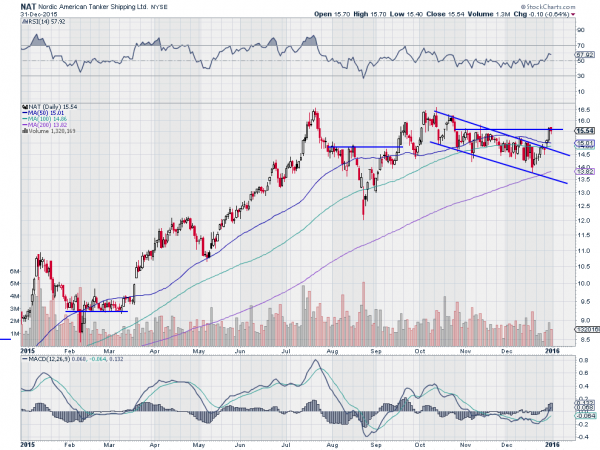

Nordic American Tankers, Ticker: N:NAT

Nordic American Tankers, NAT, had been pulling back from a double top at 16.5 in a downtrending channel since October, until it broke the channel to the upside last week. The price is now consolidating with a rising RSI and MACD, both supporting a push higher. Look for a push over resistance to participate to the upside.

Universal Display, Ticker: O:OLED

Universal Display, OLED, pulled back from a peak near 56, losing over 40% of its value before jumping back higher. It topped again at a slightly higher high before the recent shallow pullback and then turn higher. The RSI is in the bullish zone and the MACD is turning towards a cross up. Look for a new high to participate in a continued move higher.

Tesoro, Ticker: N:TSO

Tesoro, TSO, has trended high with falling oil prices, rising since October 2014. Closer in the price broke a bull flag last week to the upside and has support for more from a bullish and rising RSI and a MACD about to cross up. Look for continuation to participate to the upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Thursday which, as the books closed on 2015 and we started prep for 2016 saw the equity markets showing a lack of strength at best and some weakness short term.

Elsewhere look for consolidation to rule the short term. In Gold look for consolidation in the downtrend with Crude Oil also consolidating its move lower. The US Dollar Index looks to consolidate in the uptrend while US Treasuries just continue broad consolidation sideways marking time. The Shanghai Composite looks to continue its sideways motion while Emerging Markets are biased to the downside in consolidation.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s N:SPY, N:IWM and O:QQQ. Their charts look to move into the New Year showing further consolidation in the long run but with some weakness in the short run, especially in the SPY. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.